Jim Cramer is a high-profile market commentator on CNBC’s “Mad Money,” known for making bold stock calls. During segments like the “Lightning Round,” where he makes rapid-fire calls based on recent earnings, partnerships, and risks, Cramer explicitly recommended selling Chime (CHYM) stock and buying Affirm Holdings (AFRM) stock instead.

Chime is a neobank, or a fintech company, which provides banking services but does not operate like a typical bank. Meanwhile, Affirm Holdings, a fintech, focuses on “buy now, pay later” (BNPL) services that allow clients to split purchases into installment payments (with or without interest, depending on the plan).

Let’s find out why Cramer is so bullish about Affirm stock now.

Why Jim Cramer Dislikes Chime and Likes Affirm Holdings

Chime went public in June via an initial public offering (IPO) and is relatively new as a public company. There was a lot of hype surrounding its IPO, and the stock witnessed early gains before pulling back and falling 15% from its $27 IPO price. Chime is not consistently profitable. Many fintech companies burn cash to grow, yet investors increasingly demand profitability and margin expansion. This could explain why Cramer is bearish on the stock.

Comparatively, Affirm just reported what management described as an “exceptionally strong” quarter, even though the fourth quarter of fiscal 2025 is not generally Affirm’s seasonal peak, and the company achieved new highs in growth and profitability. This performance has sent its stock soaring 47% year-to-date, wildly outperforming the bigger fintech players and the overall market this year.

In the fourth quarter ended June 30, rising demand for Affirm’s services resulted in a 43% year-over-year rise in gross merchandise volume (GMV) to $10.4 billion. Total revenue increased 33% to $876 million. Active consumers totaled 23 million, up 24% year over year. Affirm is also profitable, with a net profit of $69 million in Q4, up from a net loss of $45 million in the prior-year quarter. For the full fiscal 2025, total revenue rose 38.7% to $3.2 billion with net income of $52.2 million.

Management noted that repayment performance is also holding steady, with consumers continuing to pay back on time. Importantly, 95% of Affirm’s transactions this quarter were with repeat borrowers, showing the platform’s capacity to foster loyalty and trust. CEO Max Levchin stated that the company’s growth is accelerating and that it is “firing on all pistons,” with momentum developing in both the U.S. and Canada. Affirm is also aiming to expand into the United Kingdom, a new market that might boost its growth trajectory.

The Affirm Card is also rapidly developing and becoming one of the most important products. Affirm’s card strategy is only beginning to take shape, and management hinted at further features and improvements that might drive adoption. The company has an ambitious goal of $7,500 in GMV per cardholder per year and 10 million active cardholders for the Affirm Card.

Cramer believes that everyone underestimates Affirm’s CEO, Max Levchin. Under Levchin’s leadership, the company has successfully navigated challenges while focused on expansion. During the earnings call, analysts pressed management on potential headwinds, particularly the resumption of U.S. student loan repayments and broader consumer health concerns. Levchin acknowledged the risks, but emphasized that Affirm had been planning for them. The company carefully manages credit exposure, reviews borrower performance regularly, and adjusts underwriting requirements as appropriate.

What Are Analysts Saying About Affirm Stock?

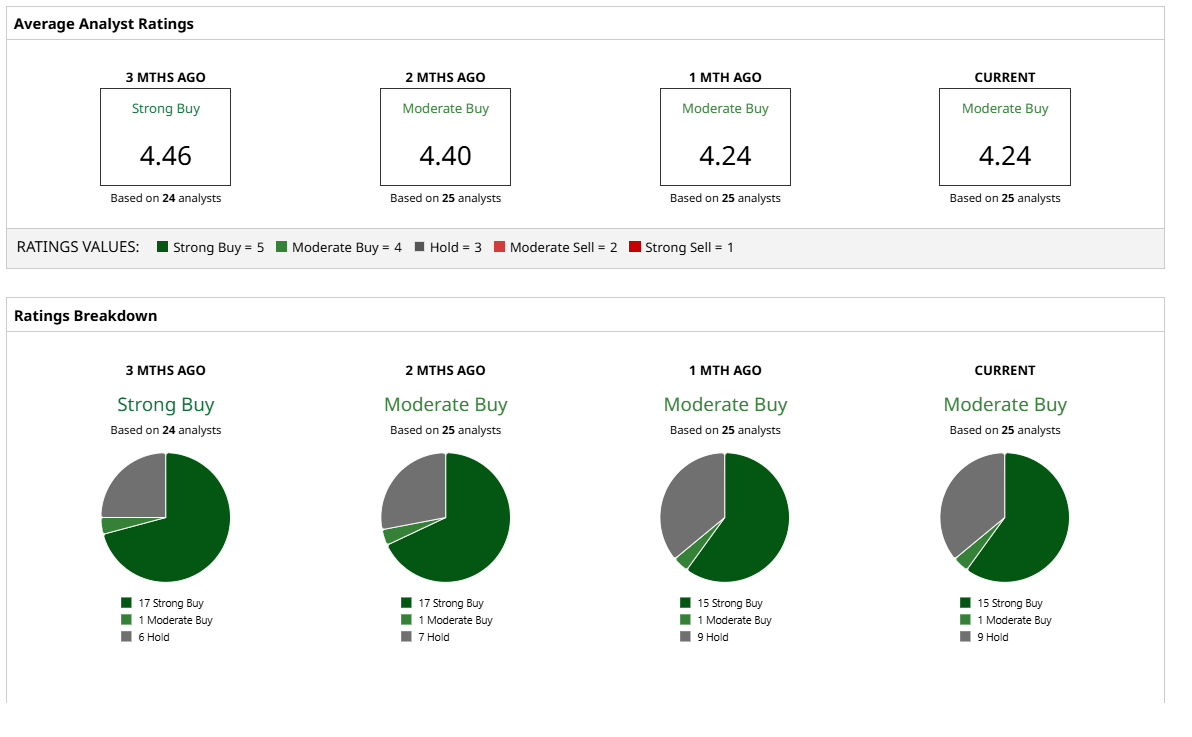

Overall, Affirm stock is rated as a “Moderate Buy” on Wall Street. Out of the 25 analysts covering the stock, 15 rate it a “Strong Buy,” one says it is a “Moderate Buy,” and nine recommend a “Hold.” Affirm stock is trading close to its mean target price of $90.90. Cramer believes Affirm stock will easily reach $100, which is 11% above current levels. Meanwhile, its high price estimate of $115 indicates the stock could gain 28% in the next 12 months. With analysts forecasting a 41% growth in earnings in fiscal 2026, followed by another 36.6% in fiscal 2026, Affirm is primed for a bright future.

Finally, I believe Cramer’s recommendation to sell Chime and buy Affirm indicates that he believes Affirm has stronger, more sustainable fundamentals and a better risk/reward profile.