Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang stated in a recent interview with CNBC’s Jim Cramer that the AI chip giant's financial guidance already accounts for zero revenue from China.

Check out NVDA's stock price here.

NVDA’s Guidance Eliminates Any Revenue Expectations From China

Addressing the U.S. and China, Nvidia CEO Huang delivered a crucial piece of reassurance, making it clear that Nvidia has financially insulated itself from potential escalations.

“All of our guidance assumes China zero,” Hung stated unequivocally. "And so if anything works out with China, it will be a bonus for us." While acknowledging that "China is a very large market, it's a very important market," he stressed that until the trade situation is resolved, "we should just assume it's zero."

A Full China Ban ‘Hurts American Companies Worse’

Beyond the financials, Huang directed an argument toward U.S. policymakers, stating that the goal is for America to "win the AI race." He warned that a complete technological blockade would be a strategic misstep.

"A complete ban is not good for American companies. Long term, it might hurt Chinese companies a complete ban, but it hurts American companies worse long term," Huang argued.

Huang Envisions Building The World On American Tech Stack

He stated that his core strategic visionis for America to truly win, arguing that the "American tech stack" should become as globally ubiquitous as the U.S. dollar.

"We really want the world to build on the American tech stack, just as we want the world to be built on the American dollar," he explained. "We want the whole world to be building on the internet that was really invented here in the United States. We want the whole world to be building on Windows… on AWS or Apple… That's a good thing. It helps American industry."

Jensen Huang On AMD And Intel

During a one-on-one chat for CNBC's investing club, Huang pushed back firmly against direct comparisons to rival chipmaker Advanced Micro Devices Inc. (NASDAQ:AMD), telling Cramer that Nvidia has evolved far beyond being merely a hardware provider.

The Nvidia chief also shed light on the company's surprising new alliance with former rival Intel Corp. (NASDAQ:NVDA), a relationship Cramer noted had been historically acrimonious, with Intel reportedly trying to “kill” Nvidia for decades.

Price Action

Shares of NVDA were up 0.55% in premarket on Wednesday. It fell 0.25% to end at $185.04 per share on Tuesday. The stock has risen 33.79% year-to-date and 39.24% over the past year.

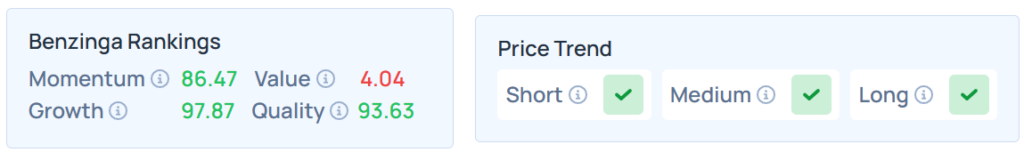

Benzinga's Edge Stock Rankings indicate that NVDA maintains a stronger price trend in the short, medium, and long terms. However, the stock's value ranking is relatively poor. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Wednesday. The SPY was up 0.14% at $670.03, while the QQQ advanced 0.13% to $605.29, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Imagn Images