I've tracked the trends of King Corn and the Kansas City Royals, particularly the similarities, for the past couple decades.

-

Both were content to move sideways during 2025.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. With the outlook for 2026 more of the same.

You can tell markets have gone quiet when I dust off my comparison of King Corn and the Kansas City Royals Major League Baseball (MLB) team. After sitting at my desk pondering what to write about for a couple days, during which time the Royals were eliminated from playoff contention (again), I was reminded of the previous piece I wrote for Barchart on the subject. As it turns out, it was almost a year ago to the day, September 29, 2024. A key difference is back then the Royals were headed to the playoffs as a wildcard team. I wrote at the time that my son had asked if the 10-year cycle in corn and the Royals meant the latter would win the World Series this year. Based on Chaos Theory, I didn’t think so. I was correct.

In fact, it would be hard to picture a team posting a more “meh” season than the 2025 Kansas City Royals. Heading into the last 4 games of the season the team has won 79 games and lost 79 games, scored 626 runs and given up 625 runs. While I’m no baseball historian, it’s hard to imagine a team has had a more sideways season than the 2025 Royals.

Which brings us to the other royalty in the comparison – King Corn. A quick recap of last year’s piece is that I’ve tracked the similarity in trends between the two for a couple decades. Last year at this time, the correlation between the two was 91%, for what that’s worth. This year, the eyeball test tells me the two have been moving together again.

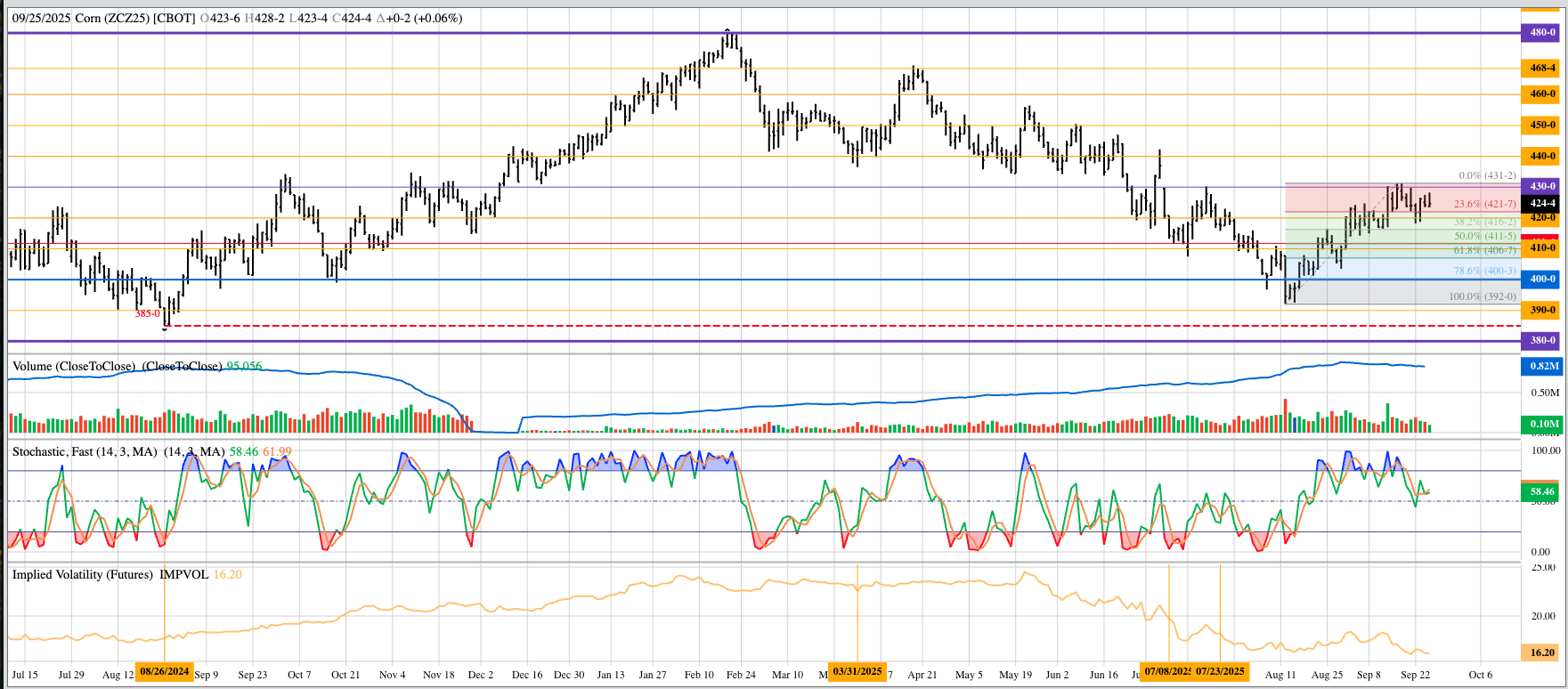

We can use whatever aspect of the corn market one chooses, but since I usually talk about long-term investments in a Dec-only fund, let’s look at the December futures contract this time around. Since March 1, roughly the start of the 2025 MLB season, the Dec25 futures contract (ZCZ25) has a trading range of about $4.70 (April 16) to near $3.90 (August 12). This puts the midpoint of the range at roughly $4.30. Much of last week saw the Dec25 issue priced near $4.30 before closing last Friday at $4.24. As of this writing (midday Thursday, September 25), the contract is sitting at $4.24. Based on the Horseshoes Proximity (Close is close enough) we can say Dec25 is sitting near the middle, or in other baseball terms, near 0.500.

For this coming weekend’s edition of Market Journal, taped Thursday as well, my friend and host Bryce Doeschot asked about the equilibrium seen in the corn market these days. Just as in a baseball game, there are a number of factors in play at any given time, though it usually comes down to pitching versus hitting. In markets, its supply versus demand, with the simple economics Law of Supply and Demand stating the market price is the equilibrium between quantities demanded and supplies available. Given Dec25 corn isn’t moving much – it has a 10-cent trading range so far this week – the argument could be made demand and available supplies have both stabilized.

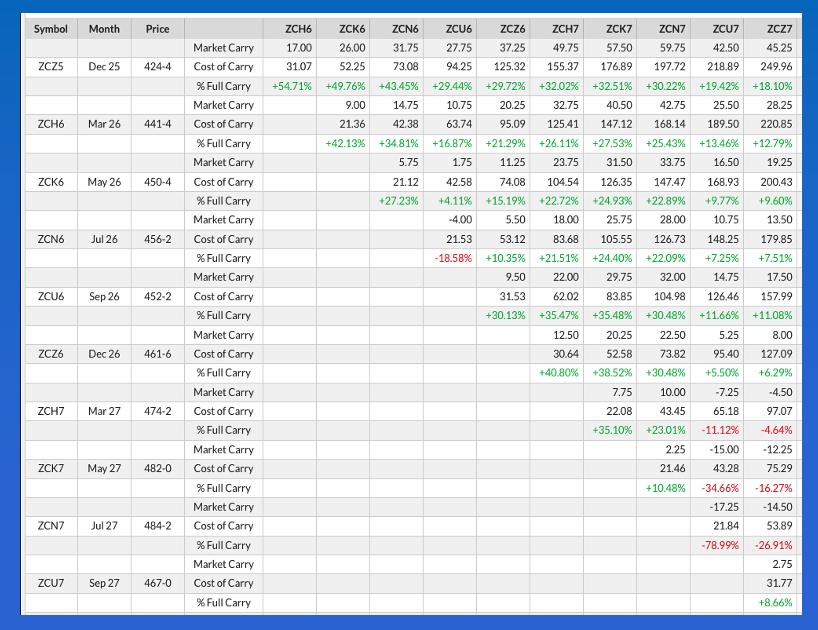

We see a similar story when we look at the two sides of the market, commercial and noncommercial. Commercial interests continue to show a neutral view of short-term fundamentals with the nearby Dec-March futures spread covering 54.7% calculated full commercial carry and the March-May spread covering 42.1%. Further out, though, things get more interesting with the May-July spread covering a bullish 27.2%. As I wrote about recently, this is the factor that could bring more long-term buying into corn.

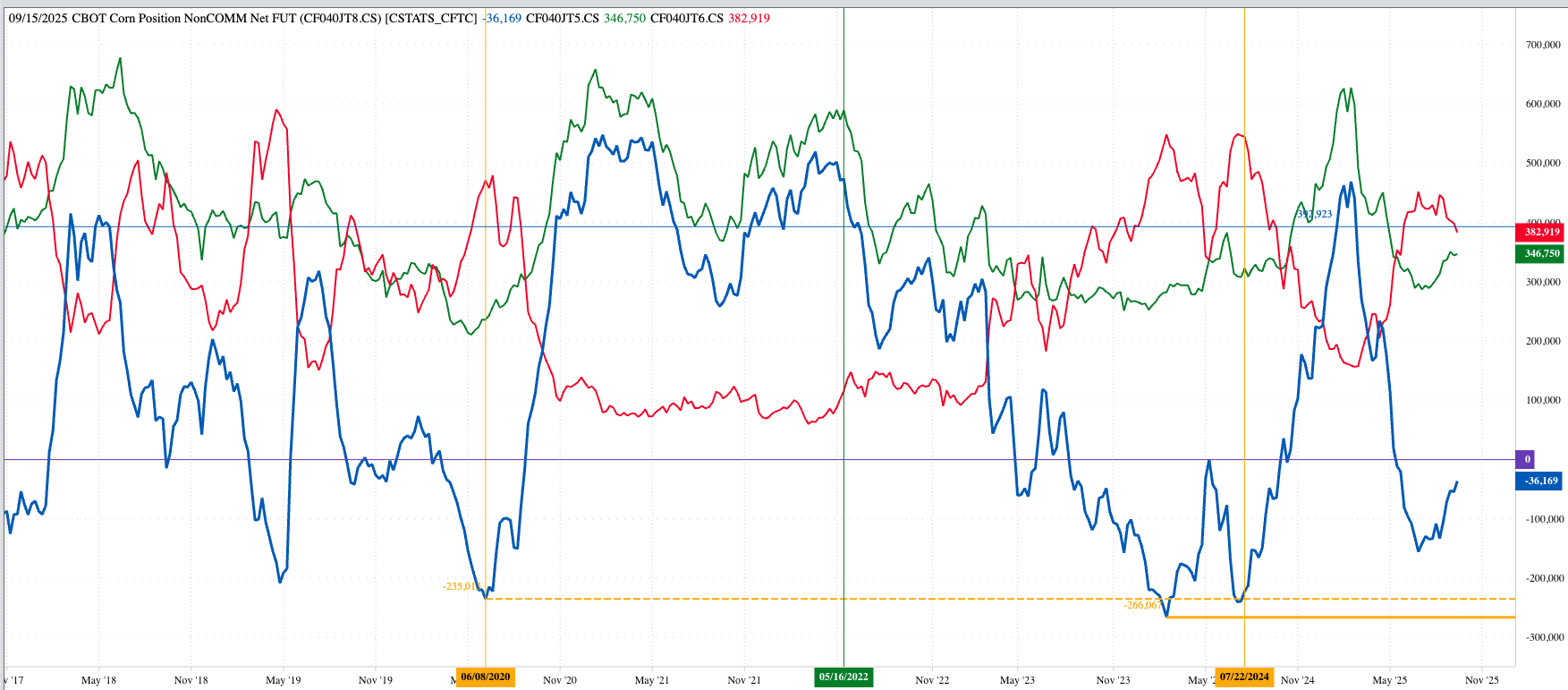

Which brings us to the noncommercial side. The most recent CFTC Commitments of Traders report (legacy, futures only) showed funds held a net-short futures position of 36,169 contracts as of Tuesday, September 16. Recently, while the commercial side has been selling due to the early stages of the 2025 harvest, Watson has been covering some of its recent large net-short futures position of 155,526 contracts from July 1. It would not be surprising to see the net-futures position continue to make its way back to par (0 contracts), particularly since I still see long-term investors building a net-long position over time based on the May-July futures spread.