Oklo (OKLO) shares are down about 8% on Thursday after filings confirmed insiders have sold millions of dollars’ worth of the nuclear technology stock over the past few days.

CEO Jacob DeWitte has unloaded $3 million of it in recent days, and another $16.1 million of sales came from Michael Klein (director) and Craig Bealmear (CFO).

Despite today’s pullback, OKLO stock is up more than 450% versus the start of this year.

What Insider Selling Means for OKLO Stock

OKLO shares are slipping today because heavy insider selling typically signals a lack of confidence in the company’s near-term prospects.

The timing, following a massive surge since early September, suggests insiders are capitalizing on recent hype rather than betting on long-term upside.

Insider selling is particularly concerning for OKLO investors because it’s a pre-revenue company still navigating regulatory hurdles.

Without operational milestones or improved revenue visibility, such updates pressure sentiment and undermine the stock’s credibility as a future energy leader.

Goldman Sachs Recommends Caution on OKLO Shares

OKLO stock tumbled this morning also because a senior Goldman Sachs analyst, Brian Lee, issued a cautious note on the nuclear energy company.

Lee initiated coverage of the NYSE-listed firm today with a “Neutral” rating and a $117 price target that does not indicate any meaningful upside from here.

According to the analyst, OKLO “needs to secure finalized customer agreements” to so much as begin to justify the massive premium at which it’s trading currently.

The company based out of Santa Clara, California owns and operates its power plants, which Lee dubbed a “heavy capital burden and a meaningful risk” to the OKLO share price in his research report.

OKLO Could Crash Further From Current Levels

Other Wall Street firms also agree that OKLO stock’s recent rally has gone a little too far.

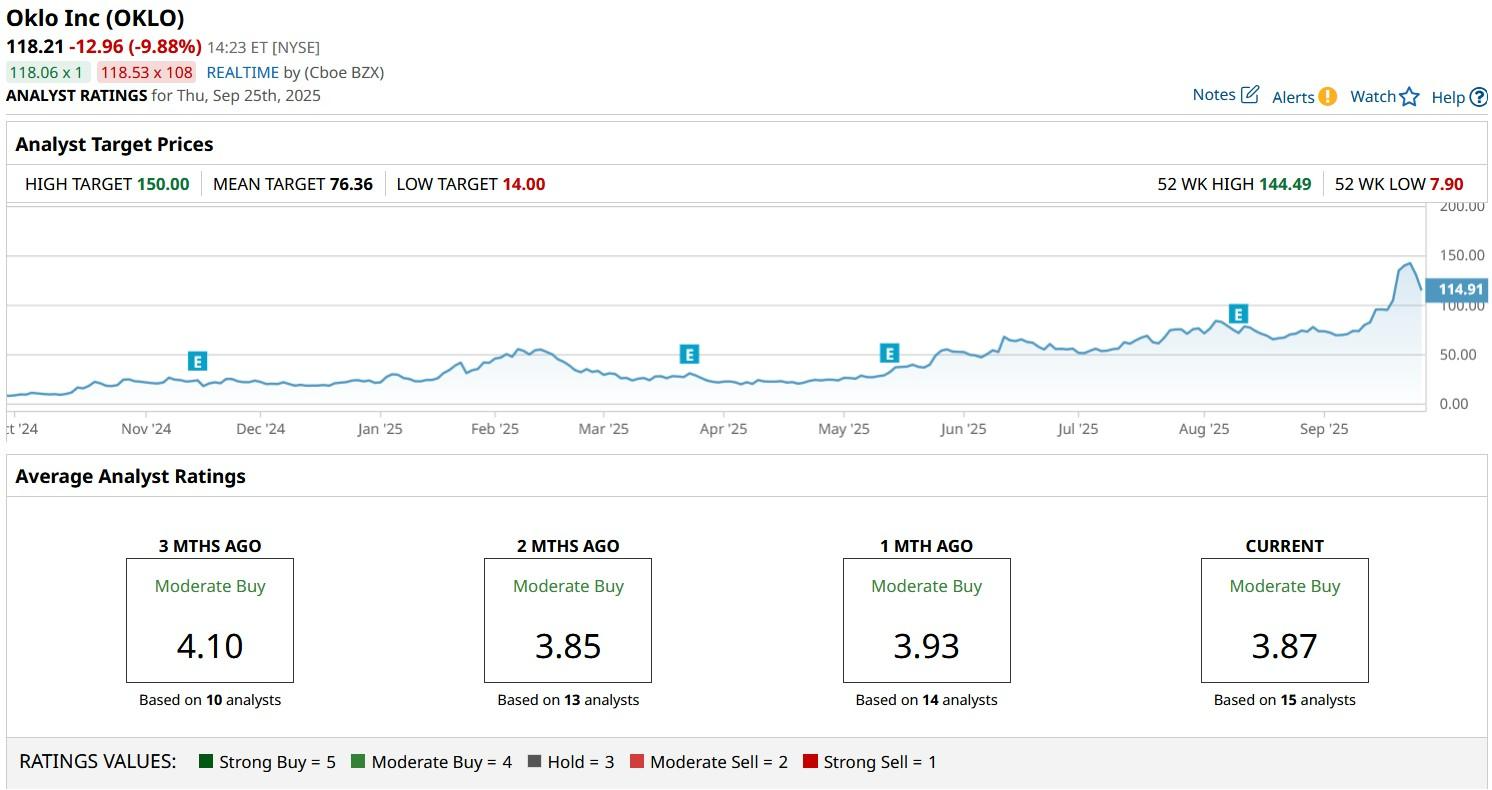

According to Barchart, the consensus rating on OKLO shares remain at “Moderate Buy” but the mean target of roughly $76 indicates potential for another 35% downside from here.