/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)

Pony AI (PONY) is a pioneering autonomous driving technology company. Specializing in the development and large-scale commercialization of autonomous mobility, Pony AI integrates proprietary software and hardware to offer robotaxi, robotruck, and autonomous vehicle solutions across major cities globally. The company has secured permits for fully driverless public services in Beijing, Guangzhou, Shanghai, and Shenzhen and has completed over 45 million kilometers of autonomous testing worldwide as of 2025.

Founded in 2016, with headquarters in Silicon Valley, it has significant operations in China.

About Pony AI Stock

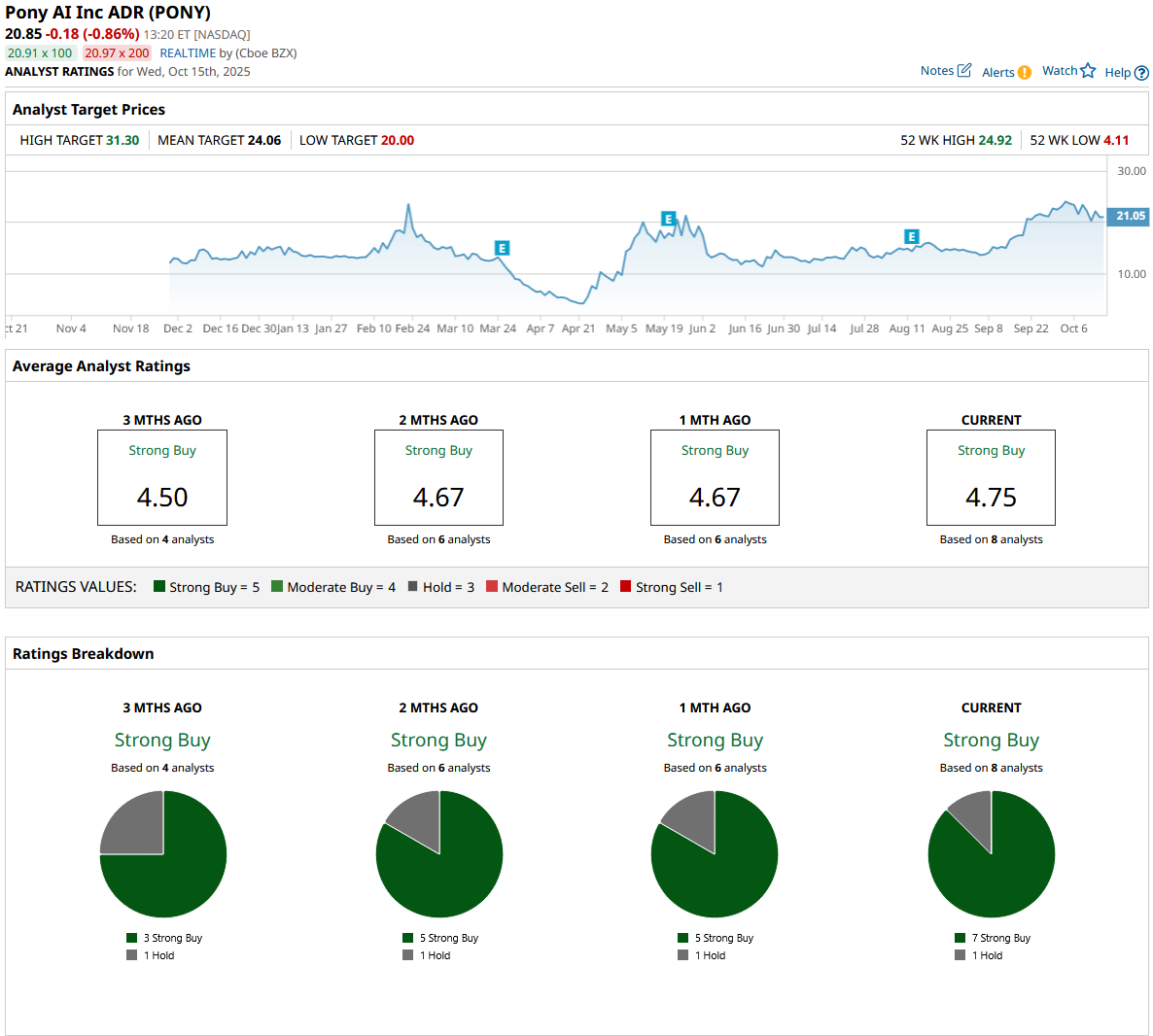

Pony AI's stock has witnessed significant volatility and growth in 2025. Over the past five days, the stock declined about 10%, while the past month saw a robust gain of 27%. For the six months, Pony AI surged more than 300%, and its year-to-date (YTD) performance is up 48%, well ahead of many sector peers and the broader market indices like the MSCI World (URTH), which grew around 16% in the same period.

Patterns indicate strong momentum rallies balanced by occasional steep pullbacks.

Pony AI Exceeds Estimates

Pony AI reported robust Q2 2025 financial results on Aug. 12, delivering revenue of $21.5 million, exceeding analyst projections by nearly 9% and marking a 76% surge year-over-year (YoY). However, the company posted a net loss of $53.1 million, translating to an EPS of -$0.14, which missed consensus estimates by 3.8%.

Robotaxi service revenues soared 158% to $1.5 million, displaying rapid adoption and expanded paid rider volumes, while licensing income jumped over 900%, driving the overall outperformance.

Delving deeper, Q2 saw gross margin turn positive at 16.1% from negative in the prior year, benefitting from production scale and substantial cost reductions in Gen-7 robotaxi hardware. Despite widening losses due to aggressive R&D and fleet expansion, Pony AI ended the period with significant cash reserves of $747.7 million, supporting its ongoing investment and global ambitions. The company produced more than 200 Gen-7 units and is targeting an operational fleet of 1,000 vehicles by year-end, partnering with industry leaders for international deployment.

For the remainder of 2025, Pony AI reiterated ambitious guidance: double-digit revenue and fleet growth, accelerating global expansion, and a focus on positive unit economics as the company advances toward its 2026 breakeven goal. Management highlighted regulatory progress and partnerships in overseas markets, supporting its vision to capture a growing share of the $1.5 trillion robotaxi market.

Fresh Analyst Coverage

Jefferies initiated coverage of Pony AI with a “Buy” rating and set a price target of $32.80, reflecting an upside potential of 56% from the market rate, reflecting strong confidence in the company’s prospects as the robotaxi market evolves in China. The firm’s analysts, led by Johnson Wan, view China’s robotaxi sector as moving from pilot projects to large-scale commercialization, with a total addressable market projected to reach RMB52 billion ($7.4 billion) by 2030.

They cited Pony AI’s regulatory leadership, focus on cost reduction, and comprehensive technology stack, spanning OEMs, transport networks, and proprietary system innovation, as key differentiators.

According to Jefferies, Pony AI is exceptionally positioned to capitalize on both network effects and margin expansion as the industry matures. The company is anticipated to capture a substantial 30% share of China’s domestic market over the long term. Notably, Pony AI stands apart as the only operator licensed to offer fully driverless, fare-based robotaxi services across all four top-tier Chinese cities, demonstrating a clear regulatory and operational edge.

The analyst note also pointed to significant partnerships with major industry players like Toyota (TM), BAIC, and GAC-Toyota for the co-development of the Gen-7 robotaxi and highlighted integrations with digital platforms such as WeChat and Uber (UBER), enhancing user access and growth potential.

Should You Bet on PONY?

The robotaxi company has been assigned a consensus “Strong Buy” rating by Wall Street, with a mean price target of $24.06, indicating an upside potential of 14% from the current market rate. The stock has been rated by eight analysts so far, receiving seven “Strong Buy” ratings and one “Hold” rating.