Lamar Advertising Company (NASDAQ:LAMR) reported mixed second-quarter results on Friday.

Lamar Advertising reported quarterly earnings of $1.52 per share which beat the analyst consensus estimate of 86 cents per share. The company reported quarterly sales of $579.311 million which missed the analyst consensus estimate of $580.719 million.

“Revenue growth accelerated slightly in the second quarter, with increases on both the national and local levels. Meanwhile, in early July we completed a milestone acquisition, with the first-ever UPREIT transaction in the billboard industry,” Lamar chief executive Sean Reilly said. “Our pacings indicate further year-over-year improvement in revenues is likely in the second half of 2025, though perhaps not to the degree that we’d anticipated entering the year. As a result, we’ve slightly revised our guidance for full-year diluted AFFO per share from a range of $8.13 to $8.28 per share to a range of $8.10 to $8.20 per share.”

Lamar Advertising raised its FY2025 GAAP EPS guidance from $6.01-$6.07 to $6.09-$6.11.

Lamar Advertising shares fell 0.8% to trade at $114.44 on Monday.

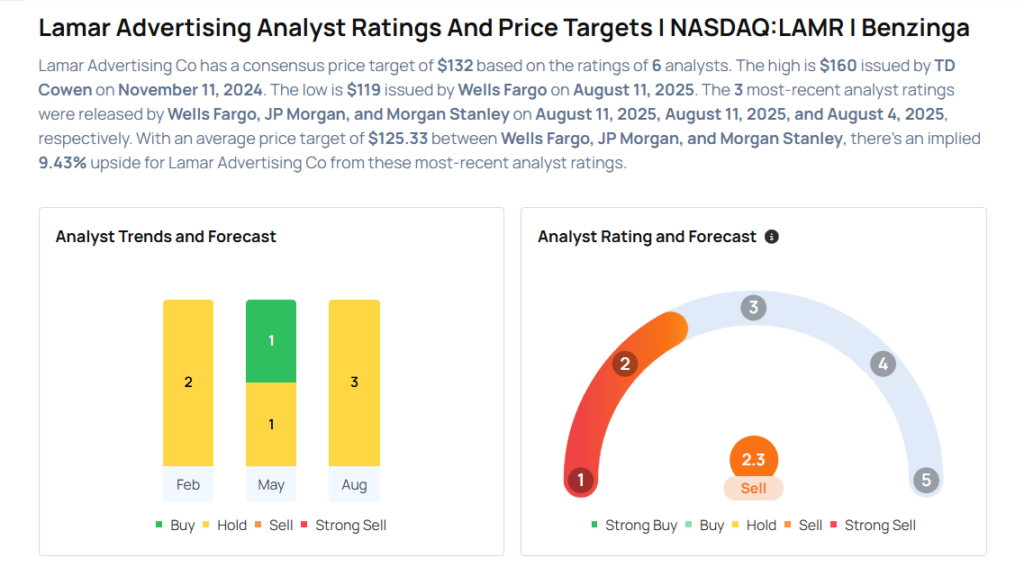

These analysts made changes to their price targets on Lamar Advertising following earnings announcement.

- JP Morgan analyst David Karnovsky maintained Lamar Advertising with a Neutral and lowered the price target from $125 to $122.

- Wells Fargo analyst Daniel Osley maintained the stock with an Equal-Weight rating and lowered the price target from $122 to $119.

Considering buying LAMR stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock