New Jersey-based Kenvue Inc. (KVUE) is a consumer health company operating across the Americas, Europe, EMEA, and the Indo-Pacific. It operates through Self Care, Skin Health and Beauty, and Essential Health segments. With a market cap of $28.7 billion, Kenvue owns several well-known brands like Listerine, BAND-AID, Tylenol, Neutrogena, and more.

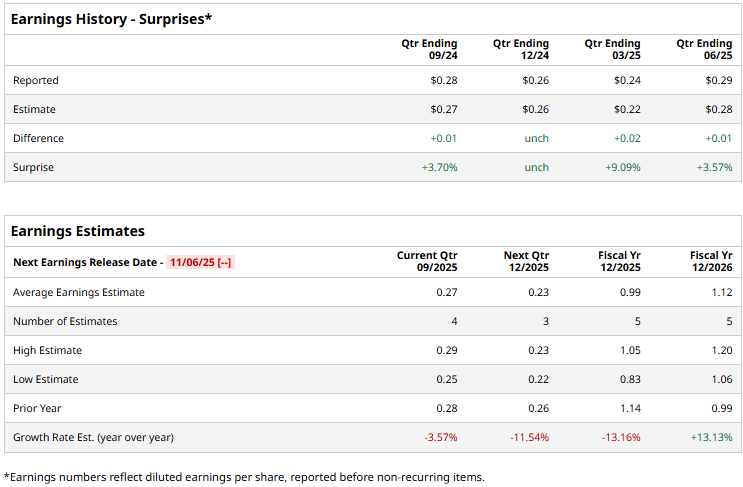

The household and personal products giant is expected to announce its third-quarter results by early November. Ahead of the event, analysts expect KVUE to report an adjusted EPS of $0.27, down 3.6% from $0.28 reported in the year-ago quarter. On a positive note, the company has a robust earnings surprise history. It has met or surpassed the Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, Kenvue is expected to deliver an adjusted EPS of $0.99, down a notable 13.2% from $1.14 reported in 2024. While in fiscal 2026, its earnings are expected to rebound 13.1% year-over-year to $1.12 per share.

KVUE stock prices have plummeted 33.8% over the past 52 weeks, notably underperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.8% dip and the S&P 500 Index’s ($SPX) 14.5% gains during the same time frame.

Kenvue’s stock prices gained 1.5% in the trading session following the release of its mixed Q2 results on Aug. 7. The company has continuously struggled to maintain its sales levels; its organic sales for the quarter dropped 4.2%. After adjusting for forex impact, Kenvue’s overall topline declined 4% year-over-year to $3.8 billion, missing the Street’s expectations by 51 bps. Meanwhile, its adjusted EPS declined from $0.32 in the year-ago quarter to $0.29, but surpassed the consensus estimates by 3.6%.

Due to the lackluster year-to-date performance and the impact of tariffs put in place on Aug. 6, the company expects its full-year performance to remain subdued.

Analysts remain cautiously optimistic about the stock’s prospects. Kenvue has a consensus “Moderate Buy” rating overall. Of the 16 analysts covering the stock, opinions include six “Strong Buys,” nine “Holds,” and one “Strong Sell.” Its mean price target of $20.36 suggests a 34% upside potential from current price levels.