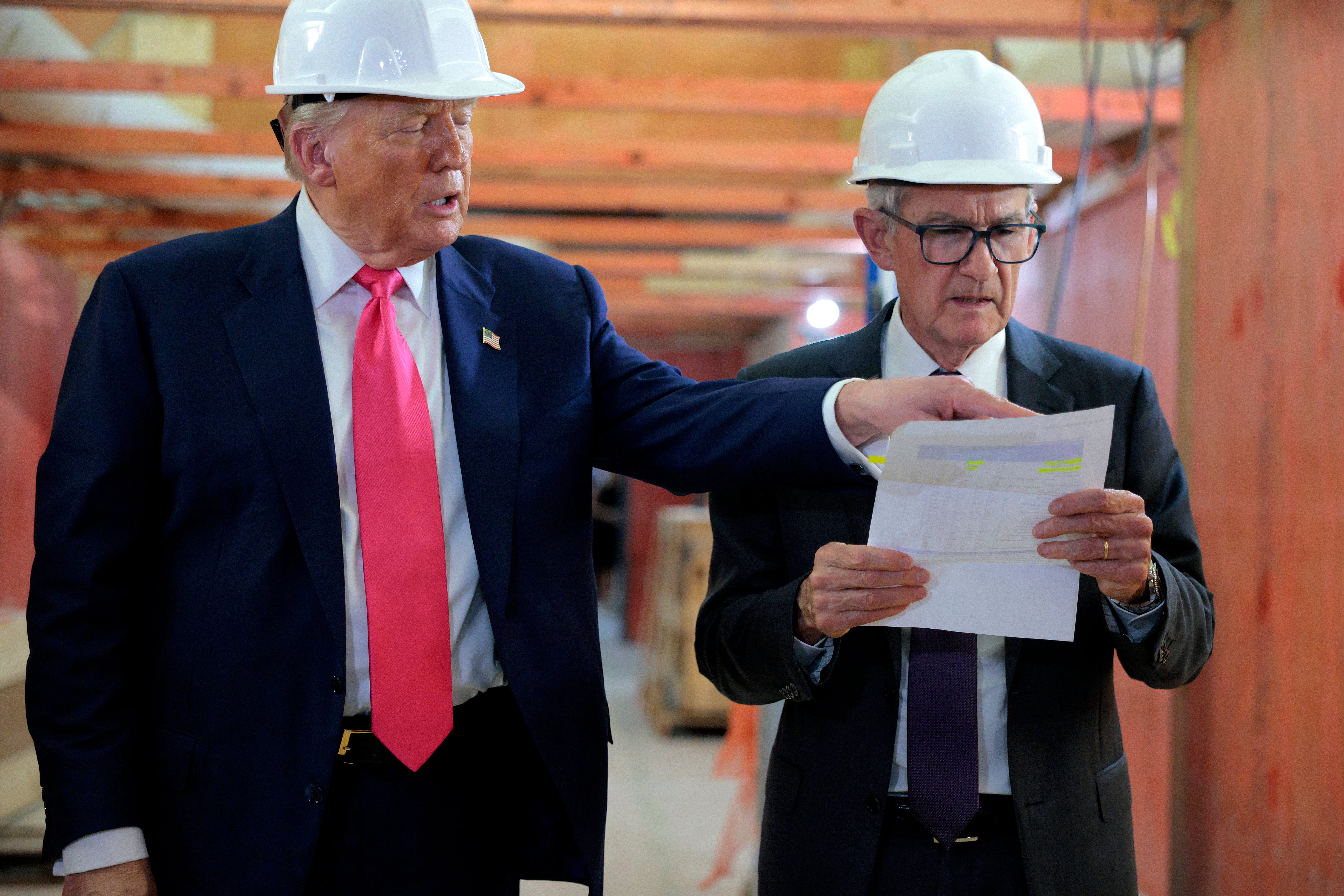

Kevin Warsh, President Trump’s pick to lead the Federal Reserve, is a “hard money hawk” who has previously called for “regime change” at the Fed.

Trump formally announced Warsh, 55, as his pick in a Truth Social post on Friday morning, where he listed the former Morgan Stanley exec’s extensive resume.

“I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. On top of everything else, he is “central casting,” and he will never let you down,” the president wrote in part.

Warsh has stellar Republican finance credentials. Some have questioned whether he fully supports the MAGA agenda. His recent statements suggest he will back the president.

Crucially for Trump, he has agreed that the Federal Reserve should be more aggressive in cutting interest rates. The president has long railed against current Fed chair Jerome Powell, and lashed out again at the veteran economist on Thursday, calling Powell a “moron” after the Fed “again refused to cut interest rates.”

Trump wants a Fed governor who is more open to White House direction, which is causing consternation in Congress, as the Fed is supposed to function independently, and Warsh has been open to the idea of lowering interest rates.

“Their hesitancy to cut rates, I think, is actually ... quite a mark against them,” Warsh said of the Fed’s board in an interview with CNBC’s Squawk Box last July, adding that the president was “right to be pushing the Fed publicly.”

Warsh served as a member of the Federal Reserve Board of Governors from 2006 to 2011; he was just 35 when President George W. Bush appointed him as the youngest-ever nominee.

The finance wunderkind has credited his upstate New York upbringing with teaching him “much of what he need[ed] to know about the real economy.” He studied at Stanford, Harvard, and MIT and rose quickly through the ranks after joining Morgan Stanley in New York City, eventually becoming an executive director.

After leaving Morgan Stanley in 2002, Warsh served as Special Assistant to the President for Economic Policy and Executive Secretary of the National Economic Council, advising President Bush and senior administration officials on economic issues, including domestic finance and consumer protection.

He also participated in the President's Working Group on Financial Markets.

There was some opposition to his Fed appointment in 2006, mainly due to his age, but Ben Bernanke, who was Fed governor at the time, later described how Warsh had proven his critics wrong.

"His youth generated some criticism, including from former Board vice chairman Preston Martin, but Kevin's political and markets savvy and many contacts on Wall Street would prove to be invaluable,” Bernanke wrote in his 2015 memoir.

Warsh played a key role in helping navigate the 2008 financial crisis, including negotiating a deal to save his former employer, Morgan Stanley, from collapse.

He was not afraid to take controversial stands, arguing in 2009 that the Fed should take a more hands-off approach to helping the economy recover, and in November 2010, he expressed strong skepticism of the Fed’s proposal to stimulate jobs and economic growth by lowering interest rates.

MAGA hawks have raised concerns that his past approach puts him at odds with Trump’s tariff agenda; in a 2011 op-ed for The Wall Street Journal, he called on policymakers to “resist the rising tide of economic protectionism,” and he has vocally defended globalization and free trade.

However, in 2024, he took a tougher line, suggesting that a harsher approach should be taken towards countries that did not favor U.S. interests.

Warsh is well familiar with Trump’s approach and was part of a business forum assembled by the then-president-elect in 2016 to provide economic policy and strategy advice. More recently, he has served on several company boards and is a scholar and lecturer at the Stanford Graduate School of Business.

Perhaps most importantly, he has personal connections to the president: Warsh is married to Jane Lauder, a billionaire granddaughter and heiress of Estée Lauder, and his father-in-law, Ronald Lauder, is a long-time friend of Donald Trump.

Warsh will face a bumpy confirmation path in the Senate; following the president’s announcement, Republican Senator Thom Tillis confirmed he would block Trump’s nominee in response to a Department of Justice investigation into Jerome Powell.

“I communicated to the President, I think of the ones that were on the short list, I think he was one of the best, and he had good options,” the North Carolina Republican told The Independent. “But process precedes people, and this process of prosecution has to end before I'm willing to vote to confirm anybody, even somebody as good as Warsh.”

The senator sits on the influential Senate Banking Committee, which would need to approve Warsh’s nomination before it moved to a full senate vote.

Sen. Elizabeth Warren, the top Democrat on the Senate Banking Committee, spoke to The Independent on Thursday before Trump made the nomination of Warsh.

“Donald Trump has already said that he won't name anybody to any job in the Fed unless they agree with Donald Trump 100 percent of the time,” she said. “In other words, translation, Donald Trump only wants sock puppets at the Fed because he wants complete control.”

Trump poised to nominate US central bank chair amid feud over rate cuts

FTSE 100 falls and oil price rises after Trump’s warning to Iran

Asian shares are mixed after Wall St sets a record, and the US dollar's value slides further

Epstein files live updates: Trump appears more than 3k times in released documents

Melania documentary live: Critics hammer ‘vapid’ film playing to near-empty theaters

Free press organizations and journalists sound the alarm over Don Lemon’s arrest