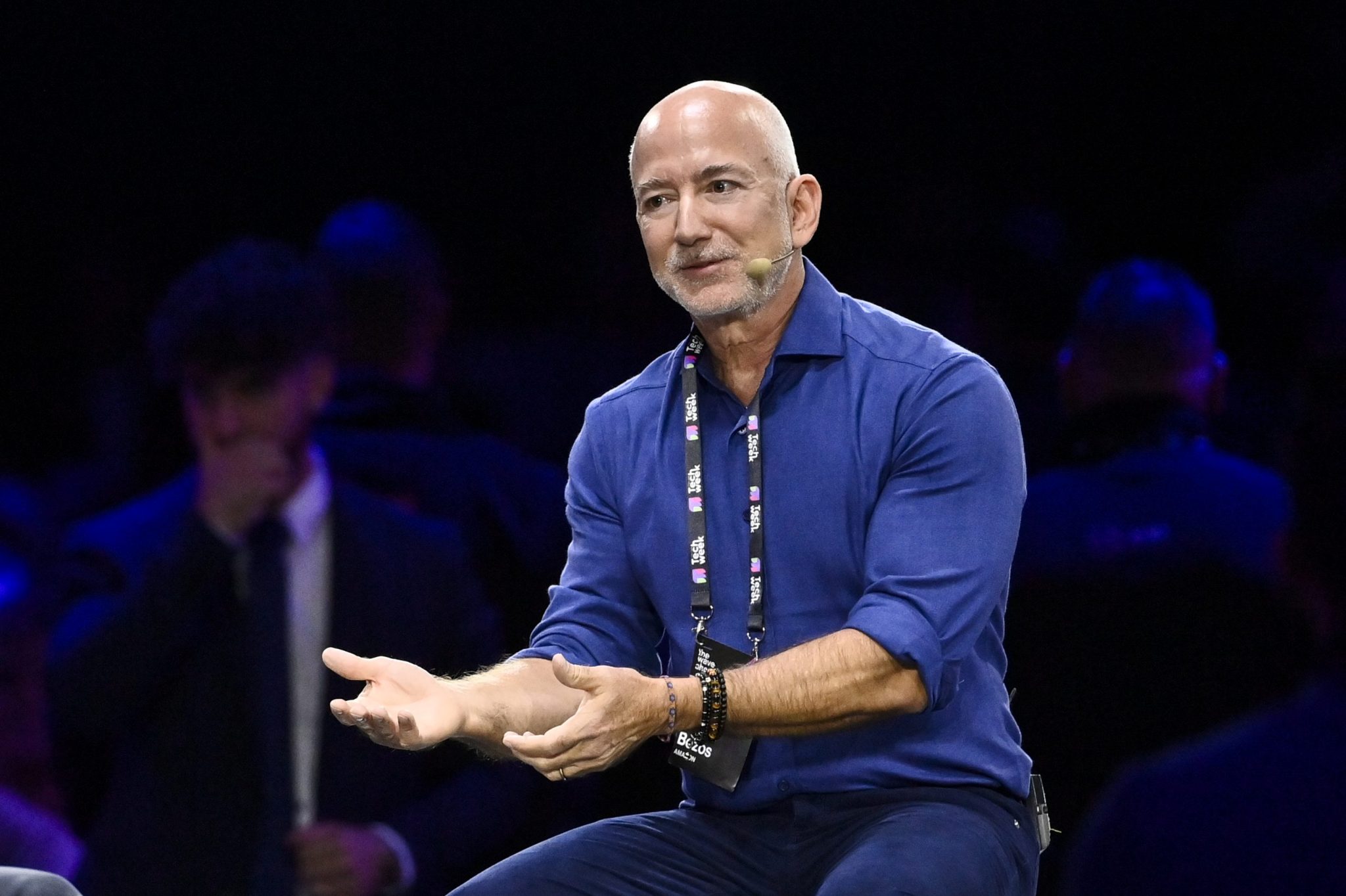

AI bubble talk continues to fizz, but Amazon founder Jeff Bezos—one of the world’s richest people—doesn’t seem bothered by the mounting foam.

As the New York Times reported yesterday, Bezos has helped fund a new AI startup called Project Prometheus, which—with $6.2 billion in backing—would make it one of the most well-financed early-stage startups in the world. Notably, as co-CEO alongside Vik Bajaj, a physicist and chemist who previously worked at Google, X, the company’s “Moonshot Factory,” Bezos has taken a formal operational role in a company for the first time since stepping down as Amazon CEO in July 2021.

According to the article, the company is focusing on AI-powered engineering and manufacturing in areas including computers, aerospace and automobiles, and has poached researchers from OpenAI, Google DeepMind and Meta. According to someone familiar with Project Prometheus’ work, the startup seeks to apply AI to physical tasks, which requires systems that can learn not just from massive amounts of digital data, like LLMs do, but from real-world trial and error.

Still, even in the high-flying, multi-billion-dollar AI startup space, the competition is fierce: Besides the billions poured into the likes of OpenAI, Anthropic, and Elon Musk’s xAI, former OpenAI CTO Mira Murati’s Thinking Machines raised $2 billion earlier this year, while former OpenAI chief scientist Ilya Sutskever has raised $3 billion for his research startup, Safe Superintelligence. Then there is Paris-based Mistral, which closed a Series C of about $2 billion in September, and even You.com’s Richard Socher is rumored to be trying to raise $1 billion for a new research lab.

Bezos, of course, has more than enough Benjamins to lead in this bubbly AI landscape. He has also clarified that while he admits that an AI bubble exists, it’s not the same as the dot-com boom and bust of the late 1990s and early 2000s, when around $5 trillion in market value evaporated.

“This is a kind of industrial bubble, as opposed to financial bubbles,” he said at Italian Tech Week last month.

Ultimately, industrial bubbles can be positive, Bezos added, pointing out that the biotech and pharmaceutical bubble in the 1990s led to the development of life-saving drugs—though in the process, many public companies that IPO’d during the boom went bankrupt or were acquired at a fraction of their starting value by the end. But, Bezos said industrial bubbles are “not nearly as bad” as other bubbles.

“It can even be good, because when the dust settles and you see who are the winners, societies benefit from those investors,” Bezos said. “That is what is going to happen here too. This is real, the benefits to society from AI are going to be gigantic.”

Bezos, who also invested last year in Physical Intelligence, a robotics AI start-up, is clearly betting that this industrial AI bubble will pay off big. But in the world of AI, even $6.2 billion isn’t enough to pop the champagne—at least not yet.

See you tomorrow,

Sharon Goldman

X: @sharongoldman

Email: sharon.goldman@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joey Abrams curated the deals section of today’s newsletter. Subscribe here.