As revealed in its fourth-quarter earnings report, Nike (NKE) — a leading name in textiles, apparel and luxury goods — is undergoing a strategic realignment under CEO Elliott Hill. The company has announced another round of layoffs, impacting less than 1% of corporate staff, building on last February’s 2% reduction, or more than 1,500 positions.

Since assuming leadership of the world’s largest sportswear brand, Hill has focused on reversing declining sales, reigniting innovation, and strengthening relationships with wholesale partners. In its fiscal Q4 earnings announcement in June, Nike indicated that sales and profit declines are expected to moderate in upcoming quarters, signaling that the most challenging period may be behind the company. Analysts were advised to anticipate early benefits from the turnaround, as the realignment begins to take tangible shape.

With its teams reorganized and its focus sharpened, Nike is laying the groundwork to emerge stronger, reconnect with its audience, and reclaim its stride in the global sportswear arena.

About Nike Stock

Headquartered in Beaverton, Oregon, Nike is a global leader in athletic and casual footwear, apparel, and equipment. Its portfolio includes renowned brands such as Nike, Jordan Brand, and Converse, while its operations span worldwide retail, wholesale, and direct-to-consumer channels.

The company is valued at a market capitalization of approximately $110 billion, reflecting its entrenched position in the industry. Beyond products, Nike provides performance equipment, digital experiences, and consumer engagement platforms that reinforce brand loyalty and global recognition.

Over the past 52 weeks, NKE stock has seen a decline of 8%. Year-to-date (YTD), the stock has dropped 1.2%. However, in the last three months, shares have surged 20%, highlighting renewed investor confidence.

NKE trades at 2.47 times sales, a multiple above the industry average though slightly below its five-year historical range, suggesting a relative discount amid strong underlying fundamentals.

Dividends remain consistent, with 23 consecutive years of growth. Nike pays an annual dividend of $1.60, equating to a yield of 2.07%. Its most recent dividend of $0.40 is scheduled for Oct. 1, payable to shareholders of record on Sept. 2.

Nike Surpasses Q4 Earnings

Nike reported its fiscal Q4 results on June 26, and while revenue and net income declined, the company surpassed analysts’ expectations. Revenue fell 12% year-over-year (YOY) to $11.1 billion but came in above the Street’s forecast of $10.72 billion.

Nike Direct declined 14%, driven by a 26% drop in Nike Digital, while Nike Stores grew 2%. Wholesale revenue fell 9%, reflecting ongoing adjustments in channel strategy and inventory management. Gross margin contracted by 440 basis points to 40.3%, primarily due to higher wholesale and factory store discounts, supply-chain cost pressures, and channel mix headwinds.

Net income dropped 85.9% to $211 million, and EPS mirrored this decline, falling to $0.14 from $0.99 in the prior year. Despite these steep reductions, results exceeded the Street’s expectation of $0.12, prompting a market reaction that lifted NKE stock 15.2% in trading on June 27.

Cash and short-term investments totaled $9.2 billion, down $2.4 billion from last year, reflecting the combined impact of share repurchases, dividends, bond repayments, and capital expenditures outweighing cash generated from operations.

Inventory remains elevated, yet the company is actively managing excess stock through value stores and select partners. Nike anticipates modest headwinds in the next two quarters as it laps prior-year clearance activity, and digital traffic is expected to remain down while the company repositions Nike Digital toward a full-price model and reduces classic footwear franchises.

Analysts expect Nike’s Q1 2026 EPS to fall 61% YOY to $0.27, with full-year 2026 EPS expected to decline 22% to $1.69. Fiscal 2027 is anticipated to see a strong rebound, however, with EPS rising 53% to $2.59, reflecting optimism in the company’s strategic realignment and long-term growth prospects.

What Do Analysts Expect for Nike Stock?

Analysts maintain a positive outlook for NKE stock as the firm's realignment progresses. HSBC upgraded NKE from “Hold” to “Buy,” raising the price target to $80 from $60, citing tangible evidence of a near-term sales recovery despite potential tariff impacts on fiscal 2026 gross margins.

Bernstein increased its target to $90 from $85 while maintaining an “Outperform” rating, reflecting confidence in Nike’s strategic execution. Likewise, Williams Trading raised its target to $100 from $73 with a “Buy” rating, while Jefferies analyst Randal Konik reaffirmed his “Buy” rating with a $115 target.

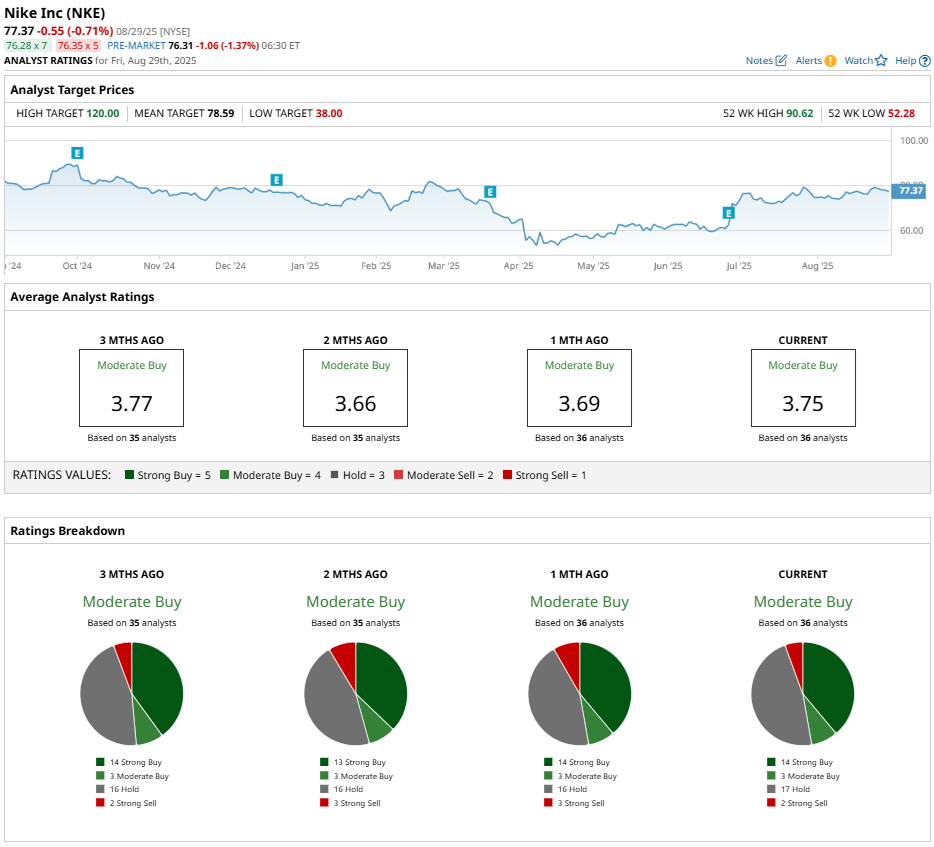

NKE stock maintains a consensus rating of “Moderate Buy” among 36 analysts covering the stock. Of these analysts, 14 recommend a “Strong Buy,” three have a “Moderate Buy,” 17 advise a “Hold,” and two advise a “Strong Sell" rating.

NKE stock’s average price target of $78.59 represents potential upside of 5% from here. The Street-high target of $120 reflects a 61% potential gain from current levels.