/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

Joby Aviation (JOBY) is a company pioneering the development of all-electric vertical takeoff and landing (eVTOL) aircraft designed for urban air mobility and aerial ridesharing. Joby’s signature aircraft combines quiet operation, zero emissions, and a range of up to 150 miles at speeds of up to 200 mph. With strategic partnerships including Delta (DAL) and Toyota (TOYOF), the company aims to launch commercial air taxi services in key global markets. Joby is advancing toward full FAA certification, positioning itself at the forefront of the next generation of sustainable urban transportation.

Founded in 2009, the company is based in California.

Joby Outshines Market

Joby Aviation’s shares have jumped 9.6% in the last five days and 10.7% over the past month, while boasting an extraordinary 234% gain in the last six months and since the start of 2025. Over the past 52 weeks, JOBY stock has risen 211%, significantly outpacing the Russell 2000, which has gained approximately 10% year-to-date (YTD) and just over 13% for the year.

Joby’s rally is fueled by strong momentum in its electric air taxi program and regulatory progress, making it a standout performer among small-cap stocks in 2025.

Joby's Disappointing Quarter

Joby Aviation’s Q2 2025 results, released Aug. 6, disappointed Wall Street as the company reported an EPS loss of $0.41, wider than the expected $0.19 loss. Revenue for the quarter was a mere $0.02 million, missing analyst estimates of $0.05 million and marking a 94.6% year-over-year (YoY) decline, as Joby remains pre-revenue while progressing toward commercialization. The shortfall highlights the ongoing financial strains typical for early-stage eVTOL firms still focused on regulatory milestones and product development.

Key metrics revealed a net loss of $325 million, primarily due to non-cash revaluations tied to strategic investments and warrants, while adjusted EBITDA came in at a $132 million loss. Operating expenses surged 16% YoY because of increased research and development outlays. Nevertheless, the company’s balance sheet remains strong with $991 million in cash and short-term investments at quarter-end, bolstered by a $250 million tranche of Toyota’s strategic investment.

Guidance for the remainder of 2025 showed projected cash use between $500 million and $540 million, excluding potential Blade acquisition impacts. Joby is ramping up production, advancing FAA certification, and targeting commercial launch, with management emphasizing operational efficiency and regulatory progress as foundations for future revenue growth.

Joby Aviation Inks New Partnership

Joby Aviation has announced a strategic partnership with Skyports Infrastructure and the Ras Al Khaimah Transport Authority (RAKTA) to roll out a commercial air taxi service in Ras Al Khaimah, UAE, by 2027.

This collaboration will combine RAKTA’s transportation oversight, Skyports’ expertise in vertiport development, and Joby’s eVTOL aircraft to create a seamless passenger air mobility network. The initial route will link key destinations in Ras Al Khaimah with Dubai, providing rapid transit and cutting travel times from more than an hour by car to under 15 minutes by air taxi.

Joby’s zero-emission aircraft are set to connect locations like Al Marjan Island (future site of the Wynn (WYNN) resort) and Jebel Jais, aligning with Ras Al Khaimah’s 2030 Mobility Master Plan focused on sustainability, efficiency, and integrated transport options. The partnership is backed by active regulatory engagement and Joby’s extensive flight testing in the UAE, streamlining certification and deployment steps.

This latest move expands Joby’s Middle East ambitions, complementing agreements across the UAE and a recent MoU with Saudi business Abdul Latif Jameel. CEO JoeBen Bevirt described the project as a model for bringing air taxi services from vision to reality by aligning operators, infrastructure, and regulators from day one.

Should You Bet on JOBY?

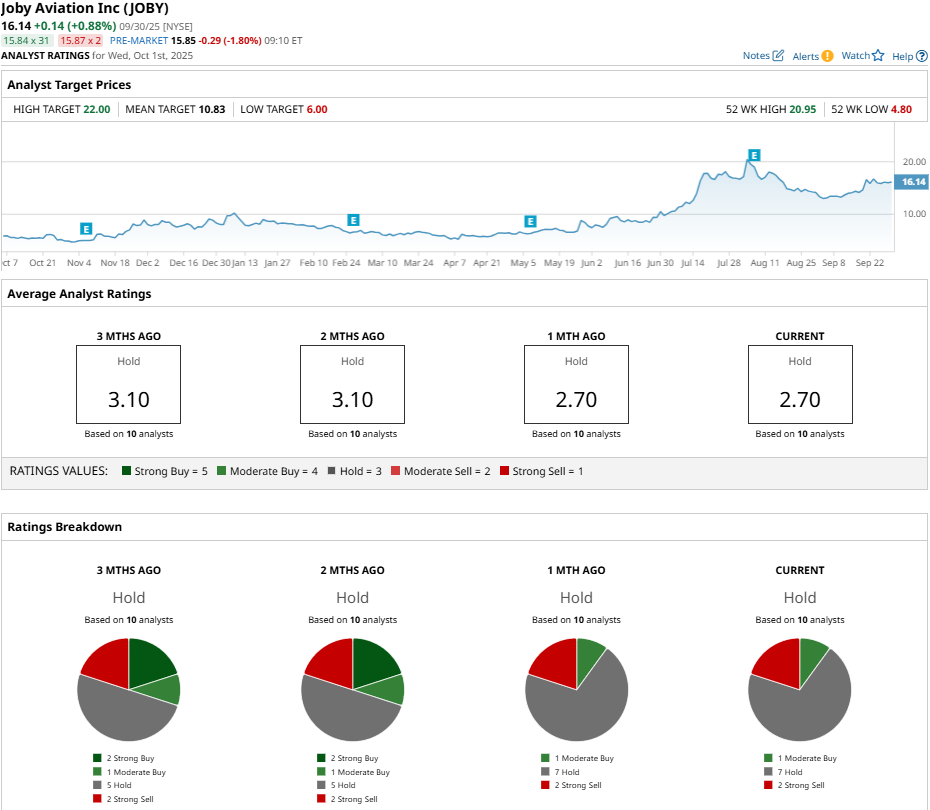

Joby Aviation has had stellar success in recent times, but despite this, Wall Street confidence is low in the air taxi stock. Analysts have a consensus “Hold” rating with a mean price target of $10.83, reflecting a potential downside of 32% from the current price.

JOBY stock is covered by 10 analysts with one “Moderate Buy” rating, seven “Hold” ratings, and two “Strong Sell” ratings.