The Fed fund futures forward curve has been yo-yoing back and forth between interest rate cut or no at the conclusion of the September Federal Open Market Committee meeting.

-

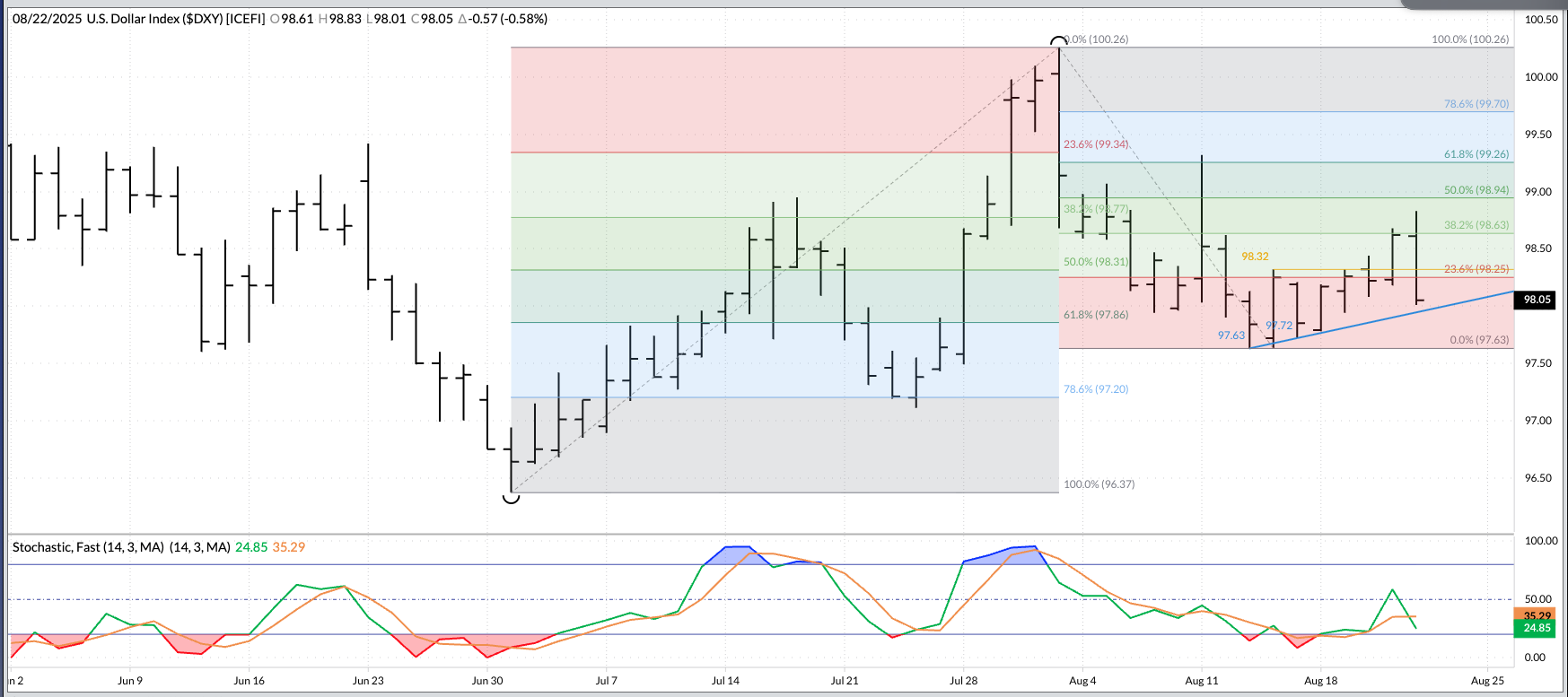

From a technical point of view, for what that's worth these days, the US dollar index moved into a long-term uptrend at the end of July, implying higher interest rates ahead.

Join 200K+ Subscribers: Find out why the midday Barchart Brief newsletter is a must-read for thousands daily. The S&P 500 has also been sagging of late, also hinting at rate hikes to stem the tide of inflation caused by trade wars and tariffs.

And now for something completely different…

Early in his remarks today from Jackson Hole, Wyoming, US Fed Chairman Powell indicated “conditions ‘may warrant’ interest rate cuts as the Fed proceeds ‘carefully’”. As we saw Thursday in the soybean market on the statement of a possible announcement from the EPA on biofuels, algorithms were triggered by Chairman Powell’s initial statement with the S&P 500 posting a big jump of nearly 90 points (1.4%) while bonds gained half a percentage point. For now, this would pay off for those who were betting on a 25-basis point increase in September (to put it in FanDuel terms).

It strikes me as odd Chairman Powell would change his tone. A closer look at his statement and we see that beyond the algorithm-influencing headlines are the familiar themes of “a high level of uncertainty making the job difficult for monetary policymakers”, “policy in restrictive territory”, and “the importance of Fed independence”. I’m sure it won’t take long for the US president to say something in response.

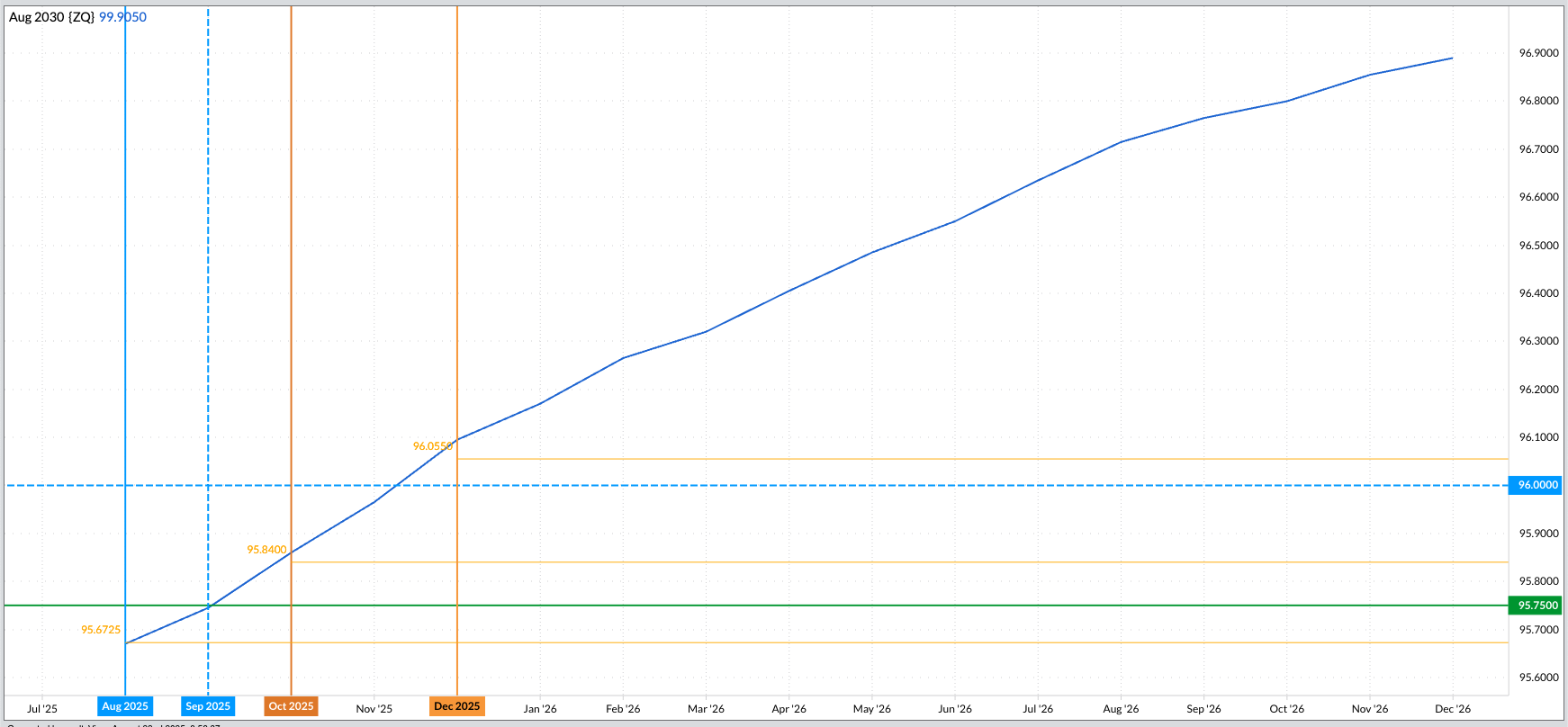

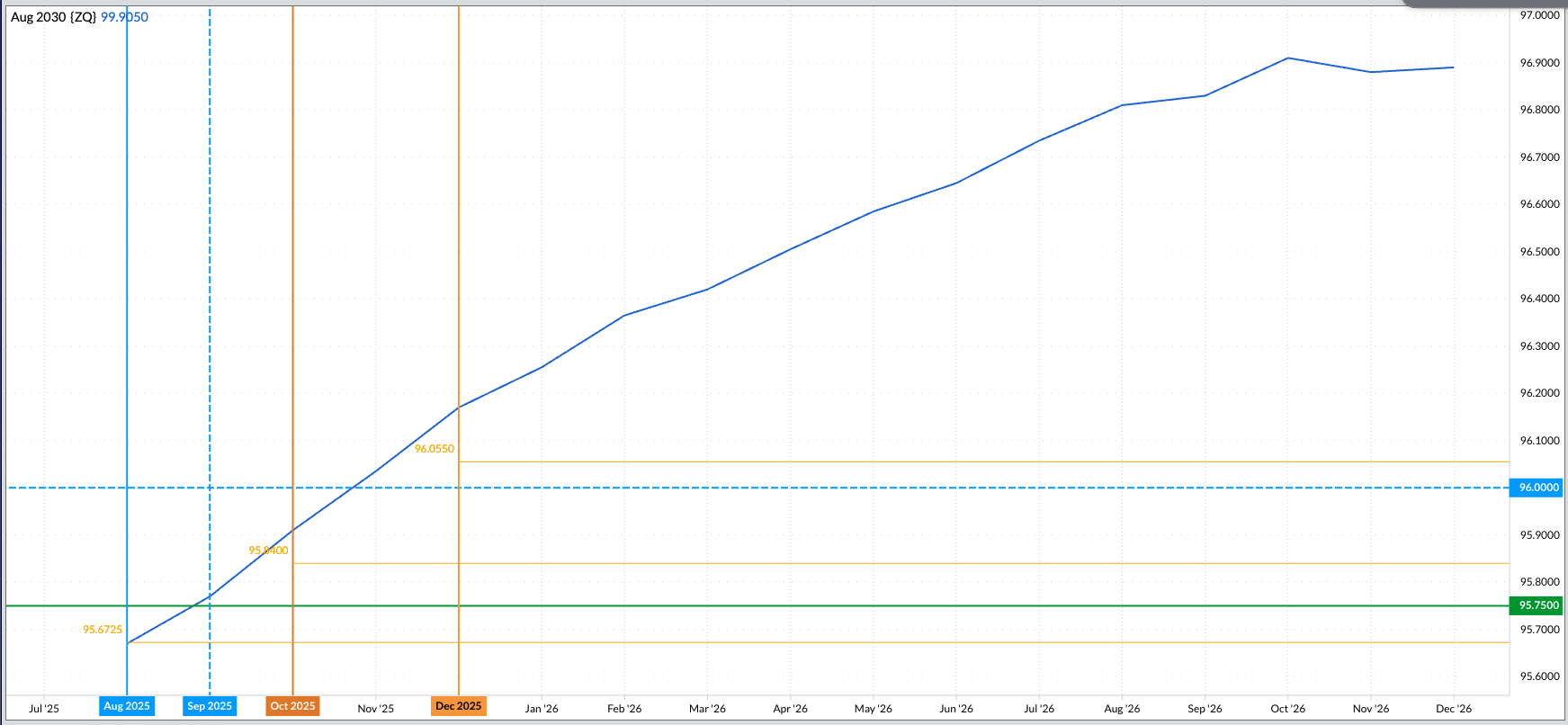

But what about the markets, specifically the Fed fund futures forward curve? As you recall, I track this for an indication of what long-term investors are thinking about future moves by the Fed. In my Barchart piece from June 18, I mentioned how the forward curve was indicating a possible 25-basis point rate cut at the conclusion of the September Federal Open Market Committee meeting (September 17). However, I also noted that being market driven, this forward curve has and will continue to change over time. It’s interesting to note that prior to Friday morning’s headlines the September futures contract (ZQU25) was priced at 95.745, putting the expected rate at 4.255%, still within the current Fed fund range of 4.25% to 4.5% (see chart above). As of this writing, though, the September contract had climbed to 95.77, dropping the expected rate to 4.23%, in line with the idea the FOMC will make a cut next month (see chart below). But there is a long way to go until we get there.

In other news, the US dollar index ($DXY) fell off a cliff, initially losing as much as 0.82 from its early morning high of 98.83 (see chart below). Before we get overly excited by this knee-jerk reaction, we should remember that currencies in general are viewed as long-term investment markets. Yes, they can be swayed short-term, but it usually doesn’t change trends on long-term monthly charts. For those who still believe in technical analysis, July saw the Index complete a bullish key reversal indicating a move to a long-term uptrend. This pattern will stay in effect until the greenback takes out last month’s low of 96.37. And if the US dollar is in a long-term uptrend against foreign currencies, then the implication is global investors are of the opinion US interest rates will have to go up due to inflation caused by the US president’s one-word trade policy (Tariffs, in case you needed a hint).

Speaking again of the US administration, earlier in the week it attempted to prop up recently sagging stock indexes by having the US Treasury buy back $4 billion of its own debt. I asked an investment fund manager about this move, and his response was, “It’s a nothing burger (I like that phrase. DN). Probably just shifting (I always have to be careful typing that word. DN again) debt to a different date, and $4 billion is nothing.” As for those stock indexes, the S&P 500 ($INX) had fallen about 140 points (2%) from its all-time high of 6,481 on August 15 (Really? Only a week ago?) through this week’s low. As I type this segment, the S&P is already pulling back from today’s spike high of 6,393.

Last but certainly not least, I want to remind everyone of a couple ideas I follow to supplement my 7 Market Rules:

- The NBA Rule (though my friend Phillip strongly disagrees with this one): All we have to watch is the last half-hour because…

- The Wilhelmi Element (named for my late friend and longtime CBOT floor reporter Gary Wilhelmi): The only price that matters is the close.

Let’s see where markets are toward the end of the day.