It has become increasingly likely that Hitachi, Ltd. will receive financial assistance from the British government for the construction of a nuclear power plant in Britain, which would be a shot in the arm for the nuclear infrastructure export strategy jointly pushed by Japan's public and private sectors.

However, turning this strategy into reality is expected to involve overcoming many thorny challenges.

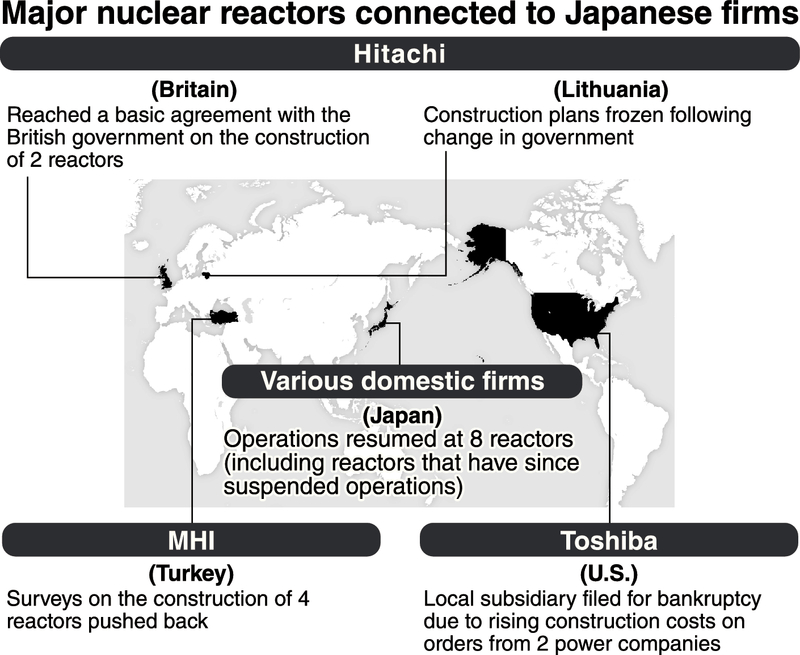

Toshiba Corp. has withdrawn from a project to construct nuclear reactors overseas, and Mitsubishi Heavy Industries, Ltd. also is having a difficult time in the field. These struggles stem from snowballing costs and delays in putting reactors into operation due to beefed-up safety measures.

On Monday, Hitachi and the British government reached a basic agreement to begin negotiations on the construction of a proposed nuclear power plant on the Isle of Anglesey. British Business and Energy Secretary Greg Clark said in Parliament, "This is an important next step for the project, although no decision has been yet taken to proceed."

The wheels on this project started turning about 5-1/2 years ago, when Hitachi purchased a British electricity producing company. Hitachi planned to construct two nuclear reactors and have them operating in the first half of the 2020s.

Hitachi's biggest miscalculation was the project's cost. The total cost has swollen to more than 3 trillion yen, significantly higher than the initial estimate, due to tougher safety measures and other expenses.

In February, Hitachi notified the British side it would walk away from the project unless the British government provided financial assistance.

In May, Hitachi Chairman Hiroaki Nakanishi met with British Prime Minister Theresa May to discuss the issue. The British side, which is scrambling to secure alternative energy sources to replace the depleted reserves in the North Sea oil fields, capitulated on the demand for assistance, laying the groundwork for the basic agreement.

However, the project faces a number of challenges.

The framework for shouldering the costs involves Hitachi, the British government, Japanese and British private companies, and financial institutions, but the participating firms have not been decided. The antinuclear movement in Britain is also gaining strength, which could influence future negotiations on the project.

Hitachi plans to make a final decision on whether to go ahead with the project in 2019. "But this could be delayed by about two years," according to an informed source.

Toshiba withdraws

The world's nuclear reactor makers are divided into three large camps. Each camp contains one of the major Japanese firms in this industry -- Hitachi, MHI and Toshiba. Reactor construction was a forte of Japanese companies.

Their dominant position has been eroded somewhat in recent years. Toshiba swallowed huge losses caused by mushrooming personnel and other costs stemming from delays in the planned construction of reactors in the United States by Westinghouse Electric Co., a major U.S. nuclear power firm Toshiba purchased. Westinghouse filed for bankruptcy in March 2017 and Toshiba withdrew from the construction of nuclear reactors overseas.

MHI plans to build four reactors in Turkey. Prime Minister Shinzo Abe directly lobbied the Turkish government to get the deal over the line in 2013, but the cost, which was initially pegged at just over 2 trillion yen, is expected to double due to increased expenses caused by enhanced safety measures.

A plan featuring private and public Japanese entities to build reactors in Vietnam collapsed in 2016 when the Vietnamese government withdrew from the project due to financial difficulties and opposition from local residents.

The three Japanese companies' struggles stem partly from the review of safety measures at reactors around the world following the March 2011 accident at Tokyo Electric Power Co. Holdings, Inc.'s Fukushima No. 1 nuclear power plant, which has pushed up the cost of constructing nuclear reactors.

No new reactors?

While the government is pushing ahead with the reactivation of nuclear reactors in Japan, it also positioned reactors as a pillar of the infrastructure exports that are a centerpiece of its economic growth strategy. The public and private sectors have teamed up in their approach to construct reactors abroad.

However, the draft of the government's new basic energy plan presented in May did not specifically mention building new nuclear power plants or rebuilding and expanding facilities at existing plants. At a time when the environment for constructing reactors at home and abroad is severe, the government did not emphatically put its weight behind the industry.

The government has set a goal of having nuclear power account for 20 to 22 percent of all electricity produced in Japan in 2030. It plans to use nuclear power as an "important base load power source" in the years ahead to ensure balance in the overall mix of components that supply energy.

Despite this, the restart of many reactors has been delayed and nuclear power currently generates only around 2 percent of the nation's electricity. In addition, some very serious issues affecting nuclear reactors remain to be addressed, such as the decommissioning of reactors at the Fukushima No. 1 plant.

The electric power industry also has other concerns. "In the years ahead, excellent human resources and technologies will be essential for nuclear power generation, but it will become difficult to find and keep them if things continue like this," an industry source said.

Read more from The Japan News at https://japannews.yomiuri.co.jp/