/Keycorp%20bank%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Valued at a market cap of $19.9 billion, KeyCorp (KEY) is a financial services company that operates as the holding company for KeyBank National Association. It offers a broad range of retail and commercial banking products and services across the United States through its Consumer and Commercial Bank segments.

The Cleveland, Ohio-based company's shares have underperformed the broader market over the past 52 weeks. KEY stock has increased 11.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied over 17%. Moreover, shares of KeyCorp are up 6% on a YTD basis, compared to SPX’s 8.2% rise.

In addition, KEY stock has lagged behind the Financial Select Sector SPDR Fund’s (XLF) 20.2% return over the past 52 weeks.

Shares of KeyCorp rose 2.4% on Jul. 22 following stronger-than-expected Q2 2025 results, with EPS of $0.35 beating the consensus estimate and marking a 40% year-over-year increase. Investor sentiment was boosted by a 20.9% rise in total revenues to $1.8 billion, driven by higher net interest income and a 10% increase in non-interest income, particularly from robust fee-based businesses. Additionally, improved capital ratios and sequential loan growth signaled financial strength, offsetting concerns over rising expenses and provisions.

For the current fiscal year, ending in December 2025, analysts expect KeyCorp’s EPS to grow 23.3% year-over-year to $1.43. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

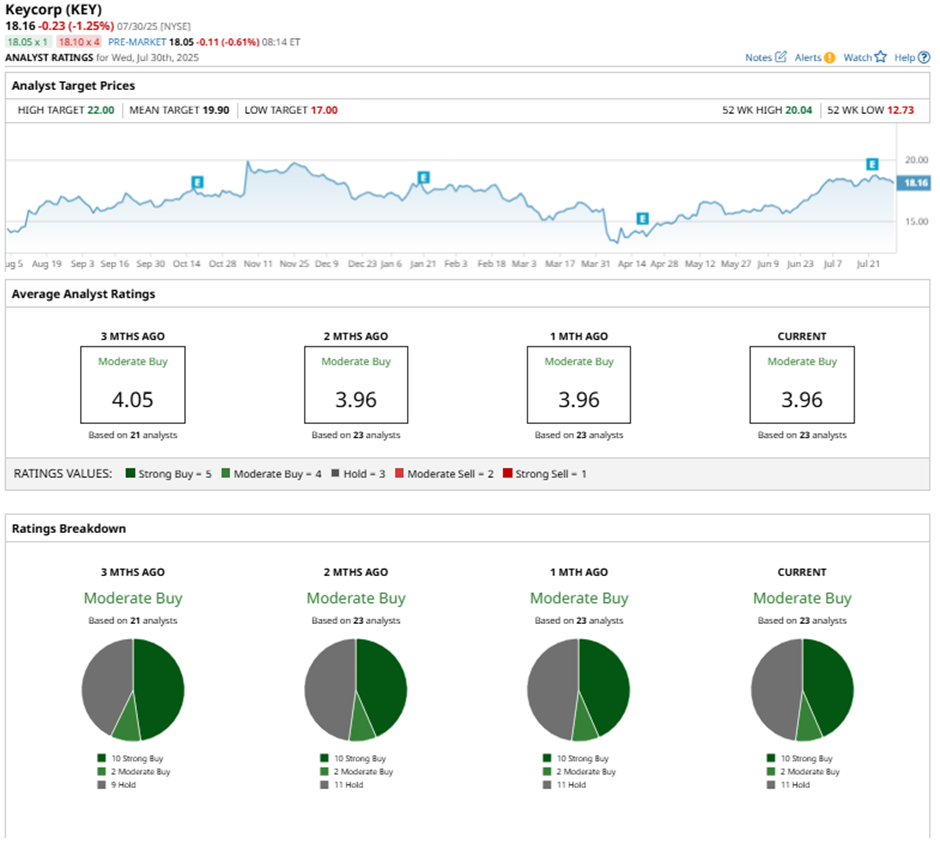

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, two “Moderate Buys,” and 11 “Holds.”

On Jul. 28, Truist raised KeyCorp’s price target to $19 while maintaining a “Hold" rating, citing increased expenses from hiring and tech investments alongside higher expected fees driven by strong investment banking momentum.

As of writing, the stock is trading below the mean price target of $19.90. The Street-high price target of $22 implies a potential upside of 21.1% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.