Lithium Americas Corp (NYSE: LAC) shares are trading lower Friday afternoon, experiencing a pullback as investors take profits following a surge earlier in the week. Here’s what investors need to know.

What To Know: The stock soared on Wednesday and Thursday after reports emerged that the U.S. government is seeking a significant equity stake in the company.

The potential investment is part of a renegotiation of a $2.26 billion Department of Energy loan for Lithium Americas’ Thacker Pass mine in Nevada. This move is seen as a strategic effort to strengthen the U.S. domestic lithium supply chain.

The Thacker Pass project, a joint venture in which General Motors holds a 38% stake, is poised to become one of North America’s largest lithium sources.

While Lithium Americas confirmed it is in discussions with the government and GM, the company has stated that no definitive agreement has been finalized. The stock’s current decline likely reflects profit-taking after the speculative rally.

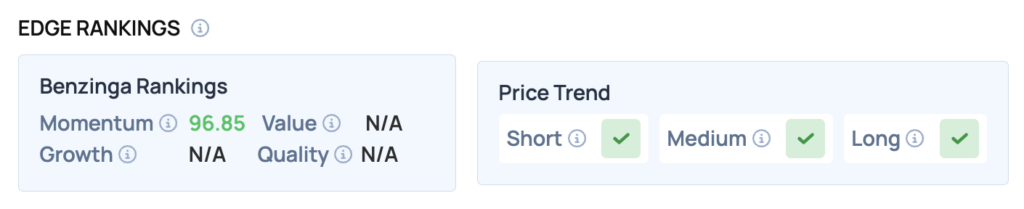

Benzinga Edge Rankings: Underscoring the stock’s powerful price action, Benzinga Edge rankings give Lithium Americas a Momentum score of 96.85.

How To Buy LAC Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Lithium Americas’ case, it is in the Materials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock