/KLA%20Corp_%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Milpitas, California-based KLA Corporation (KLAC) engages in the design, manufacture, and marketing of process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries. With a market cap of $139.9 billion, KLA operates through Semiconductor Process Control, Specialty Semiconductor Process, and PCB & Component Inspection segments.

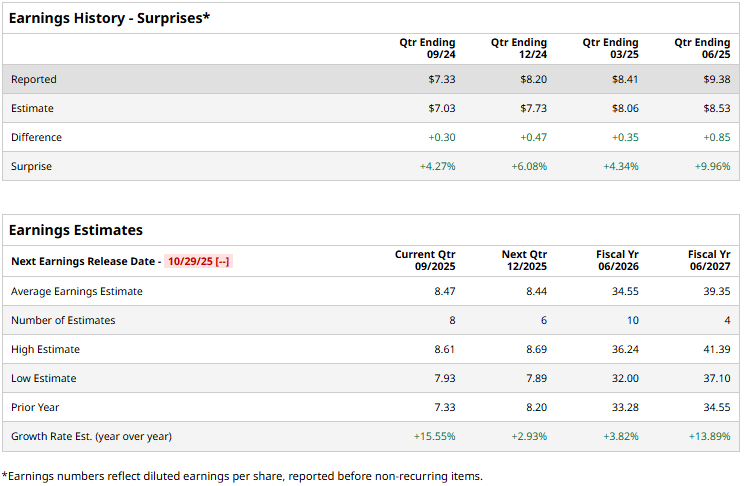

The semiconductor giant is set to announce its first-quarter results after the markets close on Wednesday, Oct. 29. Ahead of the event, analysts expect KLAC to report an adjusted profit of $8.47 per share, up 15.6% from $7.33 per share reported in the year-ago quarter. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2026, its adjusted EPS is expected to come in at $34.55, up 3.8% from $33.28 in 2025. While in fiscal 2027, its earnings are expected to soar 13.9% year-over-year to $39.35 per share.

KLAC stock prices have surged 30.9% over the past 52 weeks, notably outperforming the Technology Select Sector SPDR Fund’s (XLK) 25.9% gains and the S&P 500 Index’s ($SPX) 16.3% returns during the same time frame.

KLAC stock prices observed a marginal uptick in the trading session following the release of its impressive Q4 results on Jul. 31. Driven by the relevance and demand of KLA’s industry-leading technologies, the company has continued to observe high growth in product as well as service revenues. The company’s net revenues for the quarter surged 23.6% year-over-year to $3.2 billion, beating the Street’s expectations by 3.2%. Further, its adjusted net income increased by 11% year-over-year to $1.2 billion, and its adjusted EPS of $9.38 surpassed the consensus estimates by almost 10%.

Analysts remain optimistic about the stock’s prospects. KLAC stock maintains a consensus “Moderate Buy” rating overall. Of the 26 analysts covering the stock, opinions include nine “Strong Buys,” one “Moderate Buy,” and 16 “Holds.” As of writing, the stock is trading notably above its mean price target of $982.50.