- Review both your best and worst stock picks to learn from successes and mistakes.

- My loss on Ostin Technology (OST) was due to skipping due diligence and ignoring declining fundamentals.

- My gain on Bloom Energy (BE) came from thorough research, focusing on rising revenue and positive analyst projections.

- Always check multi-year revenue and earnings trends, as well as analyst forecasts. Shortcuts can be costly.

Reviewing Mistakes: Ostin Technology

We should frequently revisit not only our best stock picks, but our worst, to see what we did right and what we did wrong. My grandmother used to tell me you learn more from your mistakes than you learn from your successes.

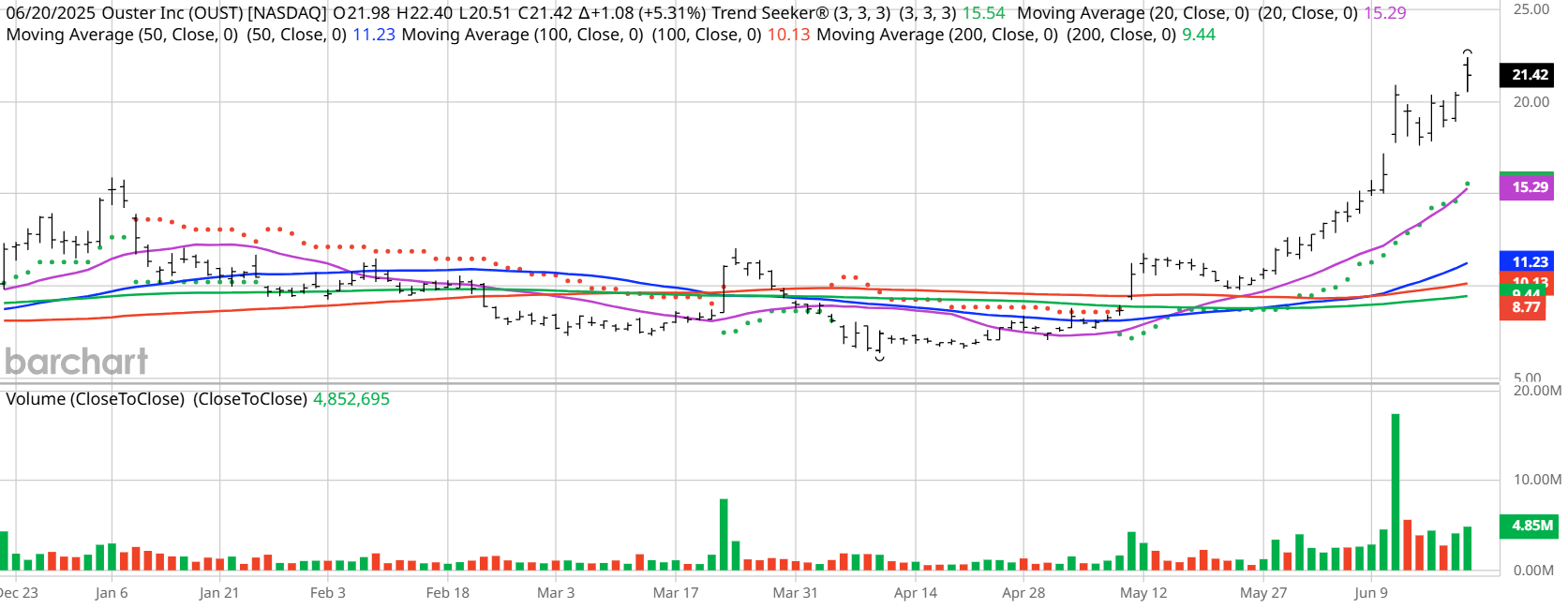

A few months ago, on June 12, I featured Ostin Technology (OST) and showed this chart:

OST Price vs. Daily Moving Averages:

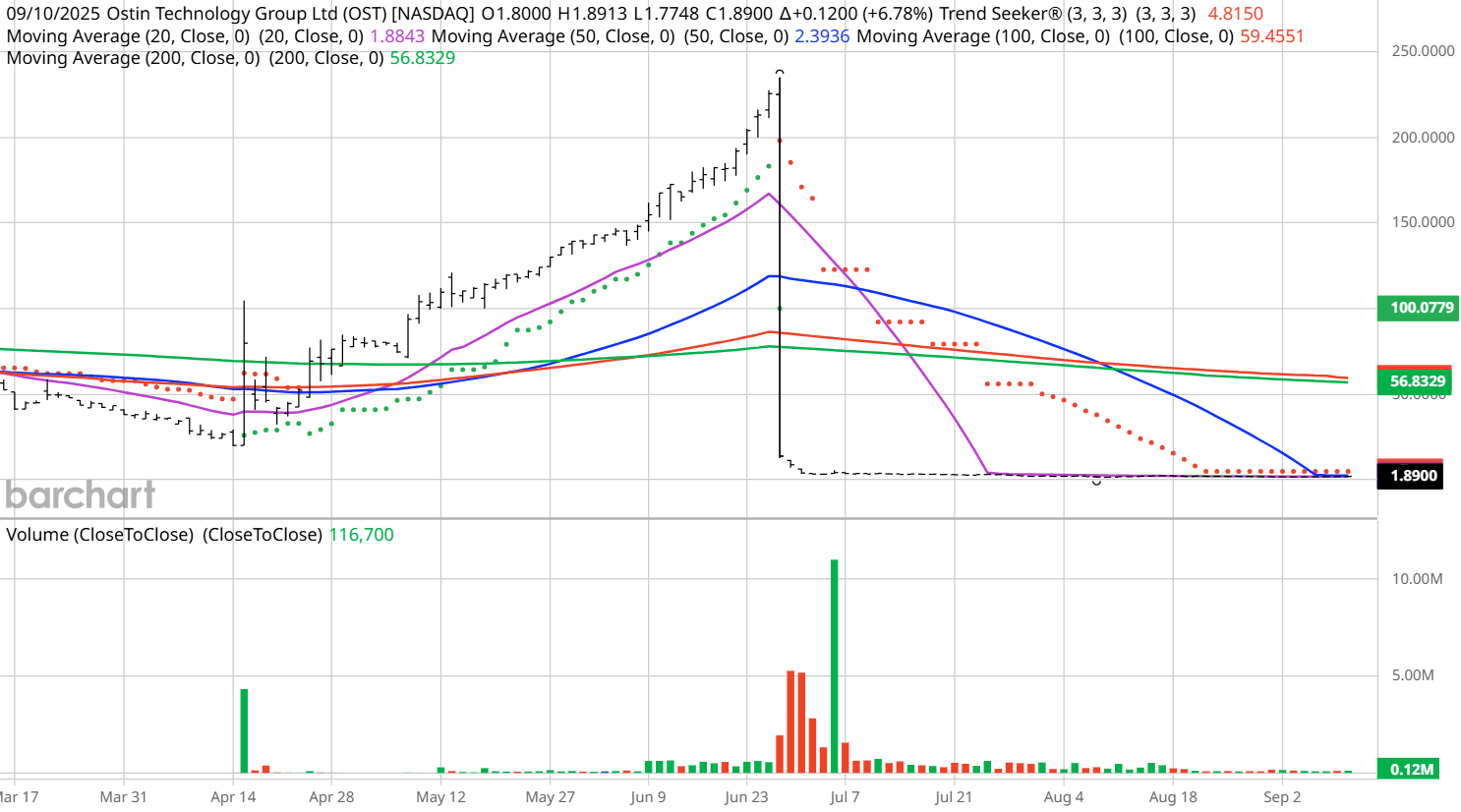

A few days later the price tanked and here is its chart today.

OST Price vs. Daily Moving Averages:

I forgot to complete my due diligence and missed that the company had declining revenue, earnings, and cash flow over the past several years and there was absolutely no reason the price was increasing.

On June 27 I had to eat crow and outline all my mistakes.

Reviewing Successes: Bloom Energy

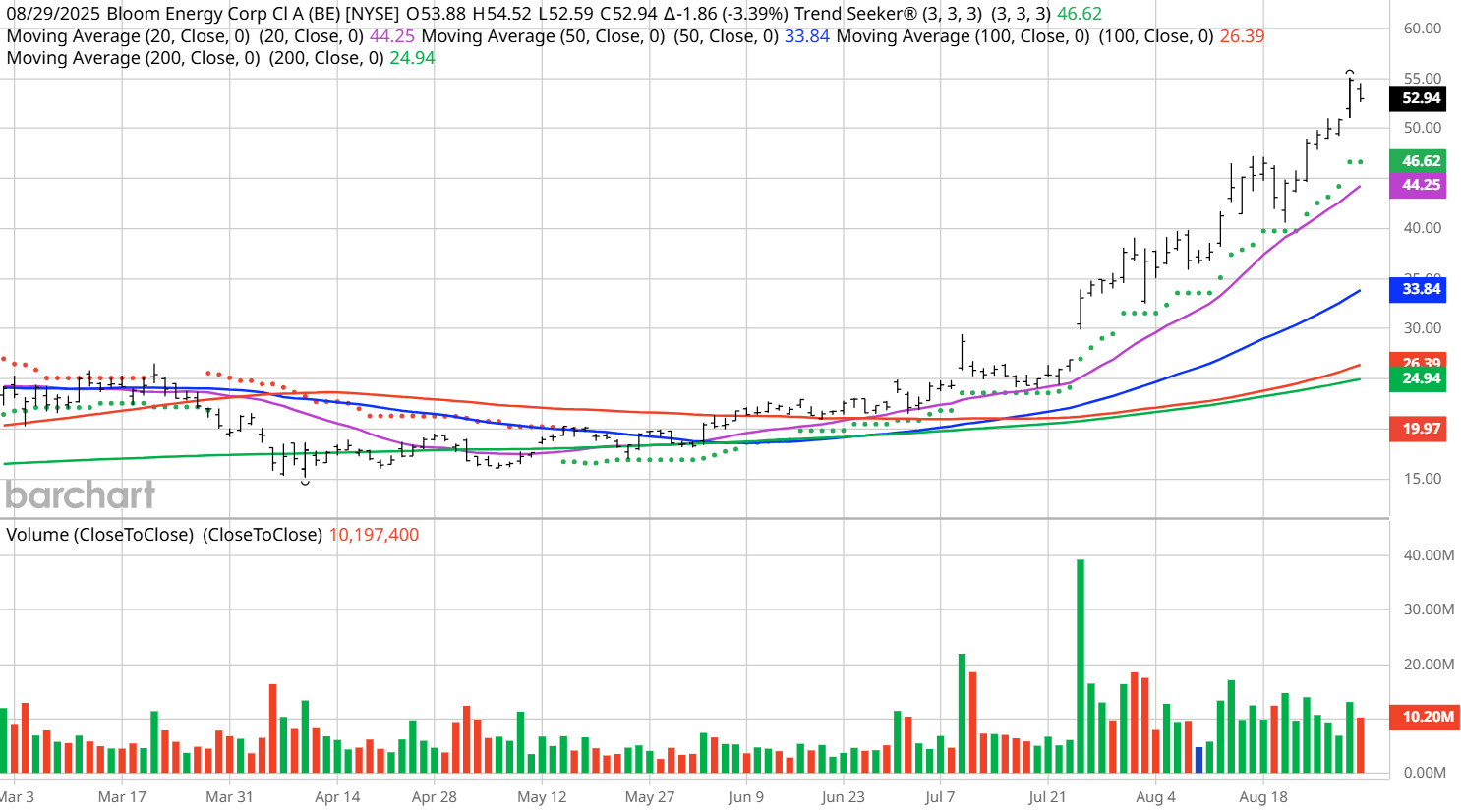

Now let's look at a stock I somehow got right. On Sept. 2, I featured Bloom Energy and pointed out my complete due diligence and Wall Street analysts’ projections of both revenue and earnings. The chart I featured looked like this:

BE Price vs. Daily Moving Averages:

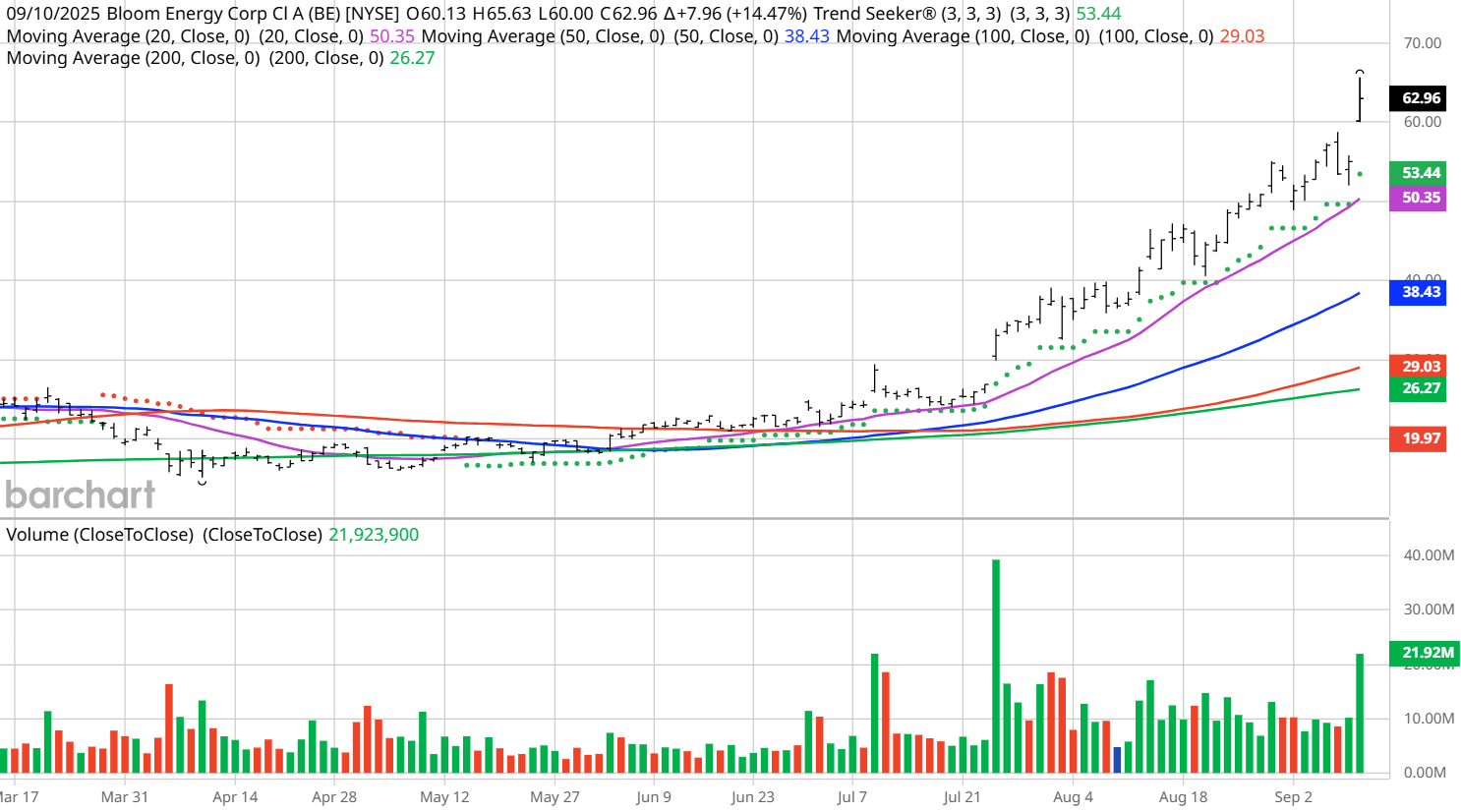

Today's chart looks like this:

BE Price vs. Daily Moving Averages:

On Sept. 2 it closed at $51.35, and on Sept. 10, it closed at $62.96. A nice 22.61% gain in just six trading days.

The difference is this stock had continuing revenue increases and Wall Street analysts were projecting increases in both revenue and earnings for this year and next.

Please, please, please don't take shortcuts. Look at the revenue and earnings for the last three years and make sure Wall Street is making positive projections for this year and the next.

You can get hurt when you take shortcuts.

Additional disclosure: The Barchart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance.

On the date of publication, Jim Van Meerten did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.