CNBC’s ‘Mad Money’ host Jim Cramer has warned that speculative investors may be on the verge of abandoning Nvidia Corp. (NASDAQ:NVDA) as the stock fell nearly 1.5% in Wednesday's pre-market trading following reports that China has officially banned its major technology firms from purchasing certain Nvidia artificial intelligence (AI) chips.

NVDA is falling in pre-market, check it out here.

Cramer Warns That Capital May Flee From Nvidia

Cramer’s post suggests that “the last of the scared and hot money is about to exit,” Nvidia, implying that speculative capital often flees during geopolitical restrictions.

This phenomenon can potentially reset Nvidia’s valuation from its current market capitalization of over $4 trillion.

China Bans Nvidia’s Chip Usage

The directive, issued by the Cyberspace Administration of China (CAC), specifically targets chips Nvidia designed to comply with U.S. export restrictions, including the RTX Pro 6000D and the H20 AI chip.

According to the Financial Times, leading Chinese companies such as Alibaba Group Holding Ltd. ADR (NYSE:BABA) and ByteDance have been instructed to halt testing and procurement of these products.

See Also: Chiina Bans Nvidia Chip Purchases For Major Tech Firms: NVDA Stock Falls In Wednesday Pre-Market

China’s Domestic Chips On Par With NVDA?

Chinese regulators reportedly determined that domestically produced AI chips have achieved performance levels comparable to the specialized Nvidia models available in the country.

This ban represents a significant escalation in China’s push for technological self-reliance and a direct blow to Nvidia’s business in a key market.

Nvidia's Deepening Chinese Woes

Nvidia’s troubles in the region are mounting. The company is already facing an antitrust investigation by Chinese regulators over alleged anti-monopoly violations.

The combination of regulatory pressure, geopolitical tensions, and now a direct procurement ban from its largest customers creates substantial uncertainty for Nvidia’s future revenue from China. This development aligns with recent calls from Chinese government advisers to develop a sovereign AI infrastructure, further signaling a strategic decoupling from U.S.-based technology suppliers.

Price Action

NVDA stock fell 1.54% in premarket on Wednesday after ending 1.61% lower on Tuesday. The stock has advanced 26.44% year-to-date and 51.29% over the year.

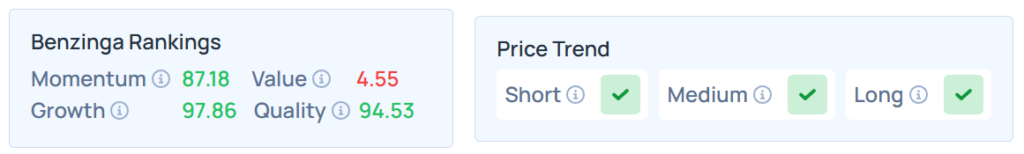

Benzinga’s Edge Stock Rankings indicate that NVDA maintains a stronger price trend in the short, medium, and long terms. However, the stock’s value ranking is relatively poor. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell in premarket on Wednesday. The SPY was down 0.062% at $659.59, while the QQQ declined 0.066% to $590.79, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Shutterstock