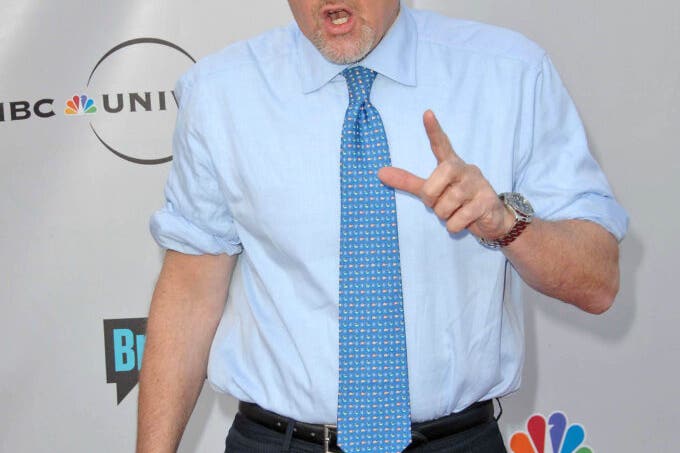

Jim Cramer is optimistic about Amazon.com Inc. (NASDAQ:AMZN), despite the ongoing tariff pressures. His prediction comes after a conversation with Amazon’s CEO, Andy Jassy.

What Happened: On Tuesday, Cramer posted on X to share his views after speaking with Jassy. He believes that the e-commerce giant is poised for a strong second half, despite the ongoing tariff pressures and expressed confidence in Amazon’s ability to maintain lower prices than most competitors, except perhaps Costco Wholesale Corporation (NASDAQ:COST), despite the current market uncertainties.

Cramer’s post was in response to his interview with Jassy on CNBC’s Mad Money, where Jassy discussed Amazon’s pricing strategy and its ability to mitigate the impact of tariffs imposed by President Donald Trump. Jassy mentioned that Amazon and its third-party sellers had forward-bought inventory to avoid tariff-related issues. He also emphasized that Amazon has not seen significant price increases so far.

“…we have, so far, not seen prices appreciably go up,” stated the Amazon CEO.

Amazon CEO Andy Jassy said the platform’s two million sellers create diversity, allowing some to absorb tariff costs while others raise costs—ultimately benefiting customers.

Why It Matters: Fundstrat Global Advisors‘ Head of Research, Tom Lee, also highlighted Amazon as a critical early indicator for U.S. inflation trends. The company’s stable pricing, despite tariff pressures, is seen as a positive sign for the broader economic outlook.

Meanwhile, other retail giants like Walmart Inc. (NYSE:WMT) have also been grappling with the tariff pressures. In May, Walmart responded to Trump’s tariff remarks, emphasizing its commitment to keeping prices as low as possible for consumers.

As the tariff pressures continue to impact the retail sector, Cramer’s prediction about Amazon’s performance in the second half of 2025 will be closely watched by market observers.

Over the past month, shares of Amazon climbed 6.17% while Costco dropped 6.33%, as per Benzinga Pro.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.