While tech stocks rocket to new highs and Bitcoin rallies, Jefferies Financial Group (NYSE:JEF) just disclosed a potential mess that should be sending up red flags across Wall Street.

The bank revealed on Wednesday that nearly a quarter of a $3 billion trade finance portfolio managed by its subsidiary, Point Bonita Capital, was tied to a single company: First Brands Group Inc., the now-bankrupt U.S. auto parts supplier.

The fund had about $715 million in receivables exposure — payments supposedly owed by major retailers like Walmart (NYSE:WMT) and AutoZone (NYSE:AZO) but funneled through First Brands itself, Jefferies said.

Those payments stopped coming on September 15.

Shares in Jefferies closed down 7.8% at $54.44 on Wednesday, but pared some losses and were trading up at $56.86 before the bell on Thursday, according to Benzinga Pro.

See how JEF shares have performed here.

The Hidden Fragility of Private Credit

First Brands’ collapse is becoming a case study in how opaque financing structures — often labeled as "safe" — can hide staggering risk.

In an interview with the Financial Times earlier this month, hedge fund manager Jim Chanos said the collapse of First Brands may be just the beginning, as cracks in private credit markets start to surface.

Jefferies wasn't just exposed. It was actively marketing First Brands' failed refinancing to investors right up until the collapse. One pitch had reportedly positioned the company as a $6 billion loan opportunity with $1 billion in cash. Yet within weeks, those senior loans were trading at 33 cents on the dollar.

This isn’t isolated.

UBS Group’s (NYSE:UBS) (SWX: UBSG) funds are also facing over $500 million in exposure to First Brands.

Another company, Tricolor Holdings—a used car dealer and subprime lender catering to undocumented borrowers—also collapsed days after First Brands. Its AAA-rated bonds fell to 12 cents on the dollar.

Jefferies also noted that First Brands is now being investigated for possibly factoring receivables more than once, meaning it may have pledged the same income streams to multiple lenders.

Costs Pegged At $173 Million By Morningstar

Despite Jefferies' relatively modest direct financial exposure, Morningstar analyst Sean Dunlop warned the fallout could be far more costly when factoring in potential litigation, regulatory scrutiny, and reputational damage.

“We peg the probability-weighted impact of direct financial losses, litigation, and regulatory fines at $173 million,” Dunlop said.

The research firm cut its fair value estimate for Jefferies from $49 to $47 per share, citing expected declines in asset management flows due to reputational damage.

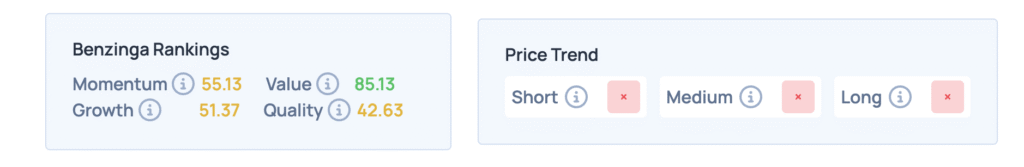

Jefferies scores high on value but lags in quality, growth, and momentum, according to Benzinga’s Edge Rankings, with short, medium, and long-term price trends all flashing red.

Read Next:

Image via Shutterstock