/Keysight%20Technologies%20Inc%20logo%20and%20stock%20chart-by%20T_Schneider%20via%20Shutterstock.jpg)

Keysight Technologies, Inc. (KEYS) is a California-based tech company that provides electronic design, testing, and measurement solutions used across industries like telecom (5G/6G), aerospace, automotive, semiconductors, and IoT. With a market cap of $29.1 billion, the company operates in two segments, Communications Solutions Group and Electronic Industrial Solutions Group.

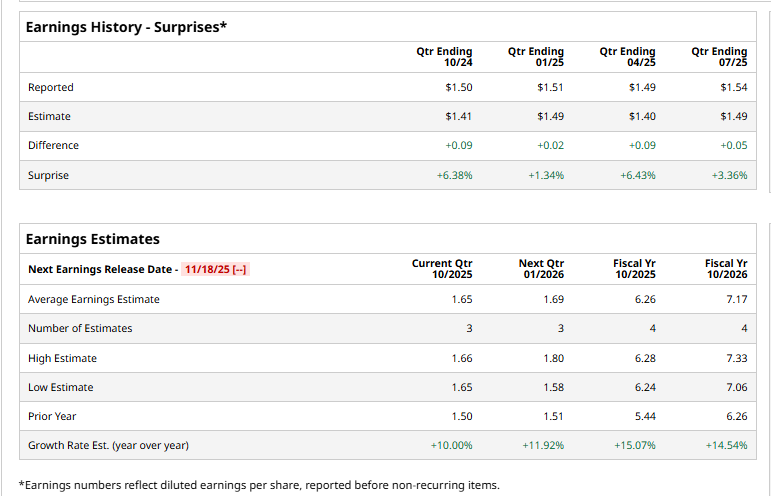

The company is set to release its fiscal Q4 earnings results shortly. Ahead of the event, analysts expect KEYS to report a profit of $1.65 per share, up 10% from $1.50 per share in the year-ago quarter. The company surpassed Wall Street’s bottom-line estimates in each of the past four quarters, which is impressive.

For the current year, analysts expect KEYS to report EPS of $6.26, up 15.1% from $5.44 in fiscal 2024.

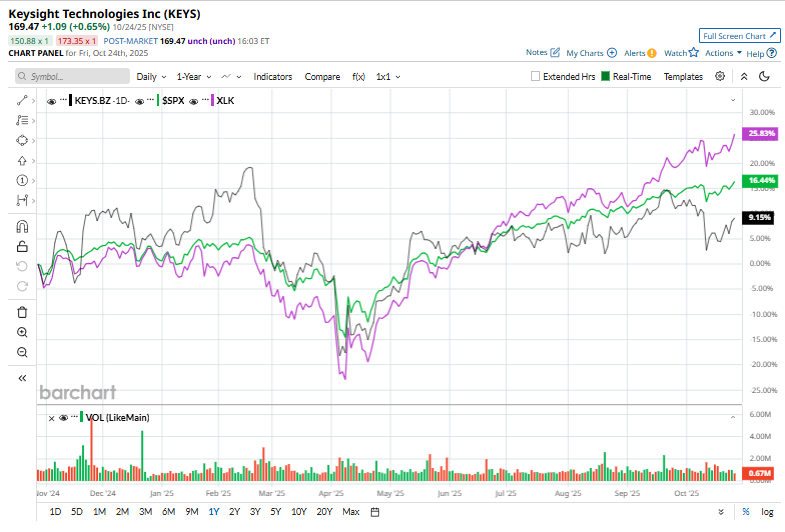

KEYS stock has grown 10.2% over the past 52 weeks, underperforming the Technology Select Sector SPDR Fund’s (XLK) 28.1% surge and the S&P 500 Index’s ($SPX) 16.9% uptick during the same time frame.

Macroeconomic headwinds have been weighing on Keysight Technologies for some time now. The stock recently fell 5.3% on Oct. 10, after the U.S. threatened “massive” tariff hikes on China in response to Beijing’s new export restrictions on strategic minerals and rare earths, materials vital to defense and semiconductor industries.

However, Keysight has been focusing on operational efficiency and strategic restructuring, which, along with a series of targeted acquisitions, have helped lift its share price. On Oct. 15, the company completed its acquisition of Spirent Communications plc, strengthening its position in network automation, cybersecurity, and 5G technologies.

Two days later, on Oct. 17, Keysight finalized the acquisitions of Synopsys, Inc.’s (SNPS) Optical Solutions Group and ANSYS, Inc.’s (ANSS) PowerArtist, expanding its design engineering and software capabilities. The stock gained 1.6% in the following session, reflecting growing investor confidence in the company’s long-term growth strategy.

The consensus opinion on KEYS stock is strongly bullish, with an overall “Strong Buy” rating. Among the 11 analysts covering the stock, eight advise a “Strong Buy” rating, one suggests “Moderate Buy,” and two suggest a “Hold.” KEYS’ average analyst price target is $191, indicating a potential upside of 12.7% from the current price levels.