Chicago, Illinois-based Kellanova (K) manufactures and markets snacks and convenience foods. Valued at a market cap of $28.8 billion, the company owns various well-known brands, including Pringles, Cheez-It, Pop-Tarts, Eggo, MorningStar Farms, and RXBAR, among others. It is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 30.

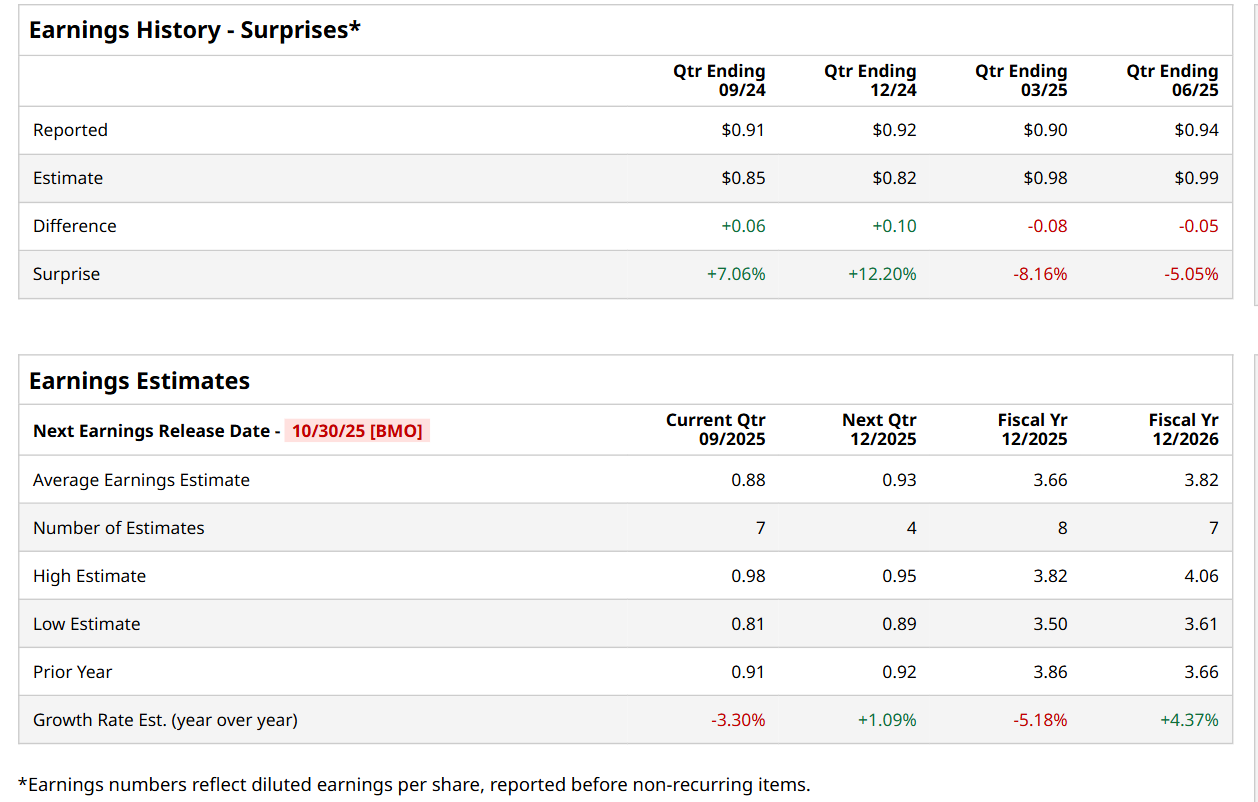

Before this event, analysts expect this snacks and convenience foods company to report a profit of $0.88 per share, down 3.3% from $0.91 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. Its earnings of $0.94 per share in the previous quarter missed the consensus estimates by 5.1%.

For fiscal 2025, analysts expect Kellanova to report a profit of $3.66 per share, down 5.2% from $3.86 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 4.4% year-over-year to $3.82 in fiscal 2026.

Shares of K have gained 2.9% over the past 52 weeks, underperforming the S&P 500 Index's ($SPX) 14.4% return over the same time frame. However, it has outpaced the Consumer Staples Select Sector SPDR Fund’s (XLP) 5% downtick over the same time period.

Kellanova posted its Q2 results on Jul. 31, and its shares surged marginally in the following trading session. While its overall revenues were impacted by widespread category softness, stronger performance in emerging markets provided a lift, helping net sales surge slightly year-over-year to $3.2 billion. However, on the downside, its adjusted EPS declined 6.9% from the year-ago quarter to $0.94, falling short of consensus estimates by 5.1%.

Wall Street analysts are cautious about K’s stock, with an overall "Hold" rating. Among 14 analysts covering the stock, all of them recommend "Hold." The mean price target for K is $83.42, implying a slight potential upside from the current levels.