Economist Justin Wolfers compared the current surge in electricity demand driven by artificial intelligence to a temporary "egg shortage," arguing that rising prices will spur new investment and stabilize power supply over time.

Justin Wolfers Says, ‘Electricity Is The New Eggs'

Taking to X, formerly Twitter, the University of Michigan economist said the power crunch caused by AI expansion is a predictable market cycle, not a crisis.

"We're basically in the first part of that egg shortage right now," Wolfers said during an MSNBC interview clip which he shared on X.

"The next stage is that if it becomes really profitable to generate electricity, people are going to enter the market. And just like egg prices came back down, these electricity prices are going to come back down," he continued.

While sharing the video on X, he said, "Higher prices invite new investment—and more generation. Give it time, and the market will hatch more watts."

AI Drives Power Scramble Across the U.S.

Wolfers' comments come as major tech firms are racing to secure their own energy sources amid grid bottlenecks and regulatory delays.

In West Texas, natural-gas power plants are being built as part of OpenAI and Oracle Corp's (NYSE:ORCL) $500 billion Stargate project. Meanwhile, Elon Musk's xAI is using gas turbines to power its colossal Colossus 1 and 2 data centers in Memphis, Tenn.

The Wall Street Journal last week reported that the U.S. must add about 80 gigawatts of new power generation each year to keep pace with AI, cloud computing and industrial electrification, as per consulting and technology firm ICF.

The country is currently building less than 65 gigawatts annually.

Despite concerns that AI could strain the U.S. power grid, Wolfers believes the market will rebalance. "I'm a lot less worried about this," he said.

AI-Driven Data Center Growth Set To Surge Global And US Electricity Demand

Goldman Sachs projects global data center electricity use—including AI workloads—to rise 175% by 2030, equivalent to adding a top-10 power-consuming country.

In the U.S., electricity demand is expected to grow 2.6% annually through 2030, fueled in large part by data center expansion—significantly higher than typical growth over the past two decades.

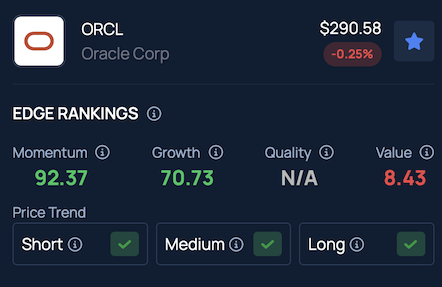

Benzinga's Edge Stock Rankings place Oracle in the 92nd percentile for Momentum, underscoring its strong and consistent performance compared to peers.

Read More:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: Pixel-Shot on Shutterstock.com