Larry Ellison, the founder and chief technology officer of Oracle Corp. (NYSE:ORCL), expressed optimism regarding the future of AI and his company’s competitive positioning in the segment.

Larry Ellison Says ‘AI Will Change Everything’

During the company’s first-quarter earnings call on Tuesday, Ellison declared, “eventually, AI will change everything,” while highlighting his company’s growing dominance in enterprise AI infrastructure.

According to Ellison, AI inference, which refers to using trained models in real-world applications, is poised to be “much, much larger than the AI training market.” He says that with millions of customers using AI models to run their businesses and governments, it is a “gigantic, multi-trillion-dollar market.”

See Also: Oracle Cuts Hundreds Of Jobs Despite Stock Near Record Highs: Report

Oracle is aggressively positioning itself as a leader in inferencing, touting its newly launched AI Database, which enables enterprises to “vectorize” private data, which is essentially converting raw data into numerical representations, before securely linking it with LLMs like ChatGPT, Gemini, Grok, and Llama.

“We're the custodian of… millions of databases,” Ellison says, adding that the company is “better positioned than anybody to take advantage of inferencing.”

Stock Soars Despite Missing Estimates

Oracle released its first quarter earnings on Tuesday, reporting $14.92 billion in revenue, up 12% year-over-year, compared to $13.3 billion last year, and falling short of consensus estimates of $15.03 billion.

The company reported a profit of $1.47 per share, which was marginally below analyst consensus estimates of $1.48 per share.

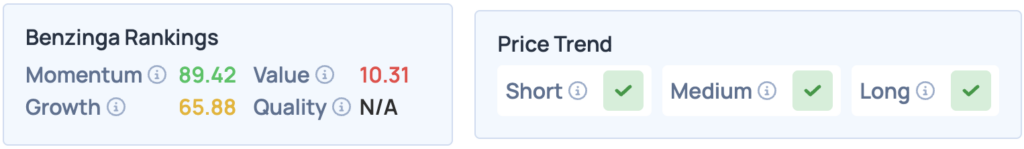

The stock was up 1.27% on Tuesday, closing at $241.51 per share, but has since soared 31.42% after hours, following the earnings announcement. According to Benzinga’s Edge Stock Rankings, the stock scores high on Momentum, and has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Photo Courtesy: drserg from Shutterstock on Shutterstock.com

Read More: