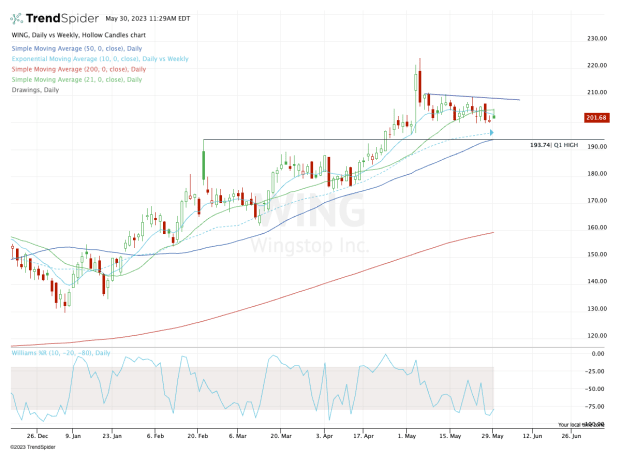

Wingstop (WING) has been quietly moving lower after touching a record on its earnings report.

In early May the Addison, Texas, chicken chain delivered a top- and bottom-line beat of Wall Street estimates, growing sales more than 40% year over year.

In the quarter comparable-store sales grew 20% year over year vs. expectations of 8.6%.

The shares rallied 9.35% on May 3 and hit all-time highs in the following session. But shortly afterward that day, the stock reversed to close more than 4% lower.

Don't Miss: How High Can AMD Stock Go? Chart Provides a Clue.

Wingstop stock has gone on to fall in three straight weeks and is currently down about 10% since the chain reported earnings.

Is that enough of a dip to go long? Maybe. But the charts have a yet much more appetizing dip-buying area of which investors should take note.

Buy The Dip in Wingstop Stock?

Chart courtesy of TrendSpider.com

Since it hit a post-earnings high of $223.77, Wingstop has found support around $200. So far, it’s finding buyers in this area again.

There’s a chance that this could be the bottom of the dip and that the stock will bounce higher from here.

But I am looking at the mid-$190s as a potentially tastier dip-buying spot. In that area, we have the first-quarter high at $194.74, along with the 50-day and 10-week moving averages.

This would be a reasonably attractive area for prospective longs to dip into Wingstop stock.

Don't Miss: Buy Costco Stock on Earnings? Here's the Must-Watch Breakout Level

If the shares can’t hold this zone as support, more selling pressure could arise. While it doesn’t appear likely at the moment, it could potentially open the door down to the $170 to $175 area — down roughly 20% from current levels.

If we do get a dip down into low- to mid-$190s, then the upside is pretty clear, too. The bulls will want to see a move back up over $200 and, ultimately, a move above the short-term moving averages (like the 10-day and 21-day).

The stock could run into some resistance around $207, and a move over $210 will ultimately be needed to put $217 in play, followed by a potential rally back to the highs above $223.

Our Memorial Day sale is on now! Get exclusive investing insights from TheStreet’s premium products. Learn more.