/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Artificial intelligence (AI) is growing fast. Companies are pouring billions into building the infrastructure needed to power countless AI applications that run large language models (LLM), machine learning (ML), generative AI, autonomous systems, and more.

Grand View Research's research indicates that the global AI market size was $279.2 billion last year and will grow to nearly $3.5 trillion by 2033. That’s a staggering compound annual growth rate of 31.5%.

And while AI is the figurative beast that is all-consuming, Nvidia (NVDA) CEO Jensen Huang raises an oft-overlooked issue. “The AIs are smart enough that everybody wants to use it,” he told CNBC. “We now have two exponentials happening at the same time.”

“Demand for Blackwell is really, really high,” he said, referring to Nvidia’s newest GPUs. “I think we’re at the beginning of a new buildout, beginning of a new industrial revolution.”

That’s an interesting point. How will we supply the power that is required for this massive increase in AI workloads? AI requires a lot of power—not only to run the data centers that bristle with powerful computing hardware, but also to supply the ability to cool the centers so they don’t burn out.

If there’s no place to rack graphics processing units (GPUs), power them, and cool them, then AI growth is destined to stagnate. And that’s where companies such as Applied Digital (APLD) come in.

About Applied Digital Stock

Based in Dallas, Applied Digital designs and builds next-generation digital infrastructure to power blockchain infrastructure and high-performance computing applications—workloads that are so big that they need clusters of GPUs and central processing units (CPUs) working together to handle them. The company has a market cap of $8 billion.

The company notes that data center construction has tripled since 2022, when OpenAI launched ChatGPT. But powering those centers will be a challenge, as the Department of Energy projects that the nation’s power grid will need 100 gigawatts of new capacity by 2030—with half of that being used by data centers.

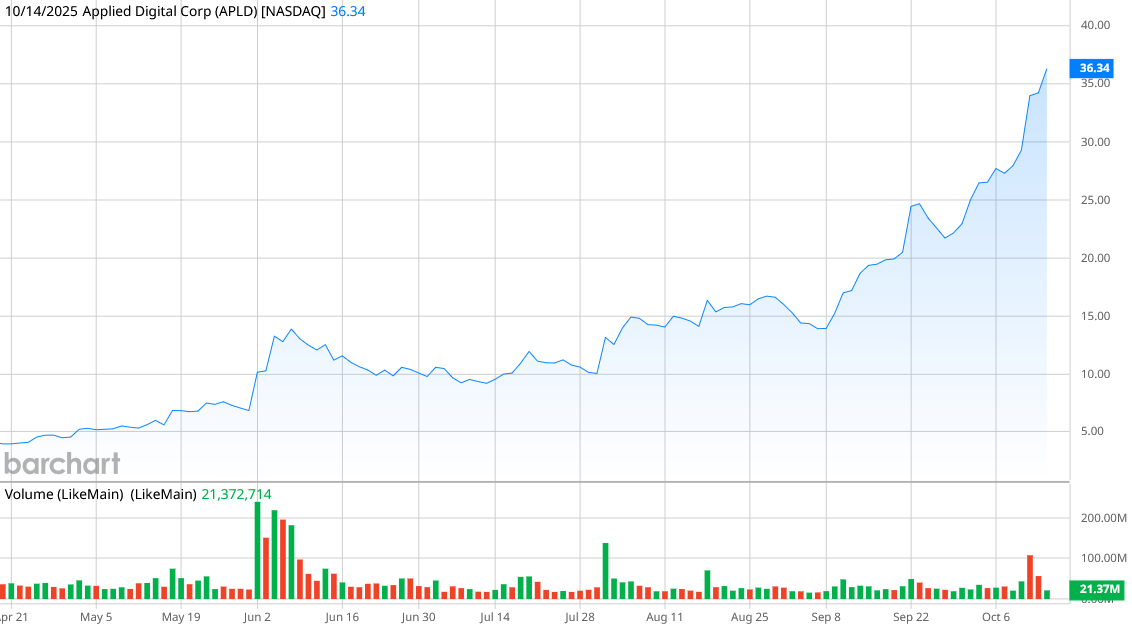

As Applied Digital has secured power sources for its data centers, located strategically in North Dakota so they can benefit from a cooler climate, the company’s stock has been on a powerful run in the last 12 months. APLD stock is up 375%, while major AI companies such as Nvidia and Palantir Technologies (PLTR) are up 32% and 315%, respectively.

But with those gains, the company’s valuation has increased tremendously. Applied Digital currently has a forward price-to-earnings (P/E) ratio of 38, after spending much of the year with a price-to-sales (P/S) ratio of less than 10. There is plenty of room for future earnings baked into APLD stock right now.

Applied Digital Beats on Earnings

Applied Earnings just reported its results for the first quarter of fiscal 2026 on Oct. 9. For the three months ending Aug. 31, the company’s revenue was $64.2 million, up 84% from a year ago. The company posted a net loss of $18.5 million, exaggerated by a $27.8 million loss due to discontinued operations, and overall posted a better-than-expected loss of $0.07 per share, while analysts had been expecting a loss of $0.11 per share.

For the three months ended Aug. 31, Applied Digital announced an adjusted loss per share of $0.03 on revenue of $64.2 million. Analysts polled by Investing.com anticipated a loss of $0.14 on revenue of $50.97M.

Management attributed the revenue gain to $26.3 million generated from tenant fit-out services in the company’s high-performance computing hosting business, as well as $5 million gains in the data center business.

The company announced a new lease agreement with CoreWeave (CRWV), which rents out Nvidia GPU computing power to developers and companies, for an additional 150 megawatts of power at the company’s Polaris Forge 1 campus in North Dakota. The deal brings the facility to capacity, with 400 MW of power. Applied Digital says it believes it will generate $11 billion in revenue from the facility over the life of its agreements.

Additional facilities are expected to come online in 2026 and 2027, management said.

APLD stock jumped 30% following the earnings announcement.

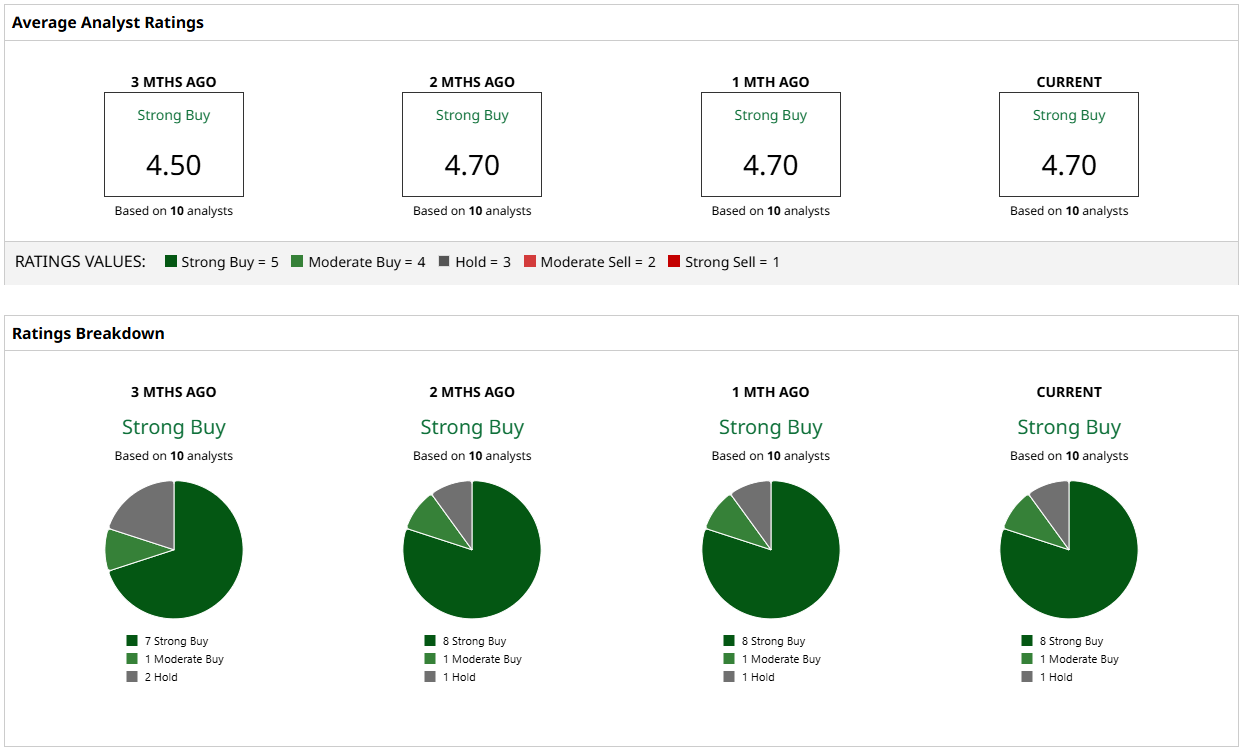

What Do Analysts Expect for Applied Digital Stock?

Analysts are nearly unanimous in their support for Applied Digital—of the 10 analysts currently covering the stock, eight of them rate it a “Strong Buy,” with one giving it a “Moderate Buy” rating and the last analyst holding.

With the stock’s rapid increase, it’s already lapped the stock's old mean target price of $25.11 and is still well above the most recent mean target of $38.22. I’m expecting analysts to further update their estimates following the company’s sterling earnings report. Even so, the high price target of $56 indicates an additional 51% upside.

While APLD stock is frothy, the company seems to be in a perfect place to meet the growing power demands of data centers and customers seeking to power their AI programs. This stock is a clear buy.