Kraft Heinz (KHC) shares are slipping this morning after the packaged food giant announced plans of splitting into two independent, publicly traded companies.

According to KHC’s press release, one of these companies will focus on shelf-stable meals (brands like Heinz and Philadelphia) while the other will be a “scaled portfolio of North America staples.”

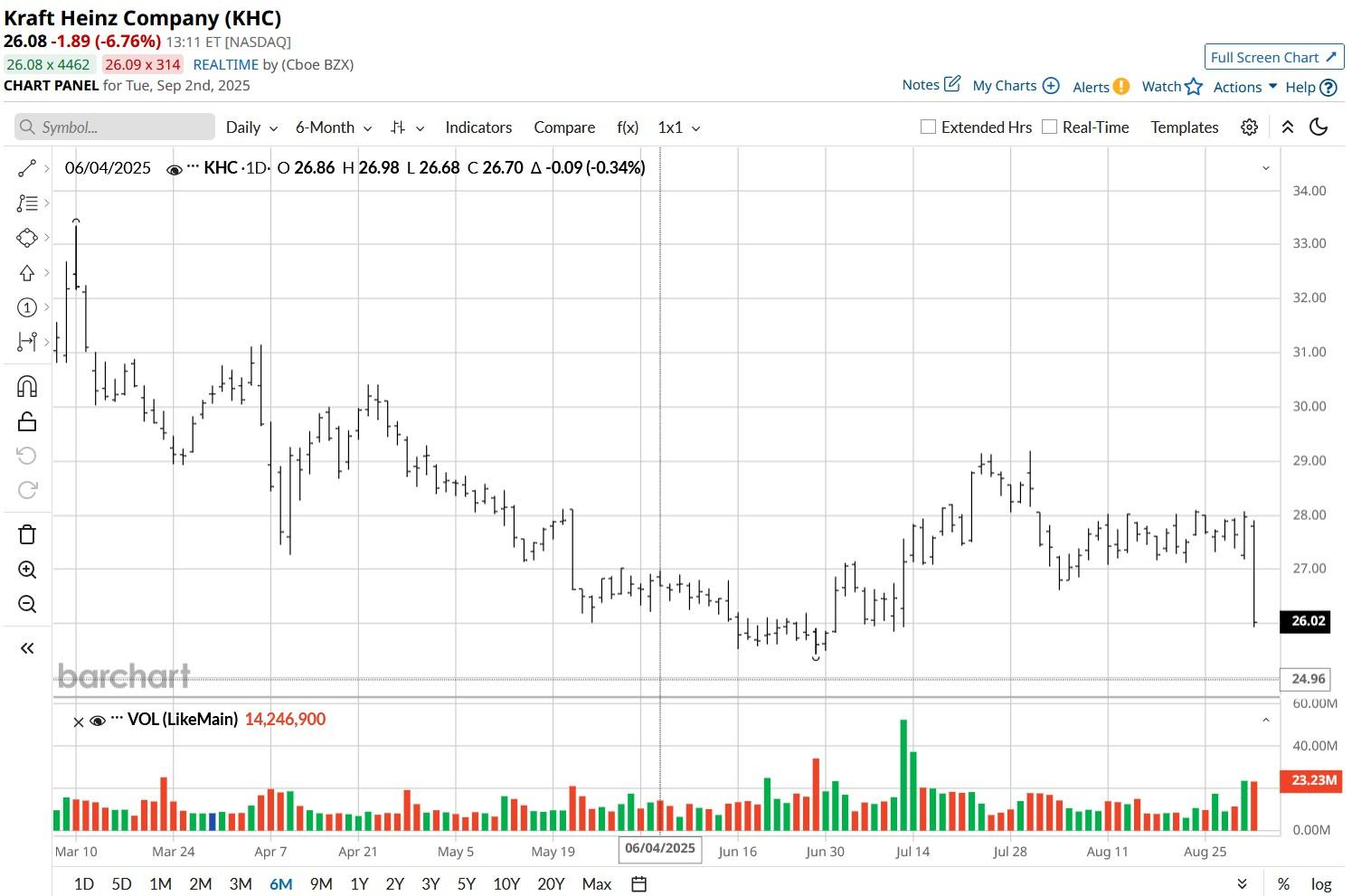

The latter will include brands like Kraft Singles and Lunchables. Following today’s decline, Kraft Heinz stock is down more than 20% versus its year-to-date high in early March.

Managements Believes Split Will Prove Positive for Kraft Heinz Stock

Kraft Heinz’s executives believe the split will unlock greater shareholder value by simplifying the company’s structure and sharpening its strategic focus.

According to Miguel Patricio, the executive chairman of Kraft Heinz, this strategic maneuver will enable more prudent allocation of capital and launch of tailored growth initiatives for each brand.

The separation is designed to offer each of the two independent firms the autonomy and resources to drive performance, streamline operations, and respond more nimbly to market demands.

All in all, this split will position both companies for long-term success in a rather competitive food landscape, he added.

Warren Buffett’s View on What the Split May Mean for KHC Shares

Despite the management’s optimism, legendary investor Warren Buffett is disappointed in KHC’s decision to split its business.

In a post-announcement interview with CNBC, the “Oracle of Omaha” admitted that Kraft Heinz merger did not prove the “brilliant idea” he had envisioned in 2015, but said splitting the business won’t necessarily fix its problems either.

Buffett’s skepticism signals a lack of confidence in Kraft Heinz’s strategic direction.

Note that Berkshire Hathaway (BRK.A) (BRK.B) is currently the largest KHC shareholder with a 27.5% stake. Warren Buffett’s remarks could, therefore, unsettle long-term investors and weigh on KHC share price moving forward.

How Wall Street Recommends Playing Kraft Heinz shares

Investors should practice caution in buying Kraft Heinz stock after the split announcement as Wall Street analysts aren’t particularly bullish on the packaged food company either.

The consensus rating on KHC shares currently sits at “Hold” only. While the mean target of about $29 indicates meaningful upside for now, the Street could downwardly revise estimates in response to the split and Buffett’s remarks in the days ahead.