/Johnson%20Controls%20International%20plc%20factory%20sign-by%20jetcityimage%20via%20iStock.jpg)

With a market cap of $72.8 billion, Johnson Controls International plc (JCI) is a global leader in smart, sustainable building solutions, offering advanced HVAC, fire, security, and energy management systems. The company operates across North America, EMEA/LA, and Asia Pacific, delivering innovative technologies and services that enhance building performance and efficiency.

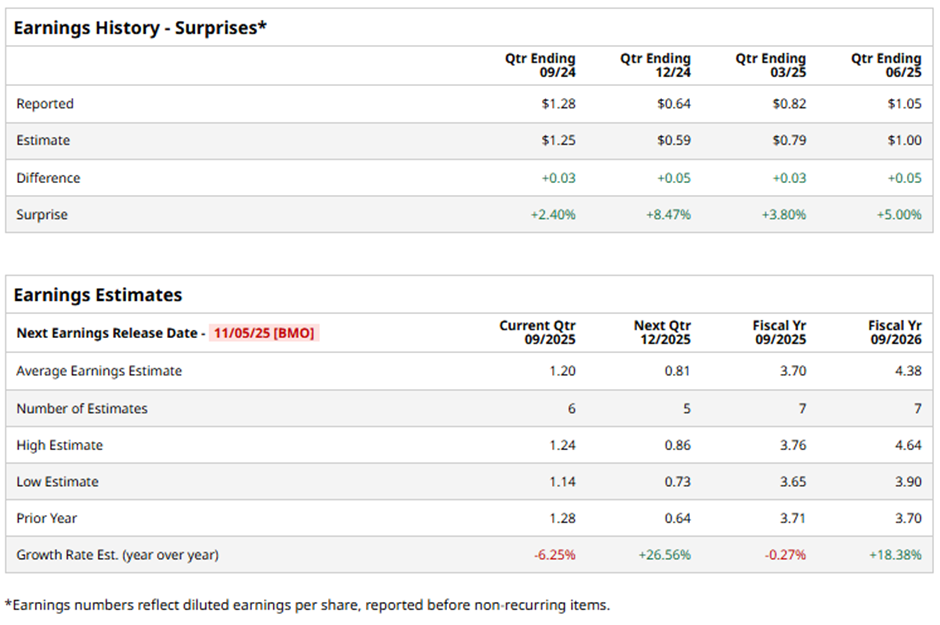

The Cork, Ireland-based company is expected to announce its fiscal Q4 2025 results before the market opens on Wednesday, Nov. 5. Ahead of this event, analysts expect Johnson Controls to report an adjusted EPS of $1.20, down 6.3% from $1.28 in the year-ago quarter. However, it has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts predict the technology and industrial company to report an adjusted EPS of $3.70, a marginal decline from $3.71 in fiscal 2024. Nevertheless, adjusted EPS is anticipated to increase 18.4% year-over-year to $4.38 in fiscal 2026.

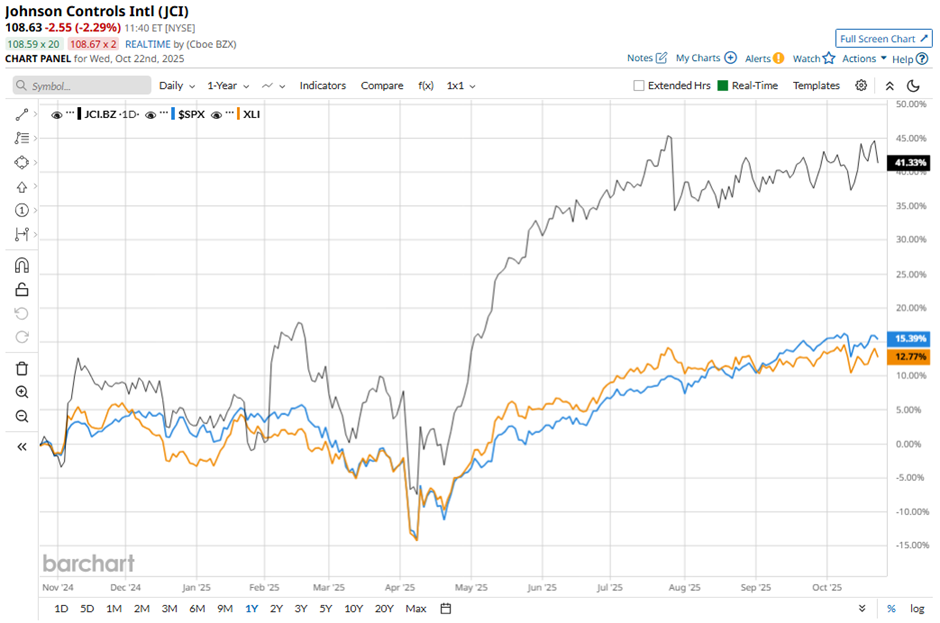

Shares of Johnson Controls have surged 42.4% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 14.9% gain and the Industrial Select Sector SPDR Fund's (XLI) 12.1% return over the same period.

Despite Johnson Controls reporting stronger-than-expected Q3 2025 adjusted EPS of $1.05 and total revenue of $6.1 billion, shares tumbled 7.4% on Jul. 29. Organic orders rose just 2% year-over-year, signaling weaker demand momentum, especially with APAC orders declining 8%. Additionally, the Americas segment - its largest revenue contributor, posted flat reported sales and a 150 basis point decline in EBITA margin to 18.4%.

While the company raised its full-year adjusted EPS guidance to $3.65–$3.68, the muted Q4 organic sales growth outlook of "low single digits" and modest margin expansion targets likely fell short of investor expectations.

Analysts' consensus view on JCI stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 21 analysts covering the stock, 12 suggest a "Strong Buy" and nine give a "Hold." The average analyst price target for Johnson Controls is $116.53, indicating a potential upside of 7.3% from the current levels.