/Leidos%20Holdings%20Inc%20logo%20on%20website-by%20monticello%20via%20Shutterstock.jpg)

Reston, Virginia-based Leidos Holdings, Inc. (LDOS) operates as an IT services company, serving defense, intelligence, civil, and health markets. With a market cap of $23.4 billion, the company provides solutions related to cybersecurity, data analytics, operations & logistics, software development, and more.

Companies worth $10 billion or more are generally described as "large-cap stocks." Leidos Holdings fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the technology sector.

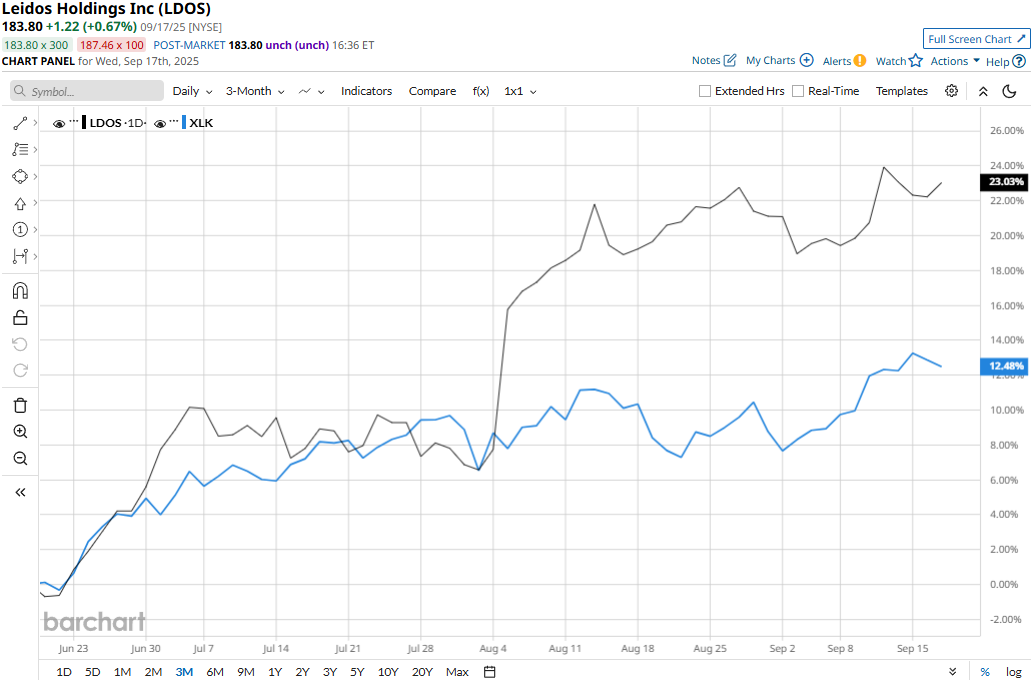

Leidos touched its all-time high of $202.90 on Nov. 22, 2024, and is currently trading 9.4% below that peak. Meanwhile, the stock has soared 23% over the past three months, notably outperforming the Technology Select Sector SPDR Fund’s (XLK) 12.5% surge during the same time frame.

Over the longer term, LDOS’ performance has remained mixed. The stock has gained 27.6% on a YTD basis and 19.1% over the past 52 weeks, outpacing XLK’s 16.7% gains in 2025, but lagging behind XLK’s 23.8% surge over the past year.

Meanwhile, the stock has traded above its 200-day moving average since late June and above its 50-day moving average since early April, with some fluctuations, underscoring its uptrend.

Leidos Holdings’ stock prices rose 7.5% in the trading session following the release of its robust Q2 results on Aug. 5 and maintained a positive momentum for six subsequent trading sessions. Q2 was marked with record margins, continued double-digit EPS growth, and strong cash conversion. The company’s revenues for the quarter increased 2.9% year-over-year to $4.3 billion, exceeding Street expectations. Meanwhile, its non-GAAP EPS soared by an impressive 22.1% year-over-year to $3.21, surpassing the consensus estimates by a significant margin. Further, its free cash flows soared 27.7% year-over-year to $457 million, boosting investor confidence.

When compared to its peer, Leidos has significantly outperformed Booz Allen Hamilton Holding Corporation’s (BAH) 21.1% decline on a YTD basis and 34.7% plunge over the past 52 weeks.

Among the 17 analysts covering the LDOS stock, the consensus rating is a “Moderate Buy.” Its mean price target of $191.27 suggests a modest 4.1% upside potential from current price levels.