Jumia Technologies AG – ADR (NYSE:JMIA) shares are trading higher Tuesday morning after RBC Capital analyst Brad Erickson upgraded the stock to Outperform and raised the price target to $15.

What Else: The upgrade follows virtual investor meetings with Jumia’s CEO and CFO, which left RBC “incrementally positive”. Erickson is particularly bullish on the sustained supply benefits Jumia is experiencing from easing foreign exchange pressures.

He notes that currency stability is improving relationships with Chinese suppliers, who are also seeking alternatives to U.S. tariffs. The company has even increased its headcount in China to manage these expanding partnerships.

RBC believes these factors set the stage for continued supply expansion and accelerated order growth. The new $15 price target is based on a 6.8x multiple of the company’s estimated 2026 enterprise value to revenue.

This more optimistic outlook suggests that previous headwinds from currency volatility are subsiding, potentially unlocking significant upside for the African e-commerce leader.

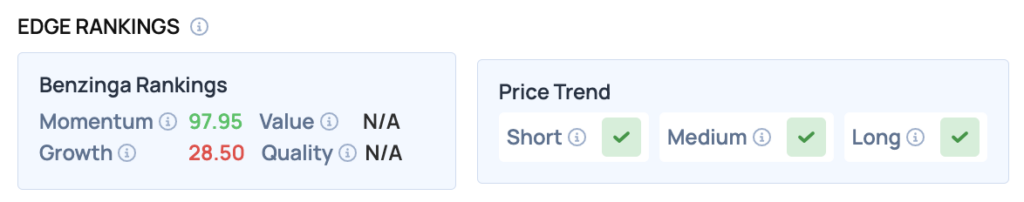

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock boasts a high Momentum score of 97.95.

Price Action: According to data from Benzinga Pro, JMIA shares are trading higher by 23.6% to $12.10 Tuesday morning. The stock has a 52-week high of $12.37 and a 52-week low of $1.60.

Read Also: Ford Slashes 1,000 Jobs In Germany As EV Demand Falters

How To Buy JMIA Stock

By now you're likely curious about how to participate in the market for Jumia Technologies – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock