On Thursday, Intel Corp (NASDAQ:INTC) executives detailed how the company plans to deploy its improved cash position and liquidity following major investments from the Donald Trump administration, Nvidia Corp (NASDAQ:NVDA), SoftBank Group (OTC:SFTBF) (OTC:SFTBY) and others.

Intel Focuses On Deleveraging First

During Intel's third-quarter earnings call, Executive VP and CFO David Zinsner explained that when CEO Lip-Bu Tan joined the company, he was really "upset" about Intel's balance sheet.

The company has already made progress, including reducing $4.3 billion in debt this quarter, with additional maturities set to be repaid in the near future.

Zinsner said, "As we think about this cash, our first focus is to delever," adding, "When Lip-Bu came in, he really was upset about the balance sheet. So we’ve done a lot to work on that and improve that for him."

CapEx Flexibility Hinges On Customer Demand

Intel is approaching capital expenditures with caution, focusing on disciplined investments tied directly to customer demand.

"Lip-Bu’s been very direct with us on this. He wants to see the whites of the eyes of the customer [so] that we can believe in that demand. And if that demand exists, of course, we will amp up the CapEx as necessary," Zinsner said.

Intel projects around $18 billion in gross capital investments for 2025, with total CapEx expected to exceed $27 billion—up from $17 billion in 2024.

OpEx Investments Target Growth And Shareholder Returns

On operational expenditures, Intel plans to maintain $16 billion of investment next year, while constantly reviewing how to allocate those funds to maximize growth and returns.

Zinsner added, "We want to be pretty disciplined about our OpEx as a percent of revenue and drive leverage. But we do see opportunities to make investments that can, I think, deliver great returns for shareholders, and we’re not afraid to do that either."

Strategic Investments Support Intel's Future

These moves come as Intel benefits from a strengthened cash position following investments from the U.S. government, Nvidia, SoftBank and others.

Intel reported third-quarter revenue of $13.65 billion, surpassing analyst expectations of $13.14 billion. The chipmaker posted adjusted earnings of 23 cents per share, well above the estimated one cent per share.

Looking ahead, Intel expects fourth-quarter revenue between $12.8 billion and $13.8 billion, compared with analyst estimates of $13.37 billion.

The company forecasts fourth-quarter adjusted earnings of eight cents per share, in line with expectations.

INTC Price Action: Intel shares surged 7.71% in after-hours trading, reaching $41.10 at the time of writing, according to Benzinga Pro.

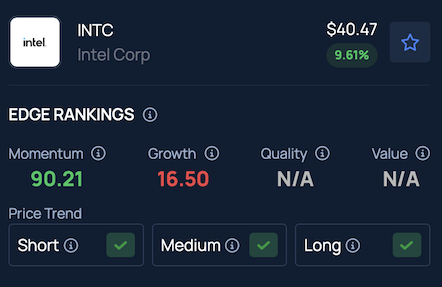

Benzinga's Edge Stock Rankings place Intel in the 90th percentile for Momentum, highlighting its strong long-term price performance. Click here to compare it with peers.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Tada Images / Shutterstock