Lithium Americas (LAC) shares are up more than 12% in morning trading Thursday following reports that President Donald Trump is seeking an equity stake in the Vancouver-headquartered mining firm. LAC stock closed up 95.8% higher on Wednesday.

The news arrives at a time when LAC is renegotiating a $2.2 billion loan for its Thacker Pass mine.

A small equity stake in exchange for pushing out part of the repayment to later years will “eliminate some risk on behalf of taxpayers,” a U.S. official said on Wednesday.

Following the two-day surge, Lithium Americas stock is up nearly 200% versus its year-to-date low.

How Federal Support May Benefit Lithium Americas Stock

Investors are reading the prospect of a federal stake in LAC as strategic endorsement of the firm’s pivotal role in securing domestic lithium supply.

It mirrors the U.S. government’s 15% stake in MP Materials (MP), whose shares have doubled post-deal.

For Lithium Americas, a deal with the Trump administration could derisk the Thacker Pass project, attract institutional capital, and accelerate regulatory approvals.

The administration’s desire to build a stake in LAC stock also signals bipartisan urgency to counter China’s dominance in critical minerals.

If finalized, federal support could unlock long-term upside for Lithium Americas shareholders and position the company as a cornerstone of America’s electric vehicle (EV) battery supply chain.

Where Options Pricing Suggests LAC Shares Are Headed

Options data from Barchart suggests meaningful upside for Lithium Americas shares in the fourth quarter of 2025.

For the Jan. 16 expiration, the implied trading range spans from $3.99 to $9.74, indicating volatility ahead but with significant upside potential.

In the near term, the expected move through Oct. 17 is 33.58%, which the upper price pegged at $9.10.

While the possibility of a sharp reversal is embedded into the options data as well, the upper bound looks much more plausible, especially if the federal equity stake materializes and loan terms are finalized favorably.

How Wall Street Recommends Playing Lithium Americas

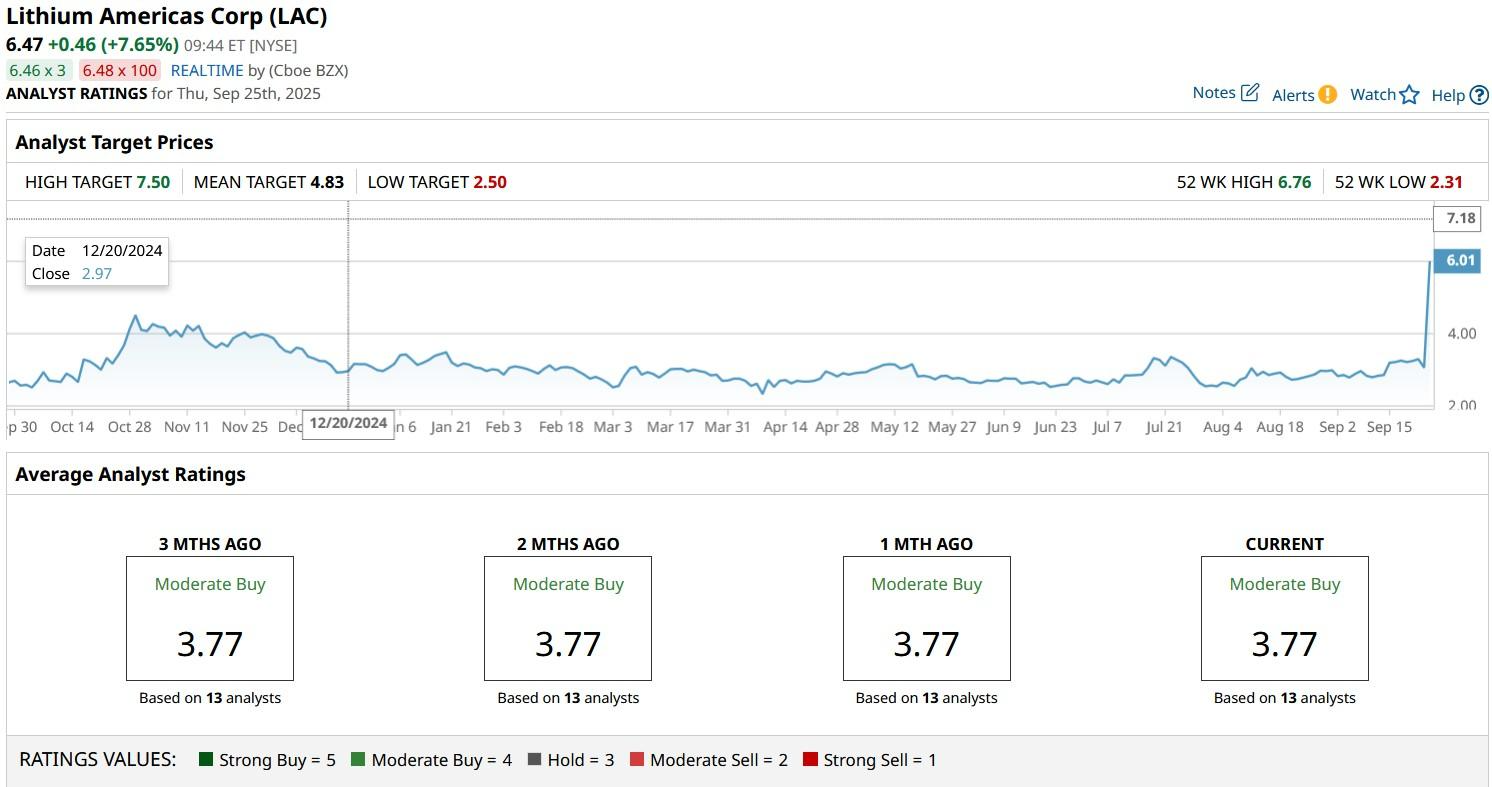

Note that Wall Street analysts currently have a positive stance on Lithium Americas stock as well.

The consensus rating on LAC shares currently sits at “Moderate Buy” with price targets going as high as $7.50, indicating potential upside of up to 10% from here.