Editor’s Note: This story has been updated to include fresh comments from Jim Cramer.

Apple Inc. (NASDAQ:AAPL) shares climbed in after-hours trading on Tuesday after a federal judge ruled Alphabet Inc.'s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google can continue paying the iPhone maker billions to remain the default search engine.

Judge Keeps Google-Apple Deal Alive

Apple stock rose 2.97% after hours, reversing a 1.04% dip during regular trading, according to Benzinga Pro.

U.S. District Judge Amit Mehta said Google will not be barred from compensating Apple for preloading its products.

"Cutting off payments from Google almost certainly will impose substantial — in some cases, crippling — downstream harms to distribution partners, related markets and consumers," Mehta wrote.

The decision stops short of banning these deals but limits revenue-sharing agreements to one year, potentially forcing Google and Apple to renegotiate annually, according to CNBC.

Antitrust Case Puts Spotlight On Big Tech

The ruling comes amid a landmark antitrust case over Google's dominance in online search, violations of the Sherman Act and the barriers it erected for competitors.

While Mehta restricted Google from making exclusive contracts, he allowed it to continue payments, preserving a revenue stream that makes up part of Apple's lucrative Services business.

CNBC's Jim Cramer commented on X, formerly Twitter, "Apple own it don't trade it!" signaling optimism over Apple's resilience despite regulatory scrutiny.

In a subsequent post, Cramer said, "I still don’t think people understand the incredible importance of tonight’s decision for Apple."

He went on to add that instead of spending huge sums on Nvidia chips to build its own AI, Apple will keep collecting Google's search money and get paid to use their AI in its products—turning a potential massive expense into a new revenue stream.

Apple's revenue from Google's default search placement is reported as part of its Services division, which also includes iCloud, AppleCare and Apple Music.

Analysts say preserving this deal provides stability as Apple shifts focus to hardware innovation and future AR and AI products, the report said.

Apple Faces AI Challenges And Market Pressure

The decision arrives days before Apple's Sept. 9 "Awe Dropping" event, where the company is expected to unveil up to seven new products, including the ultra-thin iPhone 17 Air, new Apple Watches and AirPods Pro 3.

Apple's stock has struggled in 2025, falling 5.79% year-to-date, making it one of the weakest performers among the Magnificent Seven tech stocks.

| Company | YTD Performance |

|---|---|

| Apple | 5.79% ↓ |

| Microsoft Corporation (NASDAQ:MSFT) | 20.67% ↑ |

| Amazon.com, Inc. (NASDAQ:AMZN) | 2.32% ↑ |

| Alphabet Class A | 11.57% ↑ |

| Alphabet Class C | 11.20% ↑ |

| Meta Platforms, Inc. (NASDAQ:META) | 22.67% ↑ |

| Tesla Inc. (NASDAQ:TSLA) | 13.16% ↓ |

| Nvidia Corporation (NASDAQ:NVDA) | 23.45% ↑ |

The company has also faced setbacks in artificial intelligence, including a delayed Siri upgrade.

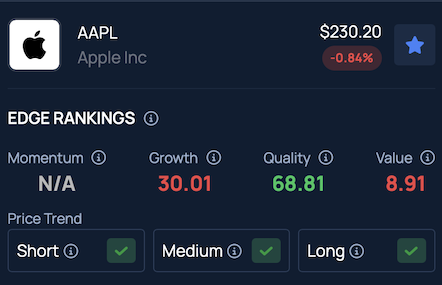

Benzinga's Edge Stock Rankings indicate that AAPL is maintaining strong upward trajectory across short, medium and long-term timeframes. Additional performance insights can be found here.

Read Next:

Photo Courtesy: hanohiki on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.