Pittsburgh, Pennsylvania-based The Kraft Heinz Company (KHC) is a leading global food and beverage company, formed in 2015 through the merger of Kraft Foods and H.J. Heinz. With a market cap of $30.2 billion, it produces iconic brands like Kraft, Heinz, Oscar Mayer, and Philadelphia, offering products across condiments, cheese, snacks, and packaged meals.

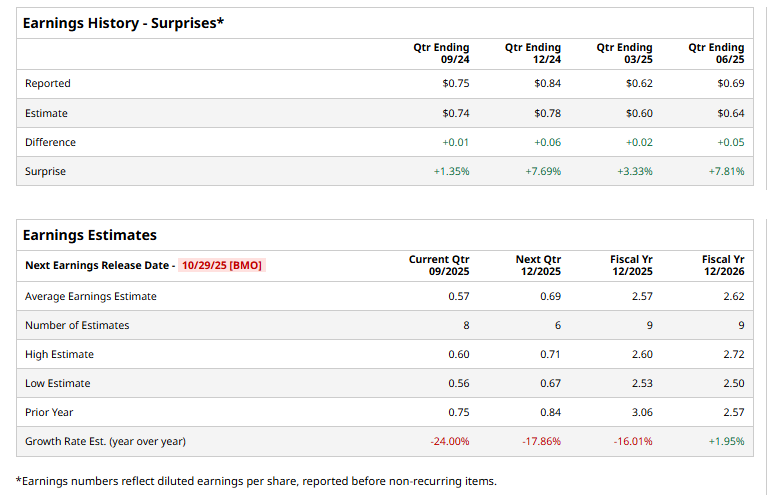

The food titan is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 29. Ahead of the event, analysts expect KHC to report a profit of $0.57 per share on a diluted basis, down 24% from $0.75 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect KHC to report EPS of $2.57, down 16% from $3.06 in fiscal 2024. However, its EPS is expected to rise 2% year over year to $2.62 in fiscal 2026.

Over the past year, Kraft Heinz has struggled, with shares down 29%, sharply lagging the S&P 500 Index’s ($SPX) 14.1% gain and underperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) fund, which fell 2.8%.

Kraft Heinz has struggled in recent years, with its stock losing over 70% of its value since February 2017. Once a Wall Street favorite for steady growth and high dividends, the company has been weighed down by cost-cutting focus, slow adaptation to healthier consumer trends, rising competition, and tighter household budgets.

Kraft Heinz’s stock saw a marginal dip after its Q2 earnings release on July 30, as the company grappled with a 2% drop in organic sales and a 1.9% decline in revenue to $6.35 billion. Margins slipped 140 basis points to 34.1%, and adjusted operating income fell 7.5% to $1.3 billion. However, adjusted EPS of $0.69 beat expectations by 7.8%, showing that the company still managed to outperform analyst forecasts despite the pressure on top-line growth.

Analysts’ consensus opinion on KHC stock is cautious, with a “Hold” rating overall. Out of 22 analysts covering the stock, 2 advise a “Strong Buy” rating, 19 give a “Hold,” and the remaining analyst suggests a “Moderate Sell.” KHC’s average analyst price target is $28.24, indicating a potential upside of 10.7% from the current levels.