Valued at a market cap of $33.5 billion, Kenvue Inc. (KVUE) is a consumer health company based in Summit, New Jersey. It focuses on developing, manufacturing, and marketing everyday health, personal care, and wellness products.

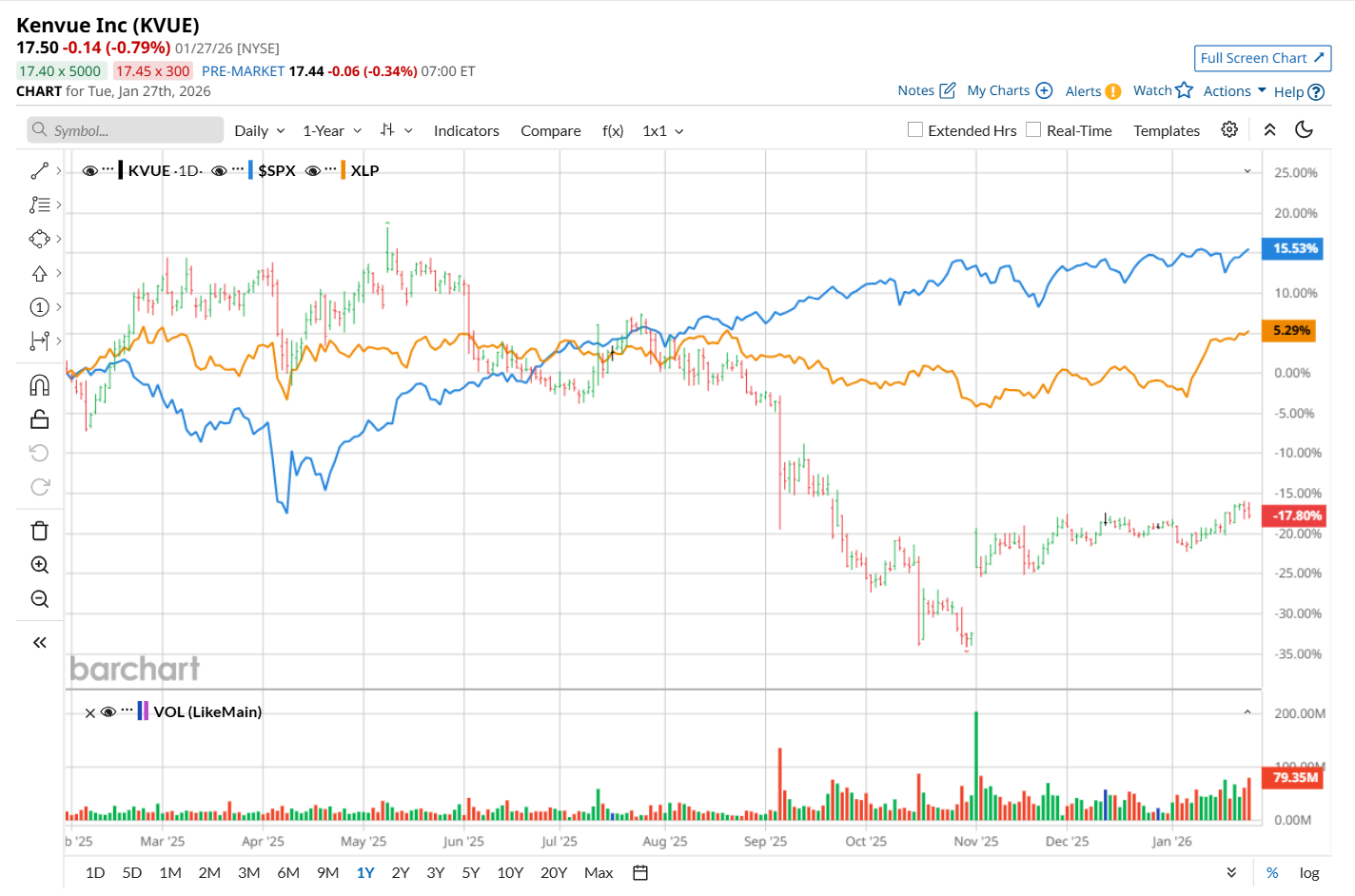

This personal care company has lagged behind the broader market over the past 52 weeks. Shares of KVUE have declined 18.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. Moreover, on a YTD basis, the stock is up 1.5%, compared to SPX’s 1.9% return.

Narrowing the focus, KVUE has also underperformed the State Street Consumer Staples Select Sector SPDR ETF (XLP), which rose 3.9% over the past 52 weeks and 7.1% on a YTD basis.

On Nov. 3, shares of Kenvue rose 12.3% after Kimberly-Clark Corporation (KMB) announced an agreement to acquire the company in a cash-and-stock deal valuing Kenvue at approximately $48.7 billion. The companies said the combination is expected to generate total synergies of approximately $2.1 billion, according to their joint press release.

For the current fiscal year, ending in December, analysts expect KVUE’s EPS to decline 9.7% year over year to $1.03. The company’s earnings surprise history is promising. It met or topped the consensus estimates in each of the last four quarters.

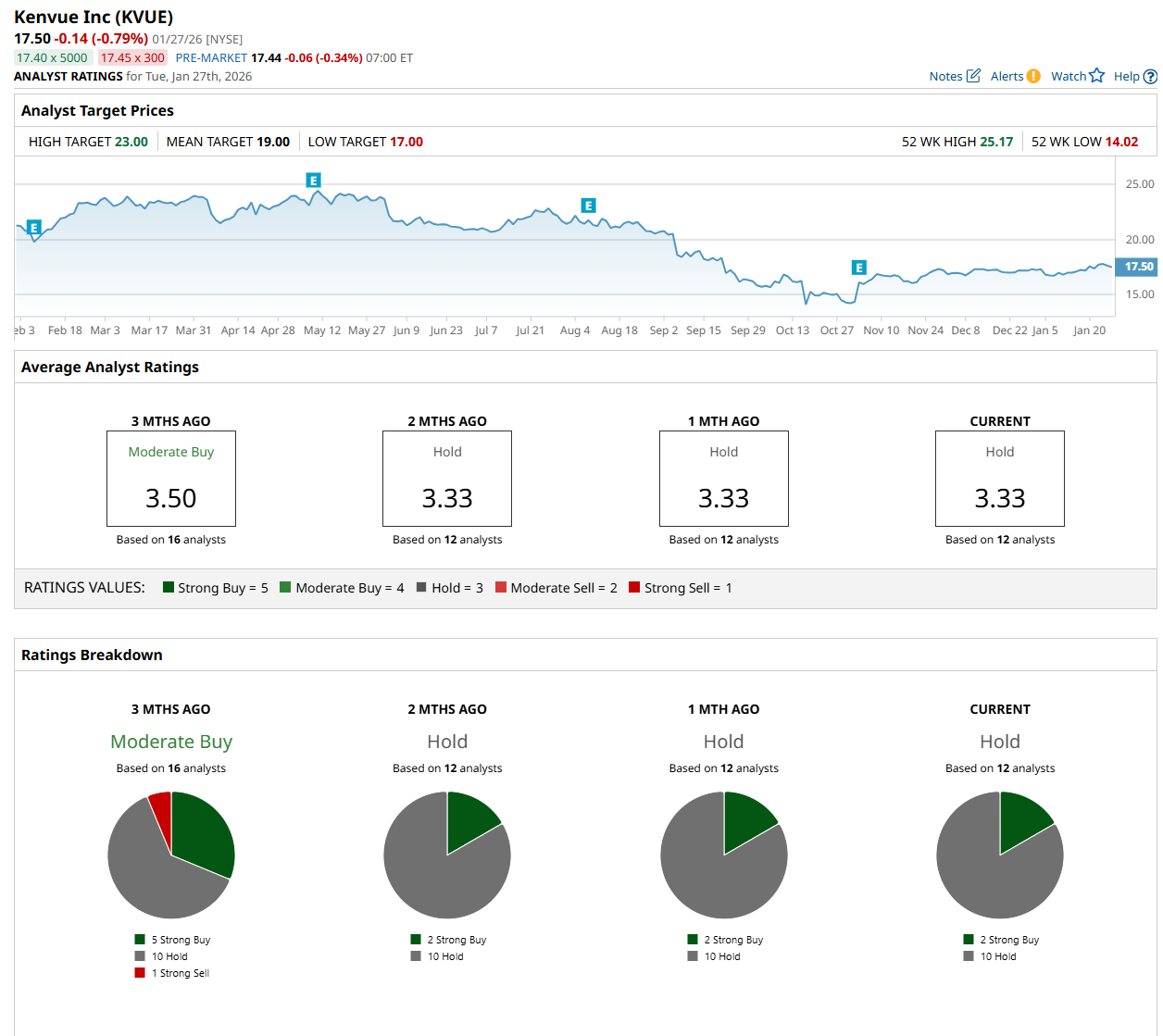

Among the 12 analysts covering the stock, the consensus rating is a "Hold,” which is based on two “Strong Buy” and 10 “Hold” ratings.

The configuration is notably less bullish than three months ago, with an overall "Moderate Buy” rating, consisting of five analysts suggesting a "Strong Buy.”

On Jan. 23, Nik Modi from RBC Capital maintained a "Hold" rating on KVUE, with a price target of $21, indicating a 20% potential upside from the current price levels.

The mean price target of $19 represents an 8.6% premium from KVUE’s current price levels, while the Street-high price target of $23 suggests a 31.4% potential upside from the current levels.