/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

While the race to define the next era of technology continues, JPMorgan Chase (JPM) has just made its move. The banking giant is staking its chips on quantum computing. Under its sweeping “Security and Resiliency Initiative,” JPMorgan plans to deploy $10 billion into frontier technologies, including quantum, as part of a $1.5 trillion decade-long push into strategic sectors.

JPMorgan said it will back companies across all growth stages through financing, advisory support, and capital investment. CEO Jamie Dimon emphasized reducing U.S. dependence on unreliable foreign sources for critical resources and technologies essential to national security.

While JPMorgan is betting on tomorrow’s infrastructure, one name that is hard to miss in this space is Amazon (AMZN). According to Barchart’s analyst consensus, AMZN stock not only commands a “Strong Buy” rating, but it is also being hailed as a top-rated quantum computing stock.

As institutional money lines up behind quantum computing optimism, eyes are bound to lock on Amazon’s cloud, artificial intelligence (AI), and growth engines to deliver steady returns.

About Amazon Stock

Amazon is a global technology and e-commerce behemoth headquartered in Seattle, Washington. Today, the company operates across a dazzling range of businesses — cloud services via Amazon Web Services (AWS), digital streaming, subscription services, advertising, physical retail, consumer electronics, and more. Its diversified growth model has placed it among the world’s most valuable public companies, with a market capitalization of $2.35 trillion, and it has a secure position in the “Magnificent Seven” group.

Amazon’s 2025 stock performance has not been very cheery. On a year-to-date (YTD) basis, AMZN stock has posted a marginal uptick, making it one of the weakest performers among the “Magnificent Seven” tech name — a striking contrast to many peers rallying strongly amid AI and cloud narratives. Meanwhile, over the past 52 weeks, Amazon has posted a more respectable 20% return.

Although Amazon’s recent underperformance has sparked investor concerns amid slower-than-expected cloud growth, sentiment appears to be turning more positive due to renewed optimism around AWS’ AI initiatives, the infrastructure project “Project Rainier,” and generally bullish analyst outlooks. Amazon’s diversified model, AWS strength, and investments in AI and infrastructure foster confidence in its long-term trajectory.

AMZN stock currently trades at a premium compared to the sector median but below its own historical average at 31.92 times forward earnings.

Amazon Is Progressing in the Quantum Computing Space

Amazon is making significant strides in the quantum computing space through its AWS platform, Amazon Braket. Braket offers access to a diverse range of quantum hardware, including superconducting qubits from IQM and Rigetti Computing (RGTI), trapped-ion processors from IonQ (IONQ), and neutral-atom processors from QuEra Computing. This variety allows researchers and developers to experiment with different quantum technologies to find the most suitable solutions for their needs.

In addition to providing hardware access, Amazon is developing its own quantum hardware. In February 2025, Amazon introduced its first quantum computing chip, Ocelot. Ocelot utilizes cat qubits to enhance error correction, potentially reducing the costs of implementing quantum error correction by up to 90%. This advancement could lead to more efficient and scalable quantum computers in the future.

Earlier this year, AWS also expanded its quantum hardware offerings by adding IQM’s 54-qubit Emerald processor to the Braket platform. This superconducting quantum processor provides higher fidelity gates and dynamic circuit support, enabling customers to explore more complex quantum algorithms.

To further accelerate quantum research, Amazon Braket introduced a feature called “program sets.” This allows users to bundle up to 100 quantum circuits into a single task, reducing processing overhead and execution times by as much as 24 times on supported devices.

Through these efforts, Amazon is positioning itself as a key player in the quantum computing industry, offering both hardware and software solutions to accelerate the development and adoption of quantum technologies.

Amazon’s Q2 Results Surpassed Projections

Amazon reported its second-quarter 2025 earnings on July 31, posting net sales of $167.7 billion, up 13% year-over-year (YOY) and exceeding analyst expectations. Operating income jumped to $19.2 billion, while net income rose to $18.2 billion, or $1.68 per share, compared with $13.5 billion, or $1.26 per share, in the year-ago quarter.

The strong performance was fueled by growth across key segments, including 11% sales expansion in North America, 16% expansion in International markets, and a 17.5% increase in AWS revenue.

Furthermore, Amazon guided for Q3 2025 net sales between $174 billion and $179.5 billion, reflecting 10% to 13% growth versus Q3 2024, with expected operating income of $15.5 billion to $20.5 billion, compared with $17.4 billion in the prior-year period.

Analysts remain upbeat, projecting EPS of $6.83 for fiscal 2025, up 23% YOY, then anticipating a further 12% annual increase to $7.67 in fiscal 2026.

Wall Street’s Bullish Bet on Amazon

Amazon has garnered positive attention from analysts, reflecting confidence in its growth prospects. Earlier this month, Goldman Sachs raised Amazon’s price target to $275 from $240 and reaffirmed a “Buy” rating. Goldman Sachs reaffirmed Amazon as a top pick ahead of Q3 earnings, noting that investors are underestimating the growth and profit potential of AWS despite increased competition.

Last month, Wells Fargo also upgraded Amazon to “Overweight” from “Equal Weight”, raising its price target to $280 from $245, citing confidence in AWS revenue acceleration driven by Project Rainier as the main driver to reverse the stock’s YTD underperformance.

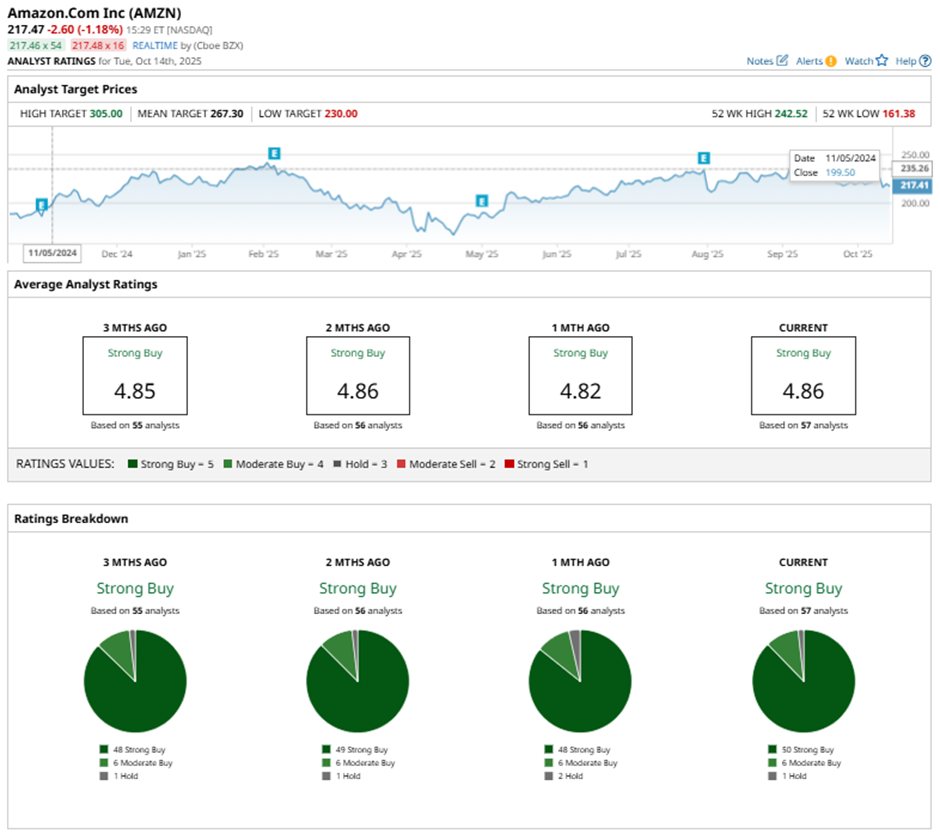

Wall Street is majorly bullish on AMZN. Overall, AMZN stock has a consensus “Strong Buy” rating. Of the 57 analysts covering the stock, 51 advise a “Strong Buy” while six suggest a “Moderate Buy" rating.

The average analyst price target for AMZN is $267.30, indicating potential upside of 19%. The Street-high target price of $305 suggests that the stock could rally as much as 36% from here.