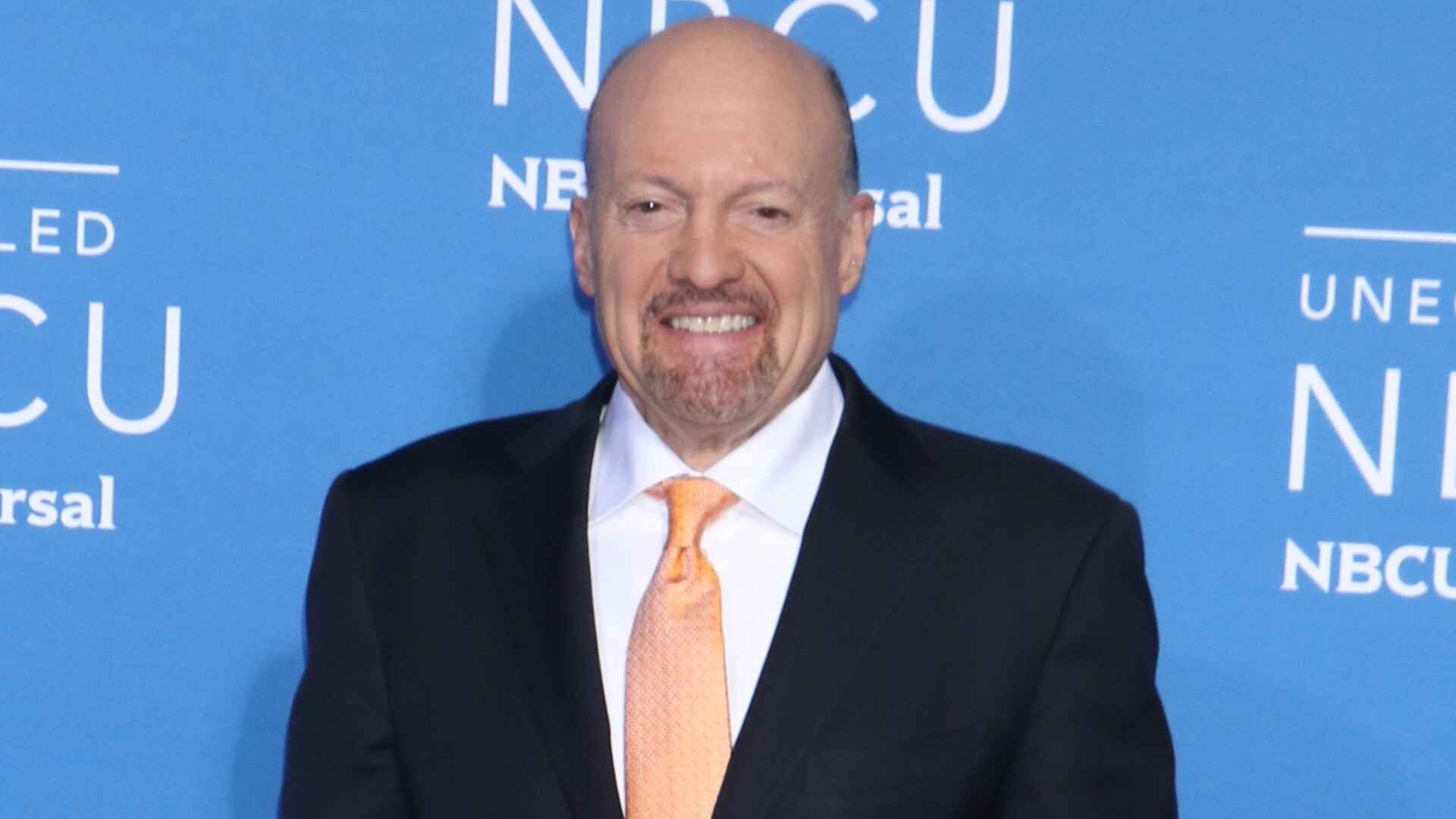

Even Wall Street veterans make costly mistakes. Jim Cramer, the veteran investor and television personality, has spent decades analyzing stocks and offering market guidance. But his path to success includes significant missteps that cost him substantial amounts of money.

Find Out: ‘You’ll Run Out of Money in 20 Years’ — Why Retirees Are Rethinking Their Savings Strategy

Read Next: 6 Clever Ways to Pocket an Extra $1K This Month

Cramer’s willingness to share these errors provides valuable lessons for everyday investors looking to avoid similar pitfalls. Here are his biggest investing regrets.

Holding Losing Positions Too Long

When Bausch Health fell short of profit forecasts and faced earlier-than-expected patent expirations, Cramer held onto his position despite clear warning signs. He admitted preferring to believe the company’s public relations messaging rather than investigate the fundamentals, and it cost him a fortune. Nobody likes to take a loss, and this emotion can overshadow rational thinking.

Be Aware: I’m a Financial Expert: This is the No. 1 Mistake Americans Make With Their Roth IRAs

Overconfidence in Brand Strength

Cramer learned that even historically well-run brands aren’t immune to economic and political risk. His investment in Estée Lauder proved this lesson when COVID-19 devastated China, the company’s biggest market. He assumed management would adapt as they always had, but they didn’t respond effectively to falling sales or the Chinese government’s crackdown on luxury goods. The stock plunged from $370 to around $90. In a survey conducted by deVere Group, 38% of high-net-worth respondents claimed their biggest mistake was banking on history repeating itself.

Following Herd Mentality

Rather than conducting independent analysis, Cramer learned early that following what everyone else is doing can lead to costly mistakes. Herd mentality can be one of the most impactful biases in investing, emerging when investors make decisions based primarily on group behavior rather than independent evaluation. This includes blindly following advice from billionaire hedge fund managers or market gurus without doing personal due diligence.

Selling Winners Too Early Out of Fear

Fear of loss can cause investors to sell quality investments prematurely, even when the original investment thesis remains intact. According to a study in Cogent Economics & Finance, behavioral finance research shows that investors tend to overreact to negative news and sell positions during temporary setbacks, according to studies published in academic journals. This panic selling locks in losses and prevents investors from benefiting from eventual recoveries. Cramer experienced this mistake when short-term volatility caused him to abandon long-term winners.

Relying on Single Economic Indicators

Cramer was taught that bond yields reveal the future direction of the economy and believed this technique was flawless. He discovered the hard way that the bond market’s forecasts can fail to materialize. Investors who base decisions on what just one indicator is saying often miss the bigger picture. Even when the yield curve inverts — a classic recession signal, — smart investors cross-reference multiple economic indicators including unemployment figures, consumer confidence indexes and corporate earnings reports before making major portfolio changes.

The Bottom Line

These mistakes highlight common pitfalls that trap investors at every level. Establish clear criteria for staying invested before emotions get involved. Don’t assume brand strength guarantees success during crises. Conduct independent research rather than following the crowd. Stick to your investment thesis unless fundamentals change. And always analyze multiple indicators before making decisions. As Warren Buffett said, the best way to learn is vicariously from other people’s mistakes.

More From GoBankingRates

- Here's How Much You Need To Retire With a $100K Lifestyle

- 3 Investing Myths That Could Be Costing You Thousands in 2025

- Two Money Tools Smart People Swear By for Financial Emergencies

- How to Get Guaranteed Growth On Your Money -- Without Risking Your Principal

This article originally appeared on GOBankingRates.com: Jim Cramer’s 5 Biggest Money Regrets