In a significant shift from previous sentiment, CNBC host Jim Cramer has declared that his past doubts regarding AI infrastructure providers IREN Ltd. (NASDAQ:IREN) and Nebius Group NV (NASDAQ:NBIS) are now irrelevant, citing the “demand” in the booming artificial intelligence sector.

Check out IREN and NBIS stock prices.

Cramer Pivots On IREN, Nebius

His recent post on X suggests an overwhelming market need that eclipses earlier comparisons, including his prior favor for CoreWeave Inc. (NASDAQ:CRWV).

Cramer’s newfound conviction comes as IREN, a former Bitcoin miner turned AI data center operator, sealed a monumental multi-year, $9.7 billion GPU cloud services contract with Microsoft Corp. (NASDAQ:MSFT).

This deal, one of the largest in AI infrastructure, will see IREN supply Nvidia Corp. (NASDAQ:NVDA) GB300 GPUs, backed by a 20% prepayment and a $5.8 billion partnership with Dell Technologies Inc. (NYSE:DELL) for equipment.

The Microsoft agreement marks a critical validation for IREN’s strategic pivot.

See Also: IREN Skyrockets After Sealing $9.7 Billion AI Cloud Deal With Microsoft

IREN, Nebius Emerge As Top ‘AI Utility’ Picks

Previously, in October 2025, market strategist Shay Boloor of Futurum Equities had already identified IREN and Nebius as top “AI Utility” picks, emphasizing the “industrial” nature of the next wave of AI trade.

Boloor highlighted IREN’s access to “the cheapest renewable power in the world” at just three and a half cents per kilowatt-hour, and its deep integration with NVIDIA’s H100 class GPUs and liquid cooling designs.

Nebius Group NV has also been recognized for its crucial role in the AI infrastructure landscape, securing significant deals, including a reported $17 billion with Azure, and lauded for operating “some of the most efficient cooling systems in the world.”

The staggering demand for AI power and cooling solutions underpins Cramer’s reversal. Industry projections, as highlighted by Boloor, anticipate global data center AI power demand to quadruple within the next decade, reaching an astonishing 1,500 terawatt-hours by 2034.

This insatiable thirst for power has been “locked in through multi-year contracts from all these hyperscalers – Amazon, Microsoft, and Google,” according to Boloor.

IREN And Nebius Zoom In 2025 Amid Increasing Demand

IREN’s stock has surged 547.71% this year; meanwhile, Nebius has soared by 294.85% year-to-date.

The rapid evolution of companies like IREN and Nebius, fueled by unprecedented AI demand, appears to be fundamentally reshaping the investment landscape, making past comparisons and doubts truly a thing of the past.

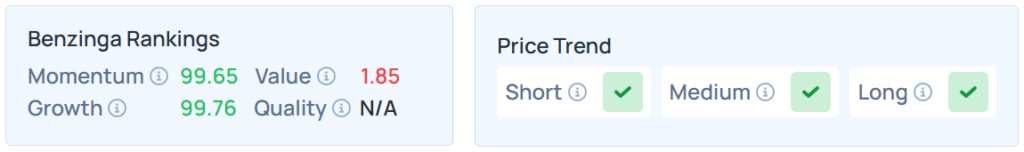

Benzinga’s Edge Stock Rankings indicate that IREN maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

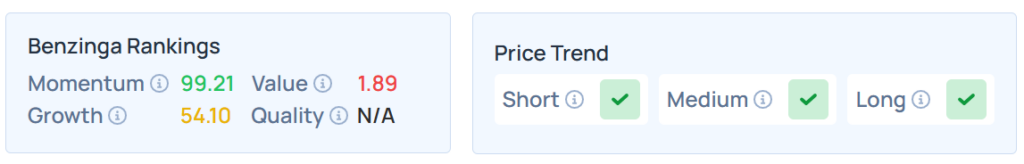

NBIS maintained a stronger price trend over the long term but a weak trend in the short and medium terms, with a moderate growth ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

While the S&P 500, Dow Jones and Nasdaq 100 closed in a mixed manner on Monday, the futures were lower on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Shutterstock