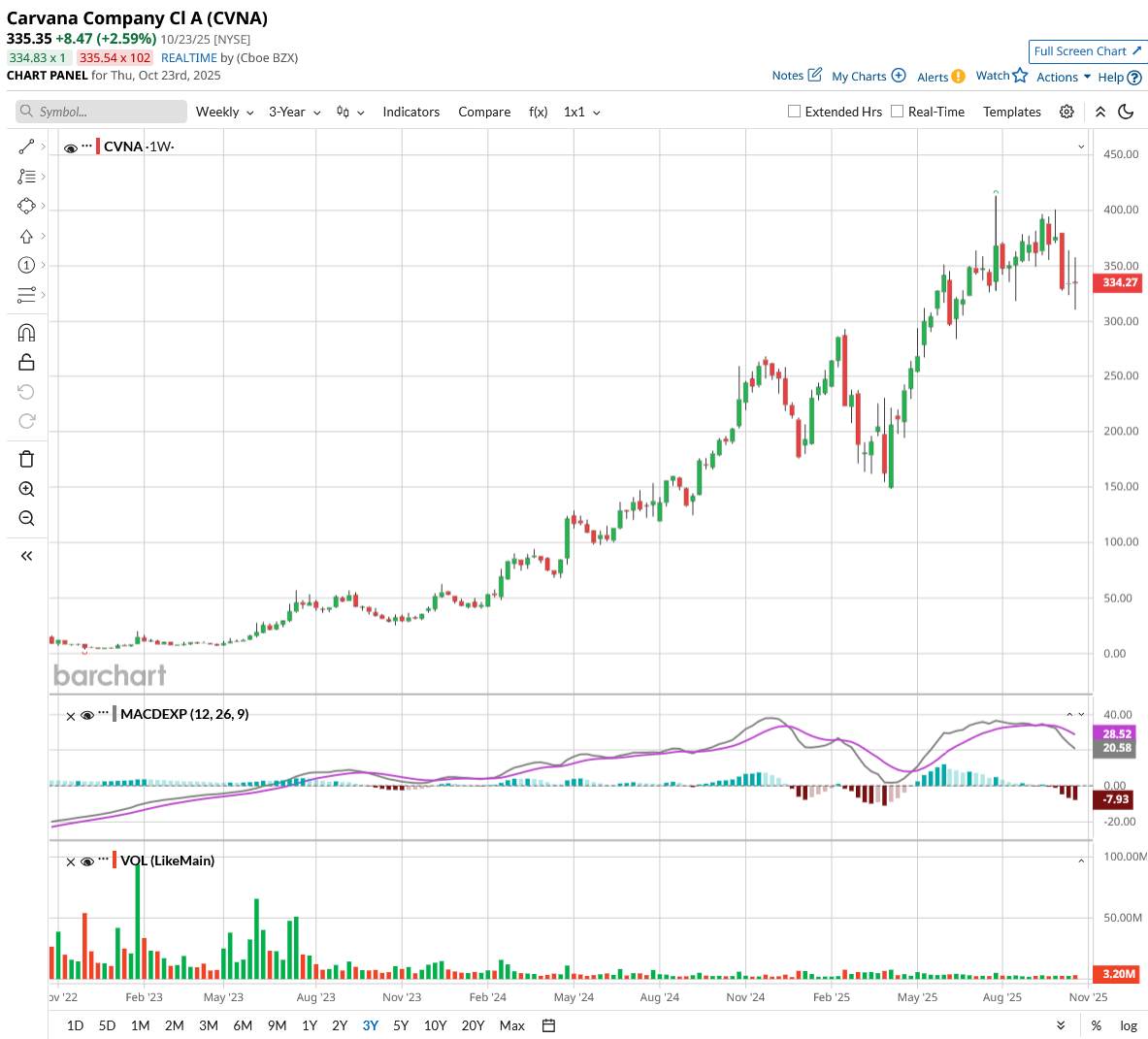

Jim Chanos, a noted short seller on Wall Street, disclosed a new bet against used car retailer Carvana (CVNA). Valued at a market cap of $45 billion, CVNA stock has returned 2,155% in the last three years. However, it fell 11% yesterday after Chanos highlighted concerns over the mounting stress in the subprime auto lending market.

Chanos pointed to rising delinquencies, defaults, and the recent collapse of Tricolor Holdings as red flags, questioning how Carvana continues thriving while competitors struggle. He emphasized that Carvana lacks transparency regarding its operations and has maintained his short position for several years despite the strong recent performance.

The criticism came as Jefferies' data showed Carvana sold approximately 159,000 retail units in Q3, an increase of 46% year-over-year (YoY) and 6% higher than estimates. Additionally, sales in September rose by 54%, the fastest pace since late 2024. Notably, Carvana has grown car sales by more than 40% for five consecutive quarters.

The average selling prices on the platform rose 5% to $26,300, outpacing industry trends, while website traffic increased 22% last month. Carvana is well-positioned to capitalize on the digital shift in the $800 billion used car market. But let’s see if CVNA stock is a good buy right now.

The Bull Case of Investing in Carvana Stock

Carvana delivered record-breaking second-quarter results, with retail units sold reaching 143,280, an increase of 41% YoY, while the broader used car market expanded less than 5%. The online car retailer posted revenue of $4.84 billion and achieved new company records across multiple profitability metrics, including adjusted EBITDA margin, GAAP operating income, and net income dollars.

CEO Ernie Garcia emphasized that the company has become the fastest-growing and most profitable automotive retailer, reaching approximately 1.5% market share in the U.S. used car market.

CFO Mark Jenkins highlighted that the vertically integrated platform drives efficiency advantages, with the business model supporting annual sales exceeding one million units despite current volumes running meaningfully below that capacity. This positions Carvana for substantial overhead leverage as growth continues.

Management outlined three fundamental growth drivers powering the business.

- Continuous customer experience improvements enable transactions like vehicle drop-offs to be completed in just 38 minutes from online valuation to payment.

- Increasing awareness and trust remain critical, given that automotive e-commerce penetration is around 2% compared to nearly 20% across broader retail.

- Expanding inventory selection through the integration of acquired ADESA locations provides additional inventory pools that reduce both inbound and outbound transport distances by 20% and 10%, respectively.

Carvana is integrating 12 ADESA physical auction locations with its retail operations, implementing proprietary CARLI inventory management systems, and connecting sites to the first-party logistics network.

While these sites currently operate at lower utilization rates than legacy Carvana inspection centers, creating near-term cost pressures, they establish foundations for easier future growth.

Non-GAAP retail GPU increased $195, driven primarily by reconditioning and transport efficiencies, plus approximately $100 from tariff-related impacts. Carvana maintains medium-term goals to sell three million cars annually within five to ten years at 13.5% adjusted EBITDA margins.

Management prioritizes investing cash from operations into business expansion while selectively deleveraging through senior secured note repurchases and improving capital structure through refinancing opportunities as credit metrics strengthen.

Is CVNA Stock Still Undervalued?

Analysts tracking CNVA stock forecast sales to rise from $13.67 billion in 2024 to $46 billion in 2029. In this period, free cash flow is projected to improve from $830 million to $3.10 billion.

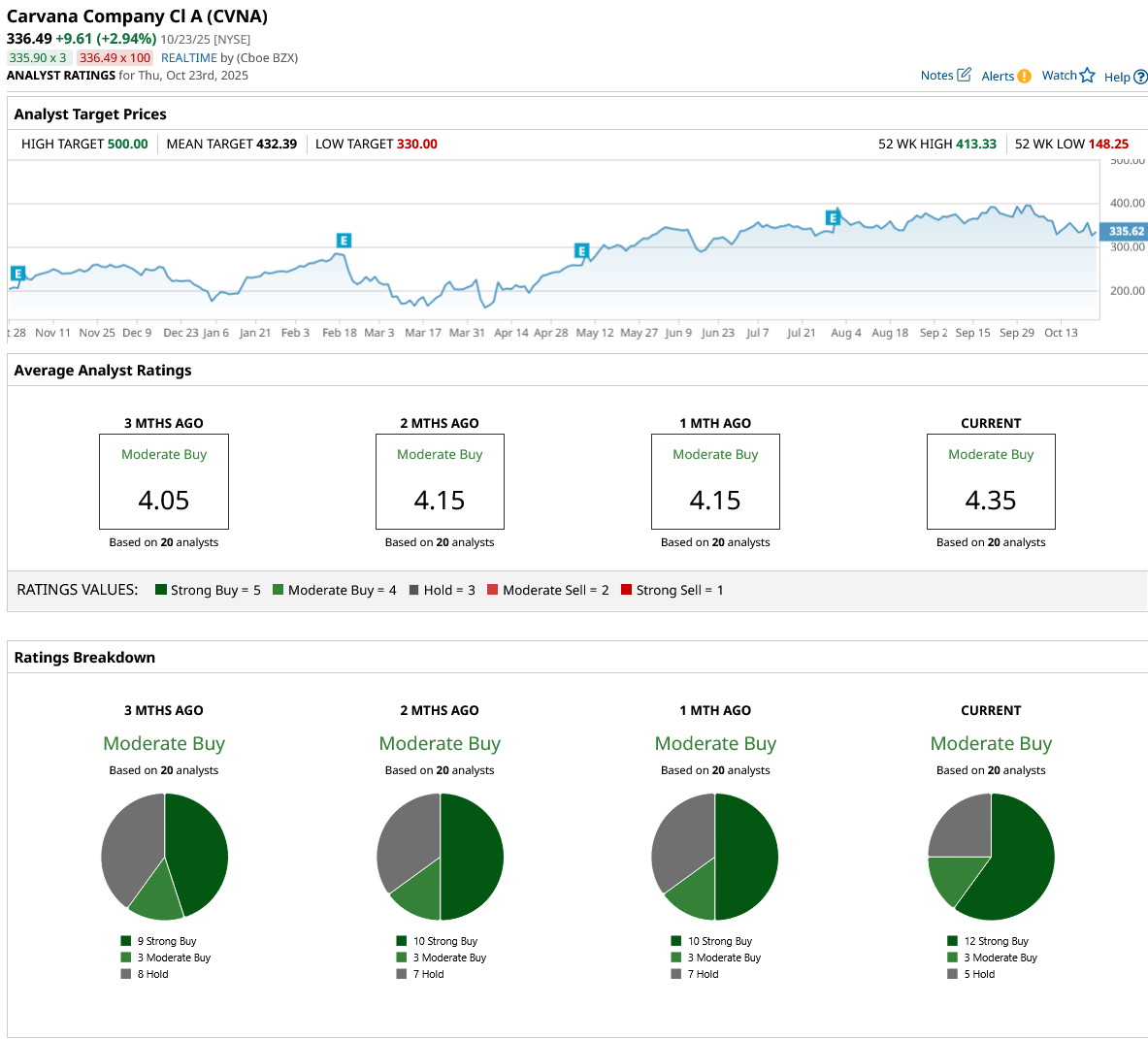

If CVNA stock is priced at 30x forward FCF, it should double within the next four years. Out of 20 analysts covering the stock, 12 recommend “Strong Buy,” three recommend “Moderate Buy,” and five recommend “Hold.” The average CVNA stock price target is $429, above the current price of $336.