/Lennar%20Corp_%20%20phone%20by-%20madamF%20via%20Shutterstock.jpg)

Lennar Corporation (LEN) is one of the largest and most established homebuilding companies in the United States, headquartered in Miami, Florida. With a market capitalization of around $30.1 billion, Lennar focuses on the development, construction, and sale of residential properties, including single-family attached and detached homes, townhomes, and multifamily rental communities across multiple U.S. regions.

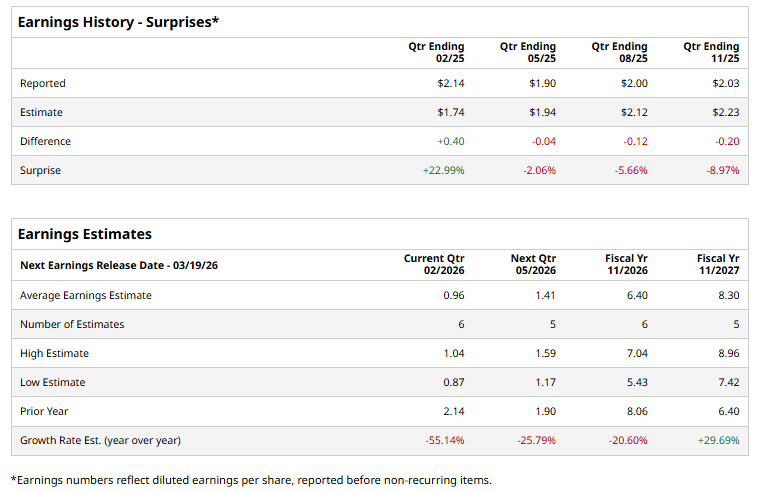

The company is slated to announce its first-quarter earnings results soon. Ahead of this event, analysts project this company to report a profit of $0.96 per share, down 55.1% from $2.14 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in one of the last four quarters, while missing on three other occasions.

For the current year, analysts expect Lennar to report EPS of $6.40, down 20.6% from $8.06 per share in fiscal 2025. Nonetheless, its EPS is expected to rebound in fiscal 2026 and grow by 29.7% year over year to $8.30.

LEN stock has declined 15.7% over the past 52 weeks, considerably underperforming both the S&P 500 Index’s ($SPX) 13.6% return and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 6.6% uptick over the same time frame.

On Jan. 21, LEN shares popped 2.5% after the company declared a quarterly cash dividend of $0.50 per share for both Class A and Class B common stock payable on February 19, 2026.

Wall Street analysts are cautious about LEN stock, with an overall “Hold” rating. Among 19 analysts covering the stock, two recommend a “Strong Buy,” nine advise a “Hold,” one “Moderate Sell,” and seven suggest a “Strong Sell.” While the stock is trading slightly above its mean price target of $108.23, the Street-high target price of $154 implies that LEN stock could rally as much as 34.3% from the current price levels.