JFrog Ltd (NASDAQ:FROG) reported better-than-expected second-quarter financial results and raised its FY25 sales guidance above estimates on Thursday.

JFrog reported quarterly earnings of 18 cents per share which beat the analyst consensus estimate of 16 cents per share. The company reported quarterly sales of $127.22 million which beat the analyst consensus estimate of $122.75 million.

The company raised its FY2025 sales guidance from $500 million-$5050 million to $507 million-$510 million.

“With a unified focus on DevOps, Security, and MLOps, JFrog has positioned itself as a system of record for all software packages, and a leader in the fast-growing AI ecosystem as a gold-standard model registry,” said Shlomi Ben Haim, CEO and Co-founder of JFrog. “Our Q2 results reflect continued strong execution amid a period of ongoing uncertainty. We remain focused on disciplined operations, while driving high-quality, sustainable growth across the business.”

JFrog shares gained 7.2% to trade at $41.58 on Friday.

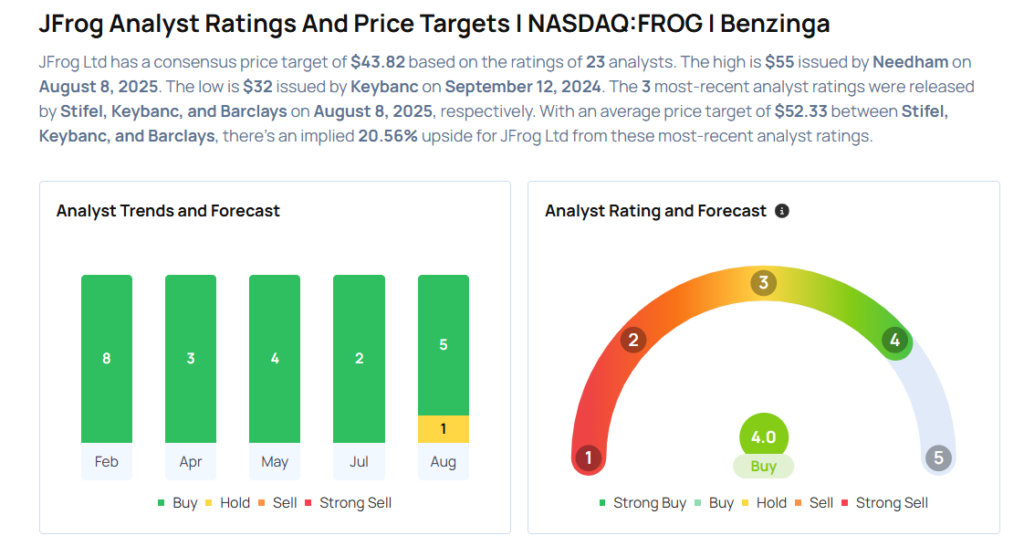

These analysts made changes to their price targets on JFrog following earnings announcement.

- Needham analyst Mike Cikos maintained JFrog with a Buy and raised the price target from $46 to $55.

- Piper Sandler analyst Rob Owens maintained the stock with a Neutral and raised the price target from $40 to $48.

- Barclays analyst Ryan Macwilliams maintained JFrog with an Overweight rating and raised the price target from $45 to $52.

- Keybanc analyst Jason Celino maintained JFrog with an Overweight rating and raised the price target from $46 to $52.

- Stifel analyst Brad Reback maintained JFrog with a Buy and raised the price target from $45 to $53.

Considering buying FROG stock? Here’s what analysts think:

Read This Next: