/Labcorp%20Holdings%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Valued at a market cap of $23 billion, Labcorp Holdings Inc. (LH) is a leading global provider of comprehensive laboratory services. Operating through its Diagnostics Laboratories and Biopharma Laboratory Services segments, the company delivers a wide range of testing, specialty diagnostics, and drug development solutions.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Labcorp Holdings fits this criterion perfectly. Serving patients, healthcare providers, pharmaceutical companies, and other industries, Labcorp helps drive clear and confident decision-making in healthcare and beyond.

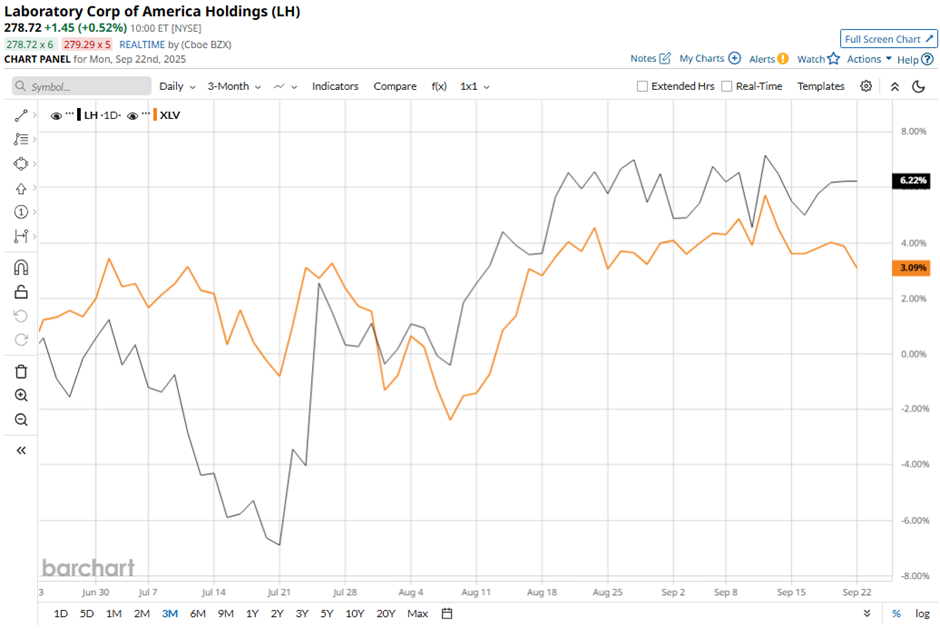

Shares of the Burlington, North Carolina-based company have fallen 2.7% from its 52-week high of $283.47. Shares of Labcorp Holdings have risen 5.4% over the past three months, outpacing The Health Care Select Sector SPDR Fund’s (XLV) 2.6% gain over the same time frame.

Longer term, LH stock is up 20.3% on a YTD basis, exceeding XLV’s 1.1% decline. Moreover, shares of the company have soared 24.2% over the past 52 weeks, compared to XLV’s 12.4% decrease over the same time frame.

Despite a few fluctuations, the stock has been moving mostly above its 50-day and 200-day moving averages since last year.

Shares of Labcorp Holdings climbed 6.9% on Jul. 24 after the company posted strong Q2 2025 results, with adjusted EPS of $4.35 and revenues of $3.53 billion, topping estimates. Growth was fueled by solid performances in Diagnostics Laboratories, which grew 8.9% to $2.75 billion, and Biopharma Laboratory Services, which rose 11% to $784.8 million. Investor sentiment was further boosted by raised full-year 2025 guidance, with revenue growth now expected at 7.5% - 8.6% and adjusted EPS at $16.05 - $16.50.

In contrast, rival Quest Diagnostics Incorporated (DGX) has outpaced LH stock on a YTD basis, surging 22.4%. However, DGX stock has returned 20.7% over the past 52 weeks, lagging behind Labcorp Holdings’ performance during the same period.

Due to LH’s outperformance relative to the sector, analysts remain bullish about its prospects. The stock has a consensus rating of “Strong Buy” from 18 analysts in coverage, and the mean price target of $295.53 is a premium of 5.9% to current levels.