Nike (NKE) has been on a long run. Its journey began 61 years ago, and the company went public in 1980. Its price per share back then, split adjusted, was about one-third of a penny. Now, 45 years after the IPO, the company has changed the way we play and turned “sneakers” into a style.

But recent years haven’t been as kind to shares. NKE stock is down to the $70 level from $180 just four years ago, due to a combination of competitive, distribution, and management issues.

After its quarterly earnings report, which showed a beat on earnings per share and revenue, analyst price targets are useless. They range from $38 to $120, telling us little about where Nike stock is headed next. The average “Moderate Buy” rating from analysts also isn’t helpful.

NKE Checks in at the Scorer’s Table

Like an NBA player alerting officials that he’s ready to enter the game, NKE’s quarter aims to show investors it’s back in the competition.

But at 41x forward earnings, even if the stock might finally be done selling off, Nike is rich. Not Michael Jordan rich, but far from cheap.

As I see it, owning an expensive stock in long-term turnaround mode in a market that could punish it just for not having both of the letters “A-I” in its corporate name, is an opportunity to use options alongside NKE share positions.

In other words, as the title here says, it’s OK to “just do it,” but perhaps use a collar to “do” NKE. But there’s a twist in this one, as I’ll explain after reviewing the charts.

Starting with the daily, we can see the stock has been dunked on recently, off double-digits since late August. NKE stock has now given back the entire extension of its big up move that occurred after last quarter’s earnings release. That alone calls for some risk management, as the stock looks far from washed out.

The weekly takes that negative vibe to another level. Like, New York Mets in September 2025 bad. The last time that Percentage Price Oscillator (PPO) indicator looked like this, the stock rolled over like an injured NFL wide receiver’s ankle, from $135 to less than half that. This is now a risk management doubleheader situation.

NKE May Require a Long-Term Gameplan

However, time frame is everything, especially in this world where zero DTE options players and buy-and-hold types invest side by side. So this monthly chart below hints at the makings of a very long-term bottom in NKE stock.

It recently ticked higher from the same level it traded at back in 2016. So, a sports-style comeback story could be in the works. But this will take multiple quarters to work through. Maybe even overtime, so to speak.

Offsetting Penalties

There are reasons to like NKE and to run from it. That’s the case with most stocks, but given the fall from grace that has ensued here, it is particularly vulnerable any time earnings are due.

So, rather than leave it all on the field so to speak, why not play offense and defense at the same time? With that as the goal, I looked through several NKE collar combinations, and came up with one that targets the following:

- Can participate with the stock if it rises from here

- Acknowledges that NKE is still prone to some big downside risk

- Gets me paid up front

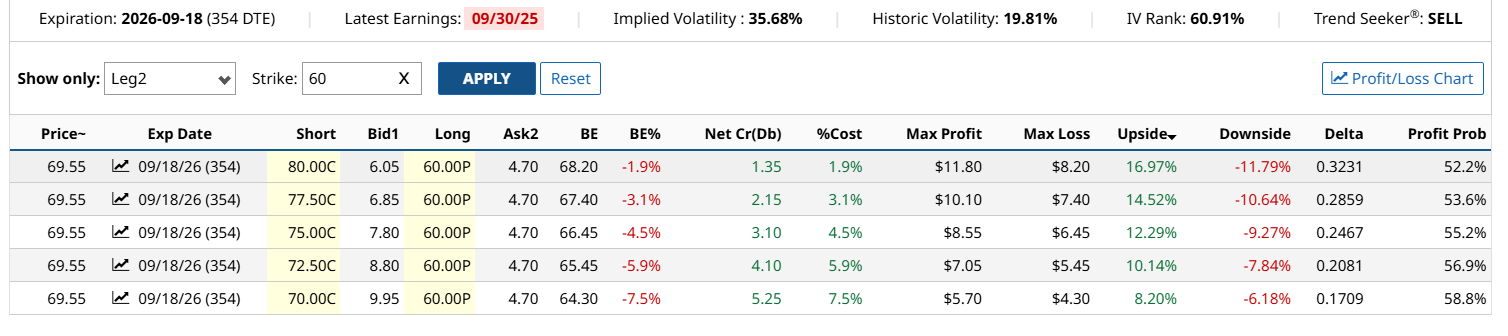

Here’s what that looks like in a collar. There are several call option strike prices here (the “short” column to the left) but the puts are struck at $60 in all cases. Keeping one side constant hopefully simplifies the analysis for you.

The one I’m looking at specifically is the $75-$60 combination. There, I accept more downside risk (9.3%), and less upside potential (12.3%), as opposed to my usual 2:1 or higher ratio. That’s because I know what I’m dealing with here, a stock that is still not over the hump.

Still this collar goes out just under a year, so that 12% upside is solid to me. But here’s the kicker: This one pays 4.5% up front. That’s essentially “buying down” the upside/downside ratio, to “just do it” now and get paid with a NKE collar.

This was an example of how the main trio of variables can be adjusted, like a car’s dashboard. Or the way some NKE shoes can have air pumped into them.

Either way, when a stock like this one shows us it still has some proving to do, I like to add some defense to my offense. After all, defense wins championships. So can carefully planned option strategies for investors and traders.