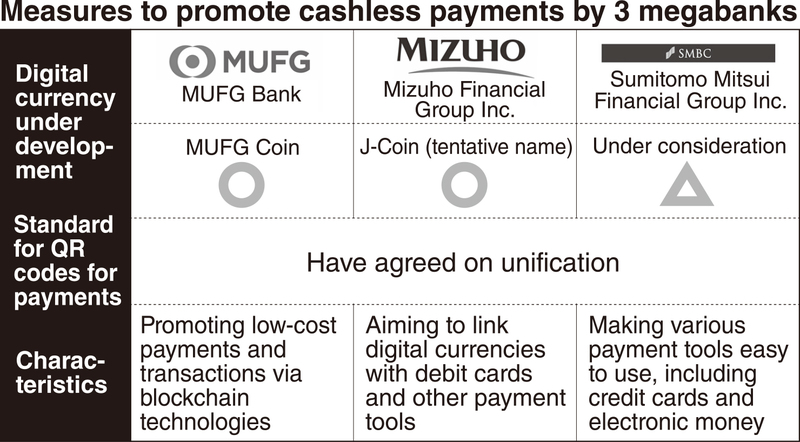

As part of efforts to encourage the use of cashless payments for goods and services, the three megabanks have agreed to unify their standards for QR codes, which customers can use to make payments without cash through their smartphones.

Their aim is to reduce the costs associated with handling cash, and increase convenience.

The unified QR code standards are provisionally named "BankPay." Apps and bank accounts will be linked through the system, enabling consumers to make purchases simply by scanning a QR code. The banks aim to have it up and running in fiscal 2019.

The agreement comes amid a growing sense of urgency over the slow spread of cashless payments in Japan.

About 20 percent of payments in Japan were cashless in 2016, according to an April report by the Economy, Trade and Industry Ministry. This is up from about 12 percent in 2008, but far below the about 90 percent in South Korea and the 40 to 50 percent range in Europe and the United States.

On average, each Japanese person has just under eight credit cards, debit cards, prepaid electronic cash cards, and other means that can be used for cashless payments.

This is the second-highest figure among major countries, behind Singapore. Yet despite the wide variety of payment methods available, consumers do not actually use them very often.

Having so many different payment methods places a major burden on businesses. In addition to a credit card payment terminal, a store may also need a FeliCa contactless IC card reader or other devices. Unifying standards for QR codes would be a step toward improving the situation.

Competition amid cooperation

Despite their agreement to unify the standards, the three megabanks have different strategies regarding their services and goals. Competition among them is expected to heat up in the future.

Mitsubishi UFJ Financial Group Inc. is pouring resources into the use of blockchain, the technology that underlies virtual currencies. The group is experimenting with an in-house virtual currency called MUFG Coin, the value of which is fixed at one coin per yen.

Their experiments have made payments easier to carry out, an MUFJ official said, adding that they also want to use virtual currency technology to provide cheap, fast international money transfers.

Sumitomo Mitsui Financial Group Inc. is working to develop a system that can be used for a several different kinds of cashless transactions.

Unifying disparate systems for credit cards, electronic cash and other means would reduce costs and be easier for stores to install.

Mizuho Financial Group Inc. is seeking to make purchases via smartphones more widespread. In March, the group released a smartphone app linked to customers' savings accounts.

At present, the app functions like a debit card, in that purchases are immediately subtracted from a user's account. In the future, the group wants to apply it to a variety of different payment methods, including credit cards and electronic cash.

Cashless payments are not becoming more widespread because neither consumers nor business are feeling the benefits.

As long as the three megabanks continue to prioritize their individual situations, the likelihood of explosive growth is low. They need to offer user-centered services.

Read more from The Japan News at https://japannews.yomiuri.co.jp/