Famed short-seller Jim Chanos has poured cold water on the market’s excitement for IREN Ltd.‘s (NASDAQ:IREN) new $9.7 billion AI cloud deal with Microsoft Corp. (NASDAQ:MSFT), warning that the deal is a high-risk financing arrangement that will likely harm shareholder value.

Check out IREN’s stock price here.

Chanos Pours Cold Water On IREN-MSFT AI Deal Hype

In a detailed analysis posted on the social media platform X, Chanos argued that despite IREN’s stock skyrocketing on the news, the deal’s underlying financials are “below $IREN's cost-of-capital.”

Chanos, who posted a ROIC/IRR analysis of the deal, claimed that even with “favorable assumptions,” the project’s return on invested capital of 7.7% and unlevered internal rate of return of 10.2% are too low.

He dismissed market enthusiasm, stating, “The 20% IRR figures people are throwing around are ridiculous. This is a financing deal, w/IREN taking all the risk.”

The critique comes just days after IREN announced the five-year agreement to supply Microsoft with NVIDIA GB300 GPU cloud services, a move that sent its stock to new highs.

Chanos Argues IREN’s MSFT Deal Will Decrease EPS

Chanos’s “sanity check” also highlighted what he sees as unfavorable terms for IREN. He calculated that the 77,000 GPUs in the deal are “being rented-out at an implied $2.88 per hour… well below where other deals have happened.”

His analysis concluded with a stark warning for investors celebrating the revenue milestone. “Finally, it's hard not to conclude that this deal will actually DECREASE EPS at $IREN going forward,” Chanos wrote, adding that the company faces “increased balance sheet risk and/or equity dilution” as a result.

The deal, one of the largest in the AI infrastructure sector, involves IREN purchasing $5.8 billion in equipment from Dell Technologies, to be funded through cash, customer prepayments, and other financing.

Benzinga reached out to IREN for comment on Chanos’s analysis but did not receive an immediate response.

IREN Skyrockets Nearly 540% In 2025

Despite ending 1.65% lower at $66.63 apiece and falling further by 1.46% after-hours, IREN has scaled 537.00% year-to-date returns. It has advanced 645.30% over the year.

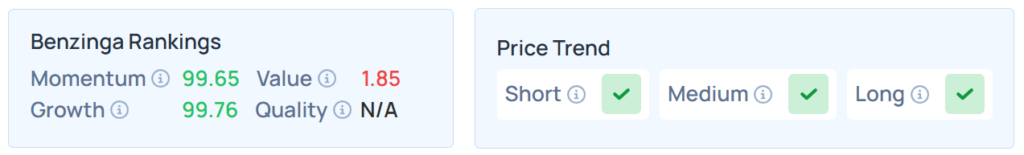

It maintains a stronger price trend over the long, short, and medium terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

While the S&P 500, Dow Jones, and Nasdaq 100 closed lower on Tuesday, the futures were mixed on Wednesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock