Valued at roughly $62.1 billion by market capitalization, Texas-based Kinder Morgan, Inc. (KMI) stands as one of North America’s largest energy infrastructure companies, operating an extensive network of roughly 79,000 miles of pipelines and 139 terminals. Its operations span the transportation of natural gas, crude oil, refined products, CO2, and renewable fuels. At the same time, its terminals handle a wide range of commodities, including gasoline, diesel, jet fuel, chemicals, metals, and ethanol, supporting energy supply across communities and industries.

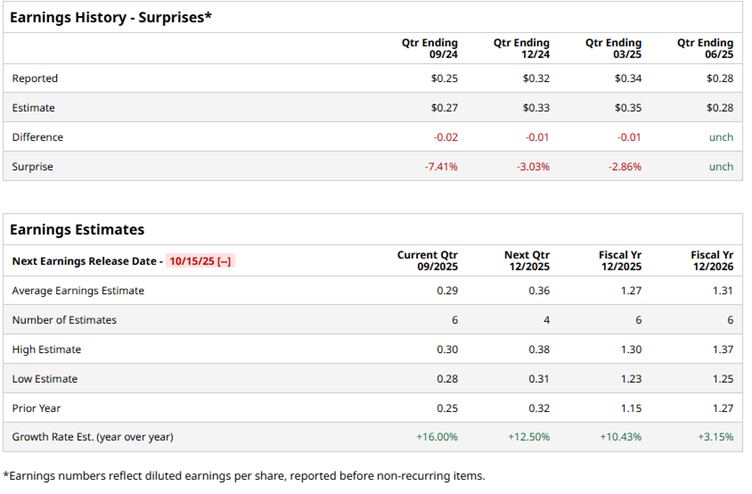

The company is all set to lift the curtains on its fiscal 2025 third-quarter earnings on Wednesday, October 15. Ahead of its upcoming earnings, analysts expect Kinder Morgan to report a profit of $0.29 per share, representing a solid 16% increase from $0.25 in the same quarter a year ago. Historically, the energy giant has struggled to consistently beat expectations, missing Wall Street’s bottom-line estimates in three of the past four quarters and meeting estimates just once.

In its most recent quarter, Kinder Morgan delivered an adjusted EPS of $0.28, aligning precisely with consensus forecasts. Over the longer term, analysts expect KMI’s earnings to continue a steady climb. Profit is projected to rise 10.4% in fiscal 2025, reaching $1.27 per share compared with $1.15 in 2024. In fiscal 2026, EPS is forecasted to jump another 3.2% year over year (YOY) to $1.31.

Over the past year, Kinder Morgan has enjoyed a strong performance on Wall Street, with shares climbing nearly 26.4%. This outpaces the broader S&P 500 Index ($SPX), which gained 15.4%, and handily beats the S&P 500 Energy Sector SPDR Fund (XLE), which rose just 4.6% over the same period, highlighting KMI’s resilience in the energy space.

Kinder Morgan posted impressive second-quarter results on Jul.16, with revenues jumping 13.2% YOY to $4 billion, surpassing Street expectations by 5.6%. Favorable federal regulations and timely permits supported the growth, while adjusted net income rose 13% to $619 million, and EPS matched consensus at $0.28. Despite the strong earnings, free cash flow fell 9.4% to $1 billion, contributing to a 1.5% decline in KMI shares on Jul.17, showing that robust top-line growth can still face pressure from cash flow dynamics.

Nevertheless, Wall Street remains cautiously bullish on Kinder Morgan, with an overall “Moderate Buy” rating. Among 20 analysts covering the name, 10 recommend a "Strong Buy," one indicates a "Moderate Buy," and the remaining nine have issued a “Hold.”

In fact, the sentiment has shifted slightly more bullish over the past three months, with “Strong Buy” recommendations rising from seven to 10. Plus, analysts have set a mean price target of $31.78, implying roughly 13.8% upside potential from the current market price.