Investors’ hunger for artificial intelligence (AI) stocks is showing no signs of slowing, with companies pouring billions into the technology to unlock its full potential. At the heart of this AI revolution are high-performance data centers, the backbone of the ecosystem, powered by servers and storage hardware from companies like Dell Technologies (DELL) and Super Micro Computer (SMCI). Both are key enablers of AI workloads, but according to CNBC “Mad Money” host Jim Cramer, Dell comes out on top.

On his show’s popular “Lightning Round” segment, where callers pitch him stocks and he fires back with fast, unfiltered takes, one caller recently asked Cramer about Super Micro Computer. Cramer didn’t hold back, pointing to the company’s unresolved accounting concerns as a major red flag, bluntly declaring, “accounting regulations equal sell.” Instead, he encouraged investors to own Dell shares, which he believes is a better investment candidate now.

With that in mind, here’s a look at both of these names to understand why Cramer leans bullish on DELL stock over SMCI.

Stock #1: Dell Technologies

Valued at $84 billion by market capitalization, Dell Technologies has been steadily carving out a stronger position in the AI era, with its server and storage products becoming critical components for high-performance data centers. The company’s Infrastructure Solutions Group (ISG), which supplies the backbone for AI workloads, has been a key growth driver, benefiting from surging enterprise demand for compute power and storage capacity.

At the same time, Dell’s Client Solutions Group (CSG) segment keeps the company well-rounded, offering laptops, desktops, workstations, and peripherals such as displays, thereby maintaining a strong connection with both consumer and enterprise customers. Dell has been holding up well this year, thanks to booming demand in its AI-focused business.

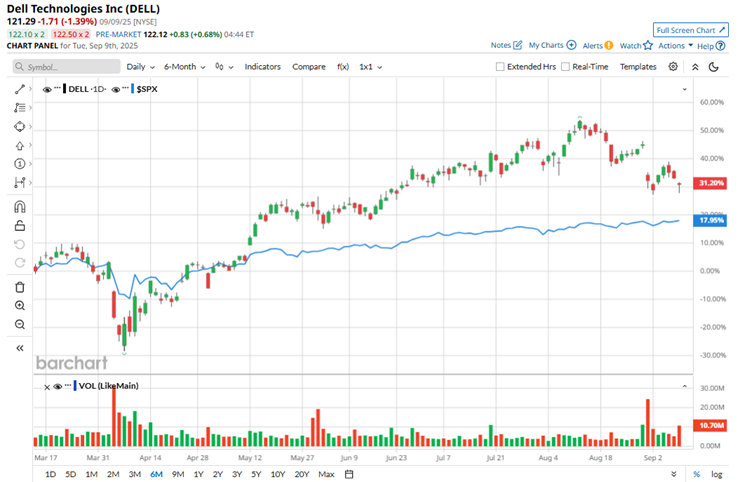

Dell’s AI servers are in hot demand, fueled by the digital transformation wave and the surge of interest in generative AI. While DELL stock is up a modest 9% year-to-date (YTD), the real surge has come over the past six months, with shares skyrocketing 37%, well ahead of the broader S&P 500 Index’s ($SPX) 18% gain during the same stretch.

Even with its recent impressive momentum, Dell remains attractively valued. Dell is currently priced at just 14 times forward earnings, which is well below the sector median. Its price-to-sales (P/S) multiple tells the same story, sitting at only 0.86 times. The stock appears to offer investors exposure to a high-growth AI story at a very reasonable valuation.

Dell’s financial muscle was on full display in its fiscal 2026 second-quarter earnings, released on Aug. 28. The company delivered a blockbuster performance with record revenue of $29.8 billion, up 19% year-over-year (YOY), blowing past analyst expectations of $29.3 billion. Profitability kept pace, with adjusted EPS rising 19% to $2.32, slightly ahead of Wall Street’s $2.31 forecast.

The growth story was powered by Dell’s surging AI server business, which is just getting started. The ISG segment reported a record $16.8 billion in revenue, soaring 44% YOY. Within that, Servers and Networking revenue, including AI servers, reached $12.9 billion, up a remarkable 69% from the previous year.

Dell generated a healthy $2.5 billion in operating cash flow during the quarter and returned $1.3 billion to investors through dividends and buybacks, a clear sign of both strong cash generation and a steady commitment to shareholders. AI demand appears to be rewriting Dell’s growth trajectory. In the first half of fiscal 2026 alone, the company shipped $10 billion worth of AI servers, already exceeding the total shipments from all of fiscal 2025.

Management now expects that number to reach a stunning $20 billion by year-end, which would represent a doubling of last year’s tally and highlight just how quickly demand for AI infrastructure is scaling. For the full-year fiscal 2026, management raised Dell’s revenue outlook, guiding for a range between $105 billion and $109 billion, while non-GAAP EPS is expected to be $9.55 at the midpoint.

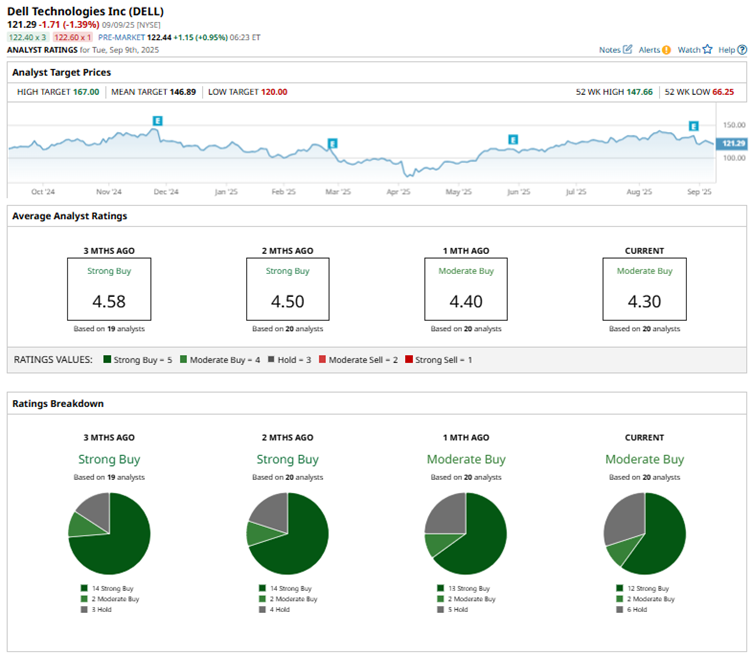

Overall, Wall Street remains upbeat on Dell’s future, giving DELL stock a consensus “Moderate Buy” rating. Of the 20 analysts offering recommendations, 12 advocate for a solid “Strong Buy,” two suggest a “Moderate Buy,” and the remaining six play it safe with “Hold.” The average target price for the stock is $146.89, which implies that DELL can rally 17% above current levels. The Street-high price estimate of $167 suggests the stock can climb 33% over the next 12 months.

Stock #2: Super Micro Computer

Super Micro Computer is recognized for its high-performance, energy-efficient servers that power the rapidly growing fields of AI, cloud services, and data centers. With a presence in the U.S., Taiwan, and the Netherlands, the company has built a strong global footprint and currently stands at a market capitalization of roughly $26 billion.

Super Micro may be a heavyweight in the AI server space, but SMCI stock has been a roller coaster ride for investors. Accounting controversies and Nasdaq delisting fears once rattled investor confidence, and while shares have staged a sharp comeback so far this year with a 44% gain, cracks are showing again. Its latest quarterly report disappointed, exposing several red flags, and SMCI stock has slipped back into negative territory over the past month.

With uncertainty still clouding the stock, SMCI’s valuation has come down noticeably from its peers. Shares now trade at 20 times forward earnings and 1.16 times sales, both well below the sector medians.

Super Micro has made a name for itself as a go-to provider of high-performance servers and storage systems built for AI workloads. This strength powered extraordinary growth throughout fiscal 2024, with sales rising at an exceptional pace. But as fiscal 2025 unfolded, the momentum showed signs of slowing. In the firm's fiscal 2025 fourth-quarter results published in early August, revenue increased 7.4% YOY to $5.8 billion, just under the $5.9 billion analysts had expected.

That growth, while positive, was a notable step down from the blistering gains of prior quarters, when sales climbed 19.5% in Q3, 54.9% in Q2, and a staggering 180.1% in Q1. On the bottom line, adjusted EPS came in at $0.41, a 24% decline from the year-ago period and below the consensus estimate of $0.44. Management cited tariffs on U.S. imports as a major factor.

Apart from top- and bottom-line misses, another notable red flag was margin pressure. Gross margin narrowed to 9.5% from 10.2% a year earlier, a sign that higher costs or pricing competition are beginning to weigh on profitability. On the balance sheet, Super Micro ended June 30 with $5.2 billion in cash and equivalents against $4.8 billion in total bank debt and convertible notes. For Q1 fiscal 2026, management forecasts revenue between $6 billion and $7 billion, alongside adjusted EPS of $0.40 to $0.52.

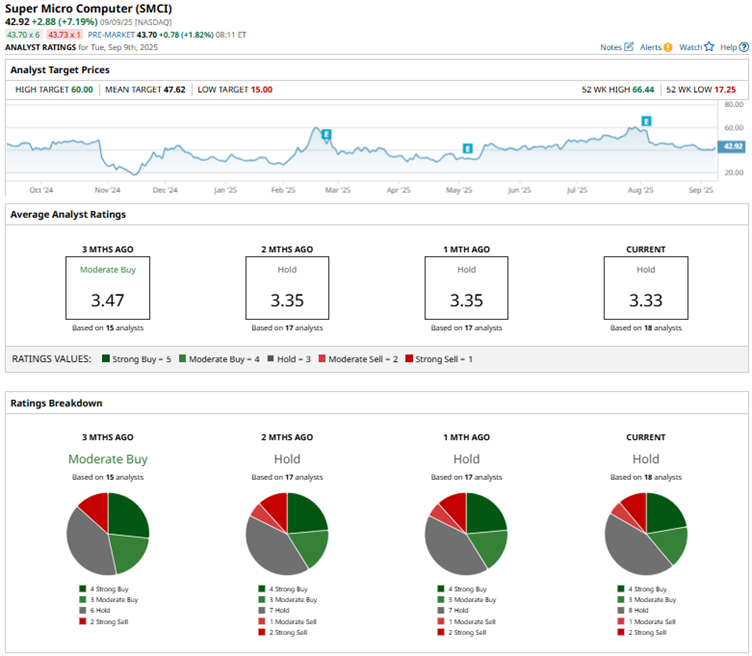

Overall, Wall Street sentiment on Super Micro is tilting cautious, with SMCI stock earning a consensus rating of “Hold.” Out of 18 analysts, only four call it a “Strong Buy” and three a “Moderate Buy,” while eight sit on the fence with a “Hold" rating. On the bearish side, one analyst rates SMCI a “Moderate Sell” and two go as far as a “Strong Sell" rating.

The average target price for SMCI stock is $47.62, which implies the stock can rally 8% above current levels. Meanwhile, the Street-high price estimate of $60 suggests the stock can climb as much as 37% from here.

Key Takeaways

Dell and Super Micro may both be key players in the AI server race, but their stories are moving in very different directions. Dell has been firing on all cylinders, crushing earnings, rapidly scaling its AI infrastructure business, and rewarding shareholders, all while trading at a very compelling valuation.

Super Micro, meanwhile, is showing signs of strain. Its latest quarter failed to meet analyst expectations and revealed slower revenue growth, declining profit, thinner margins, and tariff headwinds, keeping Wall Street cautious. Moreover, with lingering concerns around Super Micro's accounting, it’s easy to see why Jim Cramer favors Dell, which looks like the steadier choice for long-term growth.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.