Market Rebellion Co-Founder Jon Najarian gave his broad market outlook on Thursday’s edition of CNBC’s Halftime Report. Against the backdrop of Fed rate hikes, a fearful market, and record-high inflation, you might think Jon is sitting on the sidelines until the market stabilizes. You would be wrong.

Jon Najarian is an options trader. And as an options trader, he’s typically most interested in trading what the market is giving him — and lately, that’s been downside action. By utilizing bearish option strategies in combination with unusual option activity, option spreads, and more; options traders have the tools they need to be able to capitalize on bearish market action.

But in order to be a successful option trader, you need to be right. Not just right about the directional movement of the market, but about the timing of that move, the most appropriate strategy, and the stock price itself. On today’s edition of Halftime Report, Jon answered a few questions that could help an option trader decide the best strategy to use if they, like Jon, think there might be more bad news on the horizon. Questions like…

Will We Enter a Recession?

Jon Najarian’s first take was on the probability of a recession. His opinion: We probably will end up in a soft recession. And he came armed with data to back up his point.

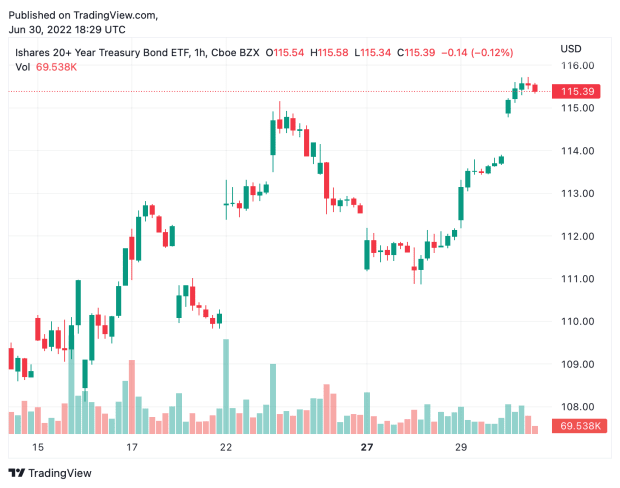

“The 10-year has made a huge move from the middle of the month. The TLT for instance was $108 in the middle of June. Now it’s pushing towards $116 today.”

“That means rates are down — breaking below 3% today. The issue here is that people do not think that the Fed has the guts to keep driving interest rates higher and pushing us into a recession. [So,] soft recession? Yeah, that’s what I’m looking for: a soft recession.”

According to a CNBC survey, 67% of CFOs believe that a recession will hit the U.S. economy by the first half of 2023.

So if we’re going into a recession, even a soft one, option traders need to ask another very important question that will shape the type of option strategies they employ:

Will We Get More Stock Market Volatility?

You aren’t going to get a soft recession without some serious volatility. At least, that’s what Jon’s seeing in the options market.

Jon pointed out that today, a trader known across the options world as 50 Cent was back in action. This trader has a very unique calling card — massive, multi-million dollar purchases in cheap CBOE Volatility Index VIX options (usually priced at around 50 cents apiece).

“Now, as far as the VIX — big player, the guy we call 50 Cent — they bought 75,000 of those upside calls today. We’ve been above 20 since the middle of April for the VIX. We haven’t been able to break down. [...] And, the predictions going forward are that we’re going to be looking at higher volatility; because of so much uncertainty, because of the Fed being backed into a corner, and it’ll be very interesting to see the [July 27th FOMC] meeting coming after that big CPI reading on July 15th.”

The VIX trade that Jon referenced above: 75,000 55-strike August 17th, 2022 calls bought with the index trading just over 30. Total trade price: $5.775M.

But does this mean it’s all downhill from here? No. Volatility doesn’t always mean straight down in a line. Often, it means market chop. But where does Jon believe that market chop will take the S&P?

S&P 500 End of Year Price Target

Analysts like JP Morgan’s Marko Kolanovic have said that it’s possible the S&P 500 could still finish the year flat, which would indicate a gain of roughly 26% from current levels. Comparatively, Mike Wilson of Morgan Stanley has held firm to his convictions for a long time — even back in January, when the S&P 500 was still at all-time-highs. He believes that it’s possible the S&P finishes the year near the $3,500 level, and that it could even test $3,000 if the Fed tightening pushes the economy into a recession.

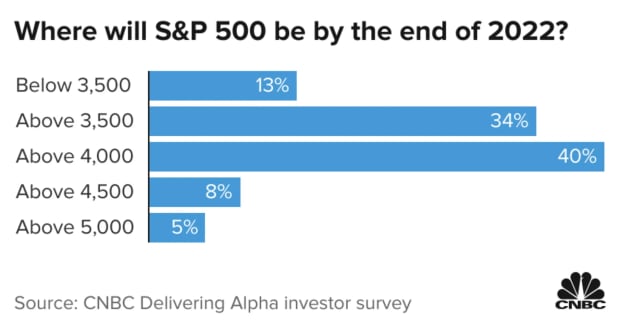

According to the most recent results of CNBC’s Delivering Alpha Survey which indicated where the majority of money managers think the S&P 500 will end for the year.

Survey says…

Jon’s take: The S&P 500 will finish between $4,000 and $4,100.

“We’ll be struggling once we get to $4,000 or $4,100 — but $4,500? No, I don’t see that happening.”

The bottom line: If you ask yourself the right questions and do your research, you don’t have to be scared of volatile markets. As Market Rebellion’s Chief Option Strategist Ryan Mastro often says, “you can make just as much money in a bear market as you can in a bull market.”