Johnson & Johnson (NYSE:JNJ) posted better-than-expected quarterly earnings and raised its FY2025 earnings guidance on Wednesday.

Johnson & Johnson reported a second-quarter 2025 adjusted earnings of $2.77 per share, down 1.8% year over year, beating the consensus of $2.68. The pharmaceutical giant reported sales of $23.74 billion, up 5.8% year over year and beating the consensus of $22.85 billion.

Johnson & Johnson revised its fiscal year 2025 guidance. The company expects adjusted earnings of $10.80-$10.90, up from prior guidance of $10.50-$10.70, compared to the consensus of $10.62. Johnson & Johnson raised sales guidance from $91 billion-$91.8 billion to $93.2 billion-$93.6 billion versus $91.4 billion.

Johnson & Johnson shares gained 6.2% to close at $164.78 on Wednesday.

These analysts made changes to their price targets on Johnson & Johnson following earnings announcement.

- B of A Securities analyst Tim Anderson maintained Johnson & Johnson with a Neutral and raised the price target from $161 to $175.

- Morgan Stanley analyst Terence Flynn maintained the stock with an Equal-Weight rating and raised the price target from $171 to $176.

- UBS analyst Danielle Antalffy maintained Johnson & Johnson with a Buy and raised the price target from $180 to $190.

- Guggenheim analyst Vamil Divan maintained the stock with a Neutral and raised the price target from $164 to $167.

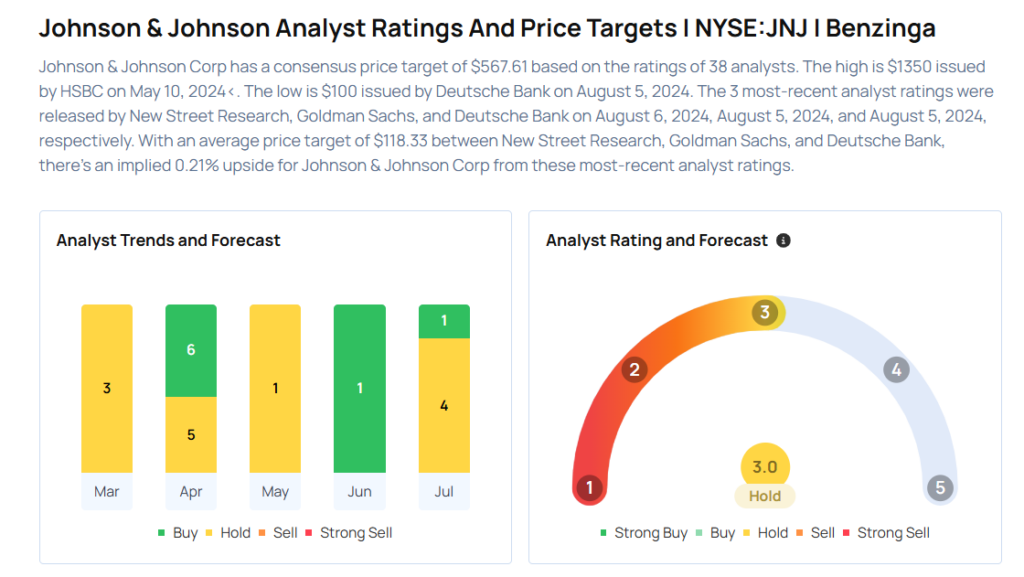

Considering buying JNJ stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock