/Lululemon%20Athletica%20inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Legendary investor Michael Burry is back in the headlines for many reasons, but also for boosting his new position in Lululemon (LULU). According to Scion Asset Management’s Q3 13F filing, Burry doubled his stake in LULU from 50,000 shares to 100,000 shares, lifting the reported position value from about $11.9 million to $17.8 million, roughly a 50% increase, in the period ended Sept. 30.

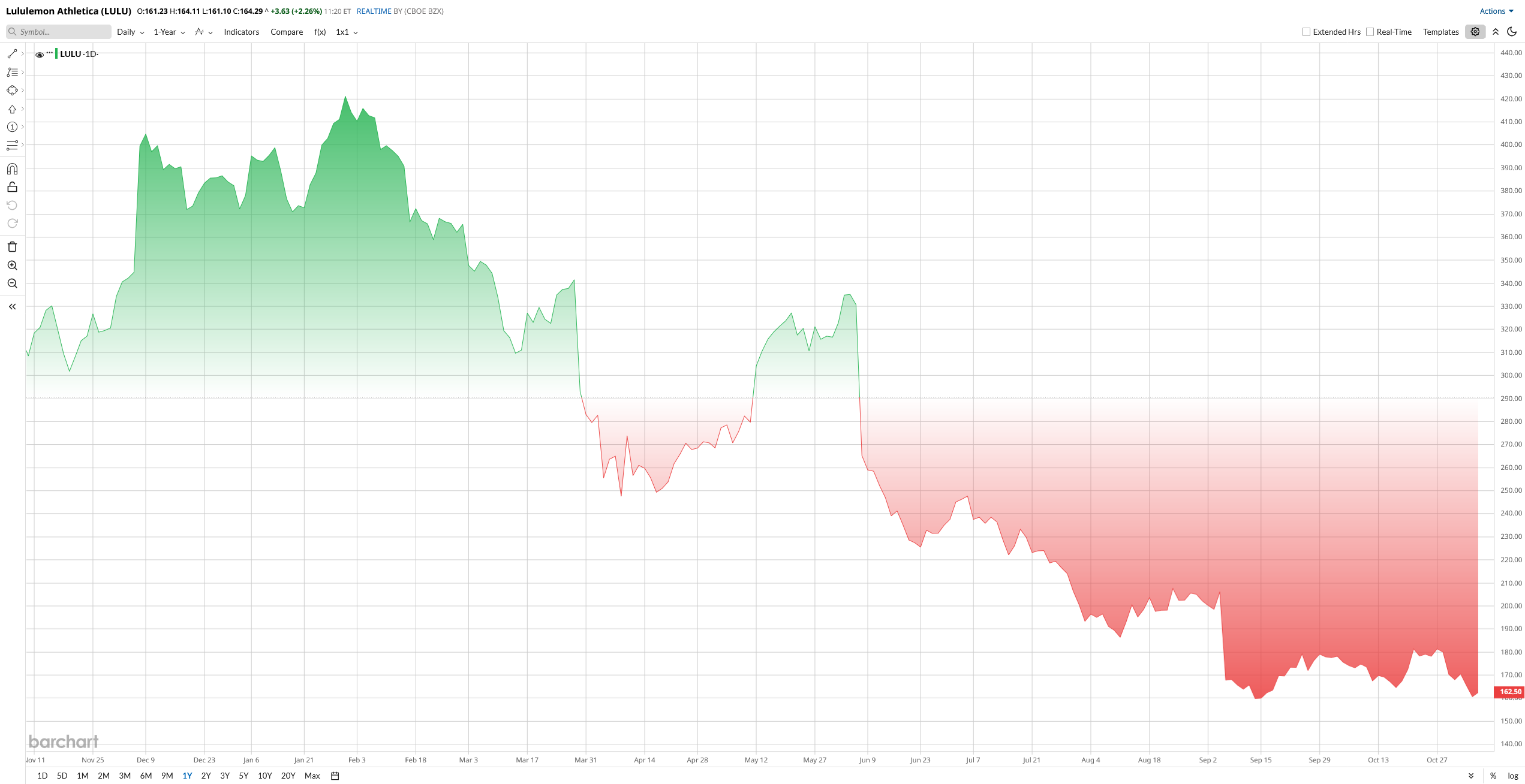

This move comes as Lululemon’s stock has plunged about 58% in 2025, driven by soft U.S. sales and higher import tariffs. Notably, Lululemon’s international growth remains strong, and the company even announced a new NFL team apparel partnership late in the year, factors that may offset some domestic weakness.

Burry’s bold move signals his view that LULU’s recent selloff may be overdone, implying a potential long-term buying opportunity. Let’s take a closer look to see if that holds up.

About LULU Stock

Founded in 1998, Lululemon is an athletic apparel company best known for its yoga and fitness wear. It designs and sells premium performance apparel, footwear, and accessories for both women and men through company-owned stores and online channels. The brand has become synonymous with high-quality leggings, tops, and casual activewear, supported by a loyal customer base and a global membership program of over 30 million. Today, Lululemon operates across North America, Asia, and Europe, maintaining a strong international footprint.

Valued at around $19 billion in market capitalization, Lululemon shares have lost roughly half their value over the past year. The downturn was due to the impact of various headwinds, such as stagnated same-store sales in the U.S., increased costs with the loss of the de minimis tariff waiver, stronger competition, and greater promotional intensity that have burdened margins. As the international markets, especially China, are likely to have attractive growth, the investors have narrowed down on domestic issues, causing the stock to hit lows in its multi-year history.

Yet after the haircut, Lululemon now looks relatively inexpensive. The stock trades at roughly 11x next-12-month earnings, well below the Consumer Cyclical sector median of 19x. Its EV/EBITDA multiple of about 7x also trails the typical 9x seen among apparel and retail peers. In simple words, LULU’s current multiples sit well under both sector averages and its own historical norms, and these discounted metrics suggest the market is pricing in weak growth ahead, but if fundamentals stabilize, today’s depressed valuation could present a compelling opportunity for long-term investors.

Lululemon Q2 Showed Growth Slowing, Trimmed Outlook

The last quarter that Lululemon experienced was Q2, which had slight growth but mixed signals. The net revenue amounted to approximately $2.5 billion, which is 7% more than it was last year but fell short of the analyst's estimate by a margin of $14.8 million.

Geographically splitting up the results, the sales in America were steady, with some 1% increase. In contrast, mainland sales in China increased by approximately 25 percent, while the rest of the world made 19%. The GAAP net income was $371 million compared to $393 million a year ago, with diluted EPS of $3.10 compared to $3.15 in the previous year.

The company's free cash flow was about $150.8 million, with cash and equivalents amounting to $1.16 billion at the end of the quarter. The company also opened 63 net new stores last year, ending Q2 with 784 stores worldwide.

The management adopted a cautious tone on its outlook. Lululemon was steered towards a Q3 revenue of between $2.47 billion and $2.50 billion and an EPS of $2.18 to $2.23.

The full-year 2025 sales forecast was narrowed to between $10.85 and $11 billion, which suggests it will grow between 2% and 4%, and this will result in EPS of $12.77 to $12.97. This is in comparison to the previous targets of 2% to 6% growth.

Analysts continue to forecast nearly $14.36 of possible EPS in the full year, with the probability that there can be an upside to the conservative management forecast. CEO Calvin McDonald openly mentioned that EPS was above expectations, but revenue was below, and, therefore, the company reduced its expectations on revenue and earnings during the year.

Recent News and Developments

Lululemon’s recent developments have drawn mixed reactions from investors. In late October, the company unveiled a new partnership with Fanatics to launch NFL team-branded apparel, a move that briefly lifted shares about 3% as markets welcomed the fresh growth opportunity.

However, broader sentiment remains cautious. The stock has tumbled badly as U.S. sales slow and competition intensifies in the premium activewear segment. Working capital growth also fell 15.7% year-over-year (YoY), well below the consumer discretionary sector median of 0.73%.

Q2 results added to the pressure, showing weaker top-line growth and shrinking margins. Management further hinted at scaling back share buybacks amid an uncertain outlook, underscoring near-term challenges despite new initiatives.

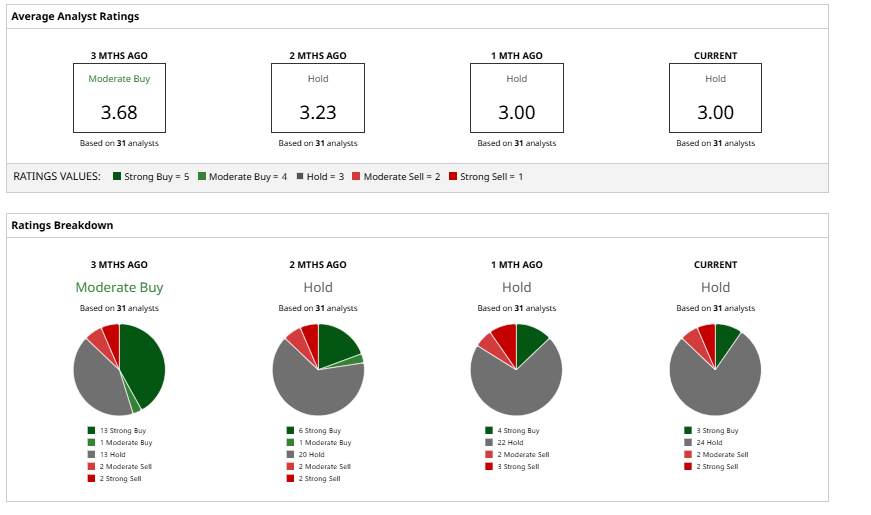

Analysts Opinion on LULU Stock

Wall Street analysts have grown more cautious, trimming targets and ratings. Goldman Sachs recently cut its LULU price target to $200, citing a weaker sales outlook and multiple margin pressures.

Morgan Stanley likewise lowered its target to $185 after the disappointing quarter, warning that higher tariffs and U.S. competition could keep a lid on growth. Bank of America (BofA) also trimmed its target to $185, pointing to slower China growth and rising costs of business.

On average, analysts still rate LULU stock a consensus “Hold,” with an average price target of $189, which implies an expected 15% upside potential. Investors will be watching the upcoming quarter for signs that the turnaround strategy is working.